Direction: Write TRUE if the statement is true and FALSE if the statement is false. _1. A written partnership contract is required to be prepared whenever a partnership is formed. _2. All partnerships are subject to income tax. _3. A partner's contribution in the form of industry or service is recorded by debiting the account "Industry". _4. In the partnership books, there are as many capital and drawing accounts as there are partners. _5.A partners contribution in the form of noncash assets should be recorded at its fair market value in the absence of an agreed value. 6A partnershin is much egsier and less expensive to orggnize than corporation

Direction: Write TRUE if the statement is true and FALSE if the statement is false. _1. A written partnership contract is required to be prepared whenever a partnership is formed. _2. All partnerships are subject to income tax. _3. A partner's contribution in the form of industry or service is recorded by debiting the account "Industry". _4. In the partnership books, there are as many capital and drawing accounts as there are partners. _5.A partners contribution in the form of noncash assets should be recorded at its fair market value in the absence of an agreed value. 6A partnershin is much egsier and less expensive to orggnize than corporation

Chapter10: Partnership Taxation

Section: Chapter Questions

Problem 23MCQ

Related questions

Question

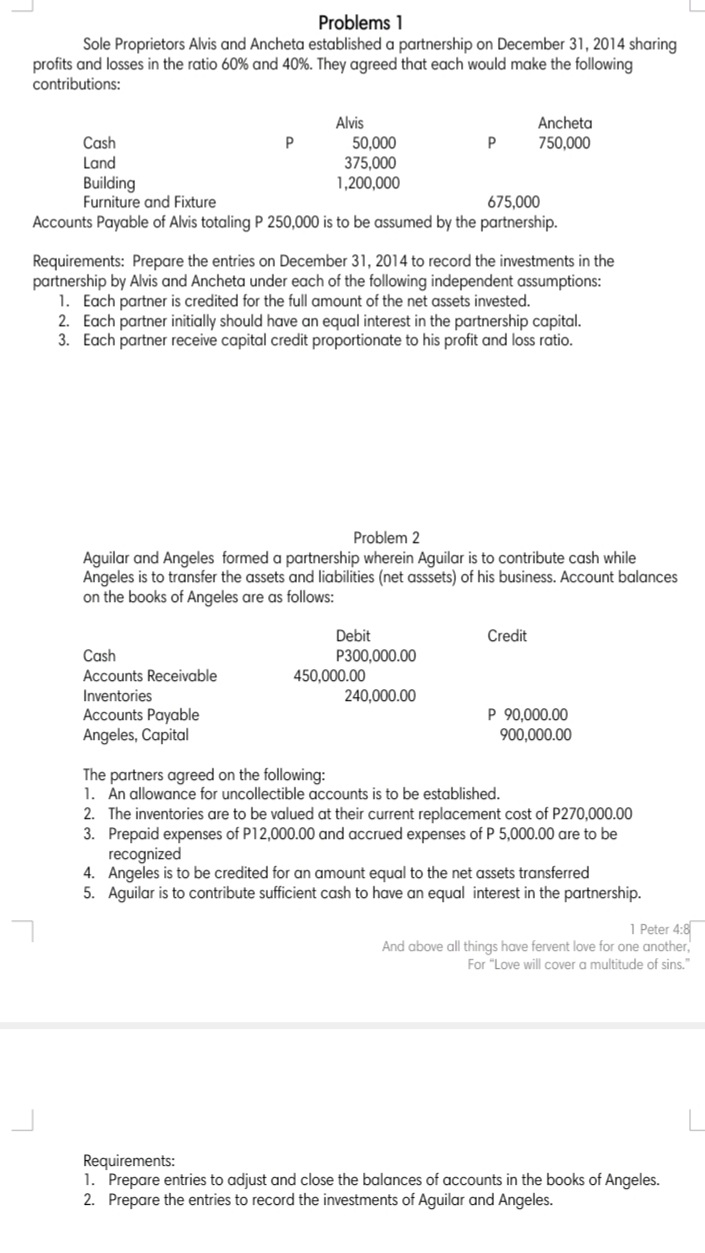

Transcribed Image Text:Problems 1

Sole Proprietors Alvis and Ancheta established a partnership on December 31, 2014 sharing

profits and losses in the ratio 60% and 40%. They agreed that each would make the following

contributions:

Alvis

50,000

375,000

1,200,000

Ancheta

Cash

P

750,000

Land

Building

Furniture and Fixture

675,000

Accounts Payable of Alvis totaling P 250,000 is to be assumed by the partnership.

Requirements: Prepare the entries on December 31, 2014 to record the investments in the

partnership by Alvis and Ancheta under each of the following independent assumptions:

1. Each partner is credited for the full amount of the net assets invested.

2. Each partner initially should have an equal interest in the partnership capital.

3. Each partner receive capital credit proportionate to his profit and loss ratio.

Problem 2

Aguilar and Angeles formed a partnership wherein Aguilar is to contribute cash while

Angeles is to transfer the assets and liabilities (net asssets) of his business. Account balances

on the books of Angeles are as follows:

Debit

Credit

Cash

P300,000.00

Accounts Receivable

Inventories

450,000.00

240,000.00

Accounts Payable

Angeles, Capital

P 90,000.00

900,000.00

The partners agreed on the following:

1. An allowance for uncollectible accounts is to be established.

2. The inventories are to be valued at their current replacement cost of P270,000.00

3. Prepaid expenses of P12,000.00 and accrued expenses of P 5,000.00 are to be

recognized

4. Angeles is to be credited for an amount equal to the

5. Aguilar is to contribute sufficient cash to have an equal interest in the partnership.

assets transferred

1 Peter 4:8

And above all things have fervent love for one another,

For "Love will cover a multitude of sins."

Requirements:

1. Prepare entries to adjust and close the balances of accounts in the books of Angeles.

2. Prepare the entries to record the investments of Aguilar and Angeles.

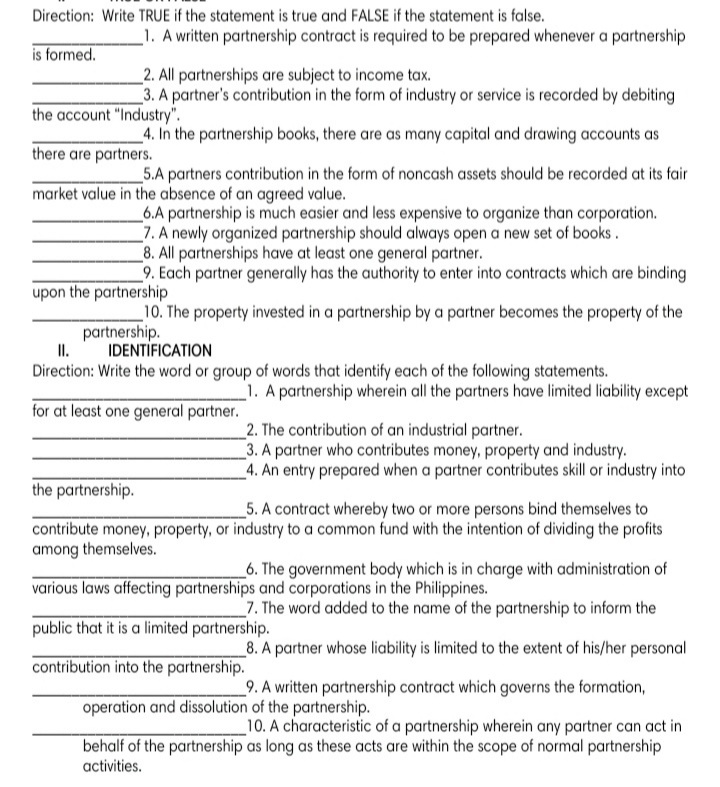

Transcribed Image Text:Direction: Write TRUE if the statement is true and FALSE if the statement is false.

_1. A written partnership contract is required to be prepared whenever a partnership

is formed.

_2. All partnerships are subject to income tax.

3. A partner's contribution in the form of industry or service is recorded by debiting

the account "Industry".

_4. In the partnership books, there are as many capital and drawing accounts as

there are partners.

_5.A partners contribution in the form of noncash assets should be recorded at its fair

market value in the absence of an agreed value.

_6.A partnership is much easier and less expensive to organize than corporation.

7. A newly organized partnership should always open a new set of books .

_8. All partnerships have at least one general partner.

9. Each partner generally has the authority to enter into contracts which are binding

upon the partnership

10. The property invested in a partnership by a partner becomes the property of the

partnership.

IDENTİFICATION

II.

Direction: Write the word or group of words that identify each of the following statements.

_1. A partnership wherein all the partners have limited liability except

for at least one general partner.

_2. The contribution of an industrial partner.

_3. A partner who contributes money, property and industry.

_4. An entry prepared when a partner contributes skill or industry into

the partnership.

_5. A contract whereby two or more persons bind themselves to

contribute money, property, or industry to a common fund with the intention of dividing the profits

among themselves.

_6. The government body which is in charge with administration of

various laws affecting partnerships and corporations in the Philippines.

_7. The word added to the name of the partnership to inform the

public that it is a limited partnership.

_8. A partner whose liability is limited to the extent of his/her personal

contribution into the partnership.

_9. A written partnership contract which governs the formation,

operation and dissolution of the partnership.

10. A characteristic of a partnership wherein any partner can act in

behalf of the partnership as long as these acts are within the scope of normal partnership

activities.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you