Direct materials variances Bellingham Company produces a product that requires 2.3 standard pounds per unit. The standard price is $3.40 per pound. 15,800 units used 35,700 pounds, which were purchased at $3.50 per pound. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet What is the direct materials (a) price variance, (b) quantity variance, and (c) cost variance? Round your answers to the nearest dollar. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. a. Direct materials price variance 24 b. Direct materials quantity variance $4 c. Direct materials cost variance $4

Direct materials variances Bellingham Company produces a product that requires 2.3 standard pounds per unit. The standard price is $3.40 per pound. 15,800 units used 35,700 pounds, which were purchased at $3.50 per pound. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet What is the direct materials (a) price variance, (b) quantity variance, and (c) cost variance? Round your answers to the nearest dollar. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number. a. Direct materials price variance 24 b. Direct materials quantity variance $4 c. Direct materials cost variance $4

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter9: Evaluating Variances From Standard Costs

Section: Chapter Questions

Problem 1BE: Direct materials variances Bellingham Company produces a product that requires 2.5 standard pounds...

Related questions

Question

Please assist. Phot 2 is the opened spreadsheet. Thank you!

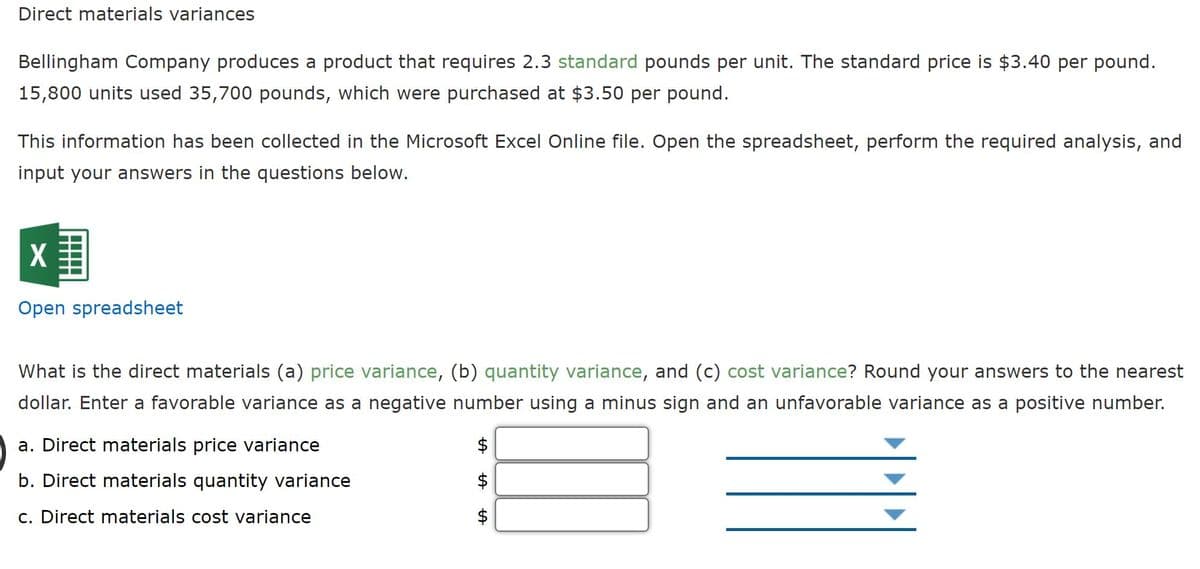

Transcribed Image Text:Direct materials variances

Bellingham Company produces a product that requires 2.3 standard pounds per unit. The standard price is $3.40 per pound.

15,800 units used 35,700 pounds, which were purchased at $3.50 per pound.

This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and

input your answers in the questions below.

Open spreadsheet

What is the direct materials (a) price variance, (b) quantity variance, and (c) cost variance? Round your answers to the nearest

dollar. Enter a favorable variance as a negative number using a minus sign and an unfavorable variance as a positive number.

a. Direct materials price variance

b. Direct materials quantity variance

c. Direct materials cost variance

$

%24

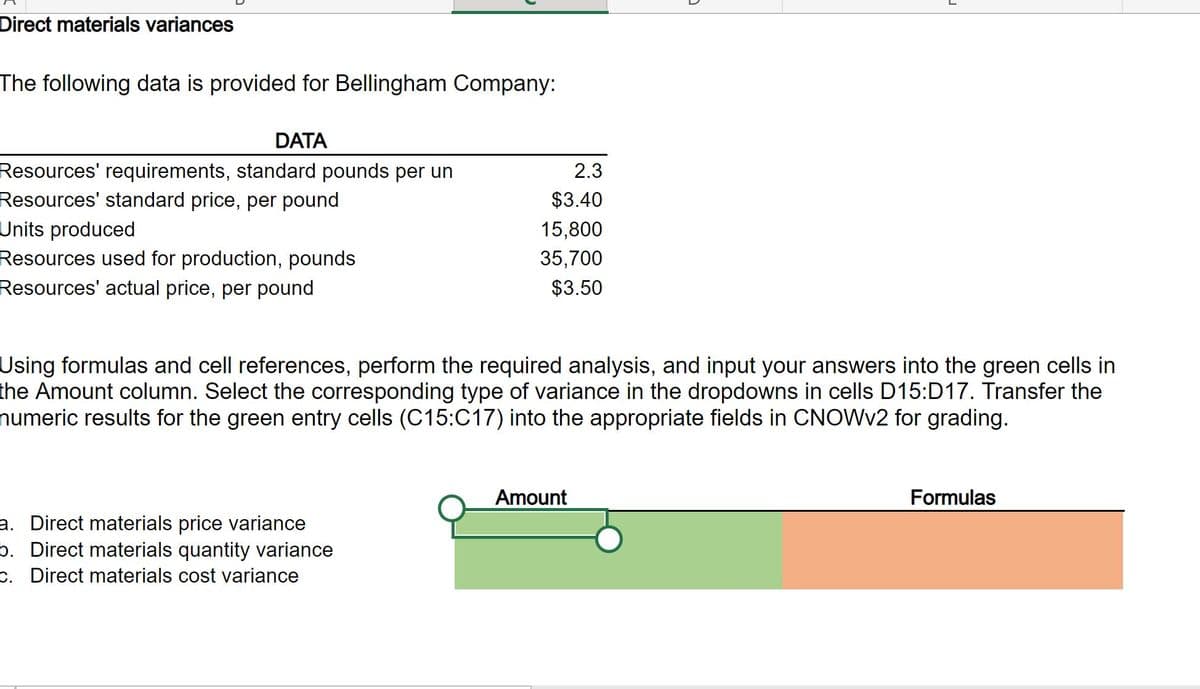

Transcribed Image Text:Direct materials variances

The following data is provided for Bellingham Company:

DATA

Resources' requirements, standard pounds per un

Resources' standard price, per pound

Units produced

Resources used for production, pounds

Resources' actual price, per pound

2.3

$3.40

15,800

35,700

$3.50

Using formulas and cell references, perform the required analysis, and input your answers into the green cells in

the Amount column. Select the corresponding type of variance in the dropdowns in cells D15:D17. Transfer the

numeric results for the green entry cells (C15:C17) into the appropriate fields in CNOWV2 for grading.

Amount

Formulas

a. Direct materials price variance

b. Direct materials quantity variance

c. Direct materials cost variance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning