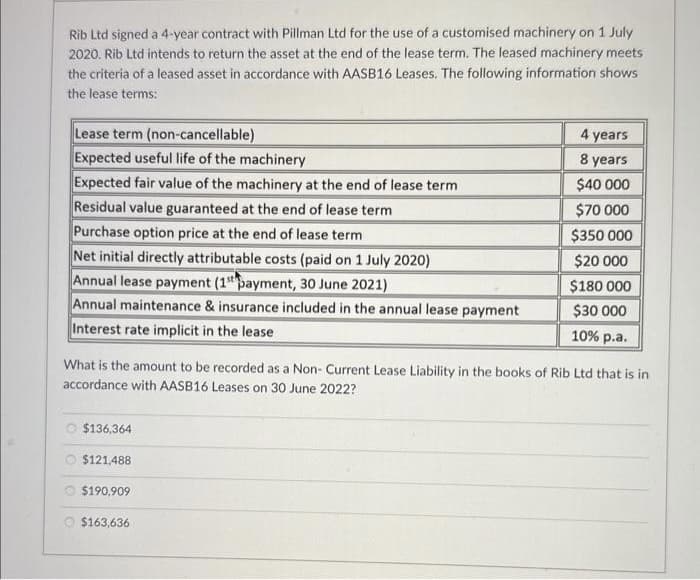

What is the amount to be recorded as a Non- Current Lease Liability in the books of Rib Ltd that is in accordance with AASB16 Leases on 30 June 2022? $136,364 $121,488 $190,909 $163,636

Q: What is the expected effect on interest rates when there is a business cycle expansion? Please…

A: A business cycle expansion is a phase of economic growth that occurs after a contraction or…

Q: Formulate but do not solve the problem. Kelly Fisher invested a total of $20,000 in two municipal…

A: Bonds are debt instruments that carry a fixed rate of interest. The interest is the income earned…

Q: On December 3, 2019 a sum of $36,700.00 was deposited into an account. What would be the future…

A: Present value is a current value, which means that if a company or individual receives money today,…

Q: Describe 1031 exchange. What other countries have 1031 (or similar) like-kind exchange?

A: In USA the IRC (Internal Revenue Code)’s section 1031 talks about the 1031 exchange. Essentially…

Q: Economic consideration is being given for a proposal to build out a new business. All capital and…

A: The process through which any project's profitability is analyzed and evaluated is recognized as…

Q: Ingrid wants to buy a $20,000 car in 8 years. How much money must she deposit at the end of each…

A: Compound Quarterly: When interest is earned on a quarterly basis on a savings account or investment…

Q: what are the main causes of going down AstraZeneca's price per share according to the london stock…

A: AstraZeneca is a British-Swedish multinational pharmaceutical and biopharmaceutical company.…

Q: If the bank wishes to set up a swap to totally hedge the interest rate risk, the bank should A. pay…

A: Let us calculate the difference between what the bank pays and receives with its existing balance…

Q: The existence of a bank is argued by her transformation functions. One typical bank product is a…

A: Banks and financial institutions are pillars of the financial system. They are intermediaries that…

Q: Cam saved $295 each month for the last four years while he was working. Since he has now gone back…

A: This is a typical time value of money (TVM) concept based question. There are fairly standard…

Q: b/ Which theory best explains these three term structure facts?

A: The three term structure facts that are commonly referenced in finance literature are: The yield…

Q: Earnings and Profits. A distribution is made when D, Inc. has assets valued at $500,000 (basis of…

A: E&P (Earnings and Profits) is the accumulated income of a corporation that is available for…

Q: The following facts pertain between Mooney Leasing Company and Rode Company, a lessee. Inception…

A: Lease is the type of agreement where the right to use the equipment is granted for the given period…

Q: On his thirteenth birthday, a boy inherits $13,000 which is to be used for his college education.…

A: Return In its most basic form, a return—also referred to as a financial return—is the amount of…

Q: 2. Does the company have enough cash and liquidity to survive an economic slowdown? Enhance the…

A: Given that at the end of 2022, the company has $300 mullion in cash in spite of a loss of $504…

Q: ii) Write down the arbitrage price pt at time t = [0, T] of a European-type contingent claim X which…

A: The arbitrage price of a European-type contingent claim X at time t ∈ [0,T] is given by the…

Q: The CEO of the very profitable Sun-4-You Solar Company plans to invest $50,000 per year for 12-years…

A: Future value refers to the future worth of an investment. Periodic deposits into the savings fund…

Q: Higuel owes $650 in 3 years and $1500 in 8 years. However, Miguel is unable to meet his $650…

A: In case of simple interest, the interest amount is charged only on the principal amount. This is…

Q: MUST USE EXCEL FORMULA! NOT ALGEBRAICALLY!

A: Present Value of Cash Flows- It can be calculated by discounting the given cash flow at appropriate…

Q: . Your company is opening a bank line of credit. The facility amount is $10MM with $3MM func he…

A: Company uses the amount of credit from the banks and financial institutions and credits helps them…

Q: Your parents agree to give you an allowance of $20 at the beginning of each week. The allowance…

A: The accumulated value of a payment series refers to the total amount that the periodic payments add…

Q: How do you measure returns to real estate investments

A: Real estate investments are investments in real estate properties. Real estate properties are in…

Q: An Investor uses £7,500 of her money + £2,500 from a loan at 8% to invest in the shares of MLN. A…

A: Investments are goods or assets that are bought to produce income or appreciate in value. The…

Q: In December 2022, Samar Co. had a share price of AED 50. They had 12 million shares outstanding, a…

A: Formulas:- 1. P/E ratio means Price -Earnings ratio. P/E ratio = Market Price per share…

Q: a. Calculate the profitability index for each investment. (Do not round intermediate calculations…

A: We will use some capital budgeting tools here. Use of capital budgeting tools helps us to find if a…

Q: What are the key differences between real estate property types? How do these differences affect the…

A: Real estate property types refer to the various types of land and buildings that are available for…

Q: Calculate the Rate given Portion and Base What percent of 80 is 136? %? P=R x B Rate 100% 0% $136…

A: The percentage is representative of a portion which will be expressed as a fraction of 100. It is…

Q: A small business borrows $46,000 for expansion at 7% compounded monthly. The loan is due in 6 years.…

A: In contrasts to a fee that the borrower may pay the lender or another party, interest is a payment…

Q: The ratio of current assets and current liabilities at BHP is equal to 3. Suppose current assets and…

A: The current ratio is a financial ratio that is used to determine the financial position of a…

Q: Dick and Jane have just purchased a house and are calculating how much money they will need when the…

A: Closing cost is the amount paid in addition to the down payment to secure a loan. It may include…

Q: You are saving for retirement. To live comfortably, Today is your 31st birthday, and you decide,…

A: There is need of planning for the future and if done on time and due to compouding of interest very…

Q: The Meadows Corporation needs to raise $62 million to finance its expansion into new markets. The…

A: Companies raise money through various resources and IPO is the main source of funding but raising…

Q: Here are direct spot and forward markets quotes for EUR over three points in time: now (1/1/XX), one…

A: A forward market is an over-the-counter derivative instrument that allows exchange of underlying…

Q: What is the expected rate of return on R. Halsey Inc. stock if it has a correlation coefficient…

A: Expected return The profit or loss an investor can anticipate realizing from an investment is known…

Q: You plan to invest $5,000 into an account. If you would like to have $10,000 in 15 years, what…

A: Solution: When an amount is deposited somewhere, it earns interest on it. The amount initially…

Q: The annuity would pay her Rs 70,000 until she lives. The insurance con expected that she would live…

A: The present value of the future cash flows from the annuity based on the time and interest rate…

Q: Reuben has the option of receiving a loan of $13,625 for 8 years at an interest rate of either 4.73%…

A: Future value, FV = P(1+r/k)^n*k Where P is the loan value. r= rate. k = compounding n= number of…

Q: 1) Find the duration of a 6% coupon bond making annual coupon payments if it has three years until…

A:

Q: b. Jamie wants to have $2,000,000 for her retirement in 25 years. How much should she save annually…

A: An annuity is a set of equal payments made at a set rate over a predetermined amount of time.…

Q: 1. Portfolio Choice Assume that r₁=.02 E(R)-.18 and market) portfolio. Suppose that an investor's…

A: A. The investor's utility function is given by: U = E(R_{ρ}) - 2σ_{ρ}^2 where E(R_{ρ}) is the…

Q: 8. Calculate the following on a bond that has a $1,000 Par Value, matures in exactly one (1) year,…

A: STEP 1 The predicted returns an investor expects after holding the bond until maturity are referred…

Q: A transportation company is considering adding new busses for its transit system. The total cost of…

A: Fair price per trip depends on the cost of purchase of Bus and cost of finance of Bus and also other…

Q: How would an increase in the interest rate effect the present value of an annuity problem (all other…

A: Present value of the annuity The amount of money that would be required today to support a series of…

Q: Why is it important to identify "Beneficial Owners," what is their significance of them in terms of…

A: The beneficial owners of a company refer to the people who receive benefits from the ownership of a…

Q: The finance director of Netra co wishes to estimate what impact the introduction of debt finance is…

A: Modigliani and Miller's approach states that the capital structure of a firm does not affect the…

Q: As a result of winning the Gates Energy Innovation Award, you are awarded a growing perpetuity. The…

A:

Q: Yosemite Corporation has an outstanding debt of $10.19 million on which it pays a 6 percent fixed…

A: Interest rate swaps are forward arrangements that involve the trade-off of one future flow of…

Q: ng engineer purchased a new car on an instalment basis with an amount of P 275, 000 as down payment.…

A: Monthly payments for the loan carry the payment for interest and payment for the loan amount also…

Q: Suppose you purchased a common stock in the United States for USD22.50 and sold it for USD28.10. If…

A: And he invested in the USA. to find his % return, we must find his values of the purchase and sale…

Q: The financial information below is for Mat Moery, who works as an administrative assistant in a law…

A: Networth is calculated as Assets - Liabilities. Revenue and expenses do not form part of the…

Step by step

Solved in 2 steps

- Use the information in RE20-3. Prepare the journal entries that Richie Company (the lessor) would make in the first year of the lease assuming the lease is classified as a sales-type lease. Assume that the lessee is required to make payments on December 31 each year. Also assume that Richie had purchased the equipment at a cost of 200,000.Use the following information to decide whether this equipment lease qualifies as an operating, sales-type, or direct financing lease to a lessor. a. There is no transfer of ownership at the end of the lease term. There is no bargain purchase option. The lease term is 60% of the economic life of the leased property. The present value of lease payments, including a residual value guaranteed by the lessee, is 100% of the fair value of the leased property to the lessor. The collectability of the lease payments is reasonably assured. The leased asset was not of a specialized nature. b. Same as (a), except that the residual value is guaranteed by a third party, not the lessee. The present value of the residual value guarantee is 15% of the fair value of the leased property. c. Same as (a), except that: the present value of the lease payments, including a residual value guaranteed by the lessee, is only 50% of the fair value of the leased asset. The collectability of the minimum lease payments is not predictable.Lessee and Lessor Accounting Issues The following information is available for a noncancelable lease of equipment entered into on March 1, 2019. The lease is classified as a sales-type lease by the lessor (Anson Company) and as a finance lease by the lessee (Bullard Company). Assume that the lease payments are nude at the beginning of each month, interest and straight-line depreciation are recognized at the end of each month, and the residual value of the leased asset is zero at the end of a 3-year life. Required: 1. Record the lease (including the initial receipt of 2,000) and the receipt of the second and third installments of 2,000 in Ansons accounts. Carry computations to the nearest dollar. 2. Record the lease (including the initial payment of 2,000), the payment of the second and third installments of 2,000, and monthly depreciation in Bullards accounts. The lessee records the lease obligation at net present value. Carry computations to the nearest dollar.

- Sales-Type Lease with Unguaranteed Residual Value Lessor Company and Lessee Company enter into a 5-year, noncancelable, sales-type lease on January 1, 2019, for equipment that cost Lessor 375,000 (useful life is 5 years). The fair value of the equipment is 400,000. Lessor expects a 12% return on the cost of the asset over the 5-year period of the lease. The equipment will have an estimated unguaranteed residual value of 20,000 at the end of the fifth year of the lease. The lease provisions require 5 equal annual amounts, payable each January 1, beginning with January 1, 2019. Lessee pays all executory costs directly to a third party. The equipment reverts to the lessor at the termination of the lease. Assume there are no initial direct costs, and the lessor expects to be able to collect all lease payments. Required: 1. Show how Lessor should compute the annual rental amounts. 2. Prepare a table summarizing the lease and interest receipts that would be suitable for Lessor. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare the journal entries for Lessor for the years 2019, 2020, and 2021.Lessor Accounting with Guaranteed Residual Value Use the information for Edom Company in E20-8, except that the residual value was guaranteed by Davis Company (the lessee). Required: 1. Assuming that the lease is a sales-type lease, calculate the selling price. 2. Prepare a table summarizing the lease receipts and interest income earned by Edom. 3. Prepare journal entries for Edom tor the years 2019 and 2020.Use the information in RE20-1. Prepare the journal entry that Keller Corporation would make during the first year of the lease assuming that the lease is classified as an operating lease.

- Lessee Accounting with Payments Made at Beginning of Year Adden Company signs a lease agreement dated January 1, 2019, that provides for it to lease non-specialized heavy equipment from Scott Rental Company beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of 20,000 to be paid in advance at the beginning of each year. 2. The cost, and also fair value, of the heavy equipment to Scott at the inception of the lease is 68,036.62. The equipment has an estimated life of 4 years and has a zero estimated residual value at the end of this time. 3. Adden agrees to pay all executory costs directly to a third party. 4. The lease contains no renewal or bargain purchase options. 5. Scotts interest rate implicit in the lease is 12%. Adden is aware of this rate, which is equal to its borrowing rate. 6. Adden uses the straight-line method to record depreciation on similar equipment. 7. Executory costs paid at the end of the year by Adden are: Required: 1. Next Level Determine what type of lease this is for Adden. 2. Prepare a table summarizing the lease payments and interest expense for Adden. 3. Prepare journal entries for Adden for the years 2019 and 2020.At its inception, the lease term of Lease G is 65% of the estimated remaining economic life of the leased property. This lease contains a purchase option that is reasonably expected to be exercised. The lessee should record Lease G as: a. neither an asset nor a liability b. an asset but not a liability c. an expense d. an asset and a liabilitySales-Type Lease with Guaranteed Residual Value Calder Company, the lessor, enters into a lease with Darwin Company, the lessee, to provide heavy equipment beginning January 1, 2017. The lease is appropriately classified as a sales-type lease. The lease terms, provisions, and related events are as follows: The lease is noncancelable, has a term of 8 years, and has no renewal or bargain purchase option. The annual rentals are 65,000, payable at the end of each year. The interest rate implicit in the lease is 15%. Darwin agrees to pay all executory costs directly to a third party. The cost of the equipment is 280,000. The fair value of the equipment to Calder is 308,021.03. Calder incurs no material initial direct costs. Calder expects that it will be able to collect all lease payments. Calder estimates that the fair value at the end of the lease term will be 50,000 and that the economic life the equipment is 9 years. This residual value is guaranteed by Darwin. The following present value factors are relevant: PV of an ordinary annuity n = 8, i = 15% = 4.487322 PV n = 8, i = 15% = 0.326902 PV n = 1, i = 15% = 0.869565 Required: 1. Determine the proper classification of the lease. 2. Prepare a table summarizing the lease receipts and interest income earned by Calder for this lease. 3. Prepare journal entries for Calder for the years 2019, 2020, and 2021. 4. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the present value of next years payment approach to classify the lease receivable as current and noncurrent. 5. Next Level Prepare partial balance sheets for December 31, 2019, and December 31, 2020, showing how the accounts should be reported. Use the change in present value approach to classify the lease receivable as current and noncurrent.

- Determining Type of Lease and Subsequent Accounting On January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: The lease is noncancelable and has a term of 8 years. The annual rentals arc 35,000, payable at the beginning of each year. The interest rate implicit in the lease is 14%. Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for 1 at the end of the lease term, December 31, 2026. The cost of the equipment to the lessee is 150,000, and the fair value is approximately 185,100. Ballieu incurs no material initial direct costs. It is probable that Ballieu will collect the lease payments. Ballieu estimates that the fair value is expected to be significantly greater than 1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of 35,000 discounted at 14% is 185,090.68 (the 1 purchase option is ignored as immaterial). Required: 1. Next Level Identify the classification of the lease transaction from Ballices point of view. Give the reasons for your classification. 2. Prepare all the journal entries tor Ballieu for the years 2019 and 2020. 3. Discuss the disclosure requirements for the lease transaction in Ballices notes to the financial statements.Supply Ltd entered into a non-cancellable five-year lease arrangement with Customer Ltd on 1 July 2022. The leased asset is a machine with an estimated useful life of six years and a salvage value of zero. There are to be five annual lease payments of $90,000, the first being made on 30 June 2023. Customer Ltd determined that this contract contains a lease. There is a bargain purchase option that Customer Ltd will be able and likely to exercise at the end of the lease term for $30,000. The implicit interest rate is 12% (1) What is the balance of lease liability the lessee should record on 1 July 2022? Show your calculations. (2) Prepare the journal entries in the books of the lessee (Customer Ltd) from 1 July 2022 to 30 June 2023 (the end of the reporting period).WHL Ltd enters into a non-cancellable 5-year lease agreement with TFL Ltd on 1 June2019. The lease is for an item of machinery that, at the inception of the lease, has a fair value of $202,769. The machinery is expected to have an economic life of 7 years. The contract consists of $50,000 of unguaranteed residual value for the leased asset. There are to be five annual payments of $62,500, the first being made on 30 May 2020. Included within the annual lease payment is an amount of $6,250 representing payment to the lessor for the insurance and maintenance of the machinery. The rate of interest implicit in the lease is 12%. The lessee intends to take ownership of the underlying asset at the end of the lease term. Required: Prepare accounting journal entries for 1 July 2019 & 30 June 2020.