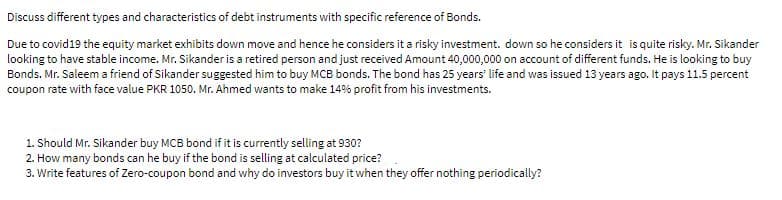

Discuss different types and characteristics of debt instruments with specific reference of Bonds. Due to covid19 the equity market exhibits down move and hence he considers it a risky investment. down so he considers it is quite risky. Mr. Sikander looking to have stable income. Mr. Sikander is a retired person and just received Amount 40,000,000 on account of different funds. He is looking to buy Bonds. Mr. Saleem a friend of Sikander suggested him to buy MCB bonds. The bond has 25 years' life and was issued 13 years ago. It pays 11.5 percent coupon rate with face value PKR 1050. Mr. Ahmed wants to make 14% profit from his investments. 1. Should Mr. Sikander buy MCB bond if it is currently selling at 930? 2. How many bonds can he buy if the bond is selling at calculated price? 3. Write features of Zero-coupon bond and why do investors buy it when they offer nothing periodically?

Discuss different types and characteristics of debt instruments with specific reference of Bonds. Due to covid19 the equity market exhibits down move and hence he considers it a risky investment. down so he considers it is quite risky. Mr. Sikander looking to have stable income. Mr. Sikander is a retired person and just received Amount 40,000,000 on account of different funds. He is looking to buy Bonds. Mr. Saleem a friend of Sikander suggested him to buy MCB bonds. The bond has 25 years' life and was issued 13 years ago. It pays 11.5 percent coupon rate with face value PKR 1050. Mr. Ahmed wants to make 14% profit from his investments. 1. Should Mr. Sikander buy MCB bond if it is currently selling at 930? 2. How many bonds can he buy if the bond is selling at calculated price? 3. Write features of Zero-coupon bond and why do investors buy it when they offer nothing periodically?

Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

Transcribed Image Text:Discuss different types and characteristics of debt instruments with specific reference of Bonds.

Due to covid19 the equity market exhibits down move and hence he considers it a risky investment. down so he considers it is quite risky. Mr. Sikander

looking to have stable income. Mr. Sikander is a retired person and just received Amount 40,000,000 on account of different funds. He is looking to buy

Bonds. Mr. Saleem a friend of Sikander suggested him to buy MCB bonds. The bond has 25 years' life and was issued 13 years ago. It pays 11.5 percent

coupon rate with face value PKR 1050. Mr. Ahmed wants to make 14% profit from his investments.

1. Should Mr. Sikander buy MCB bond if it is currently selling at 930?

2. How many bonds can he buy if the bond is selling at calculated price?

3. Write features of Zero-coupon bond and why do investors buy it when they offer nothing periodically?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education