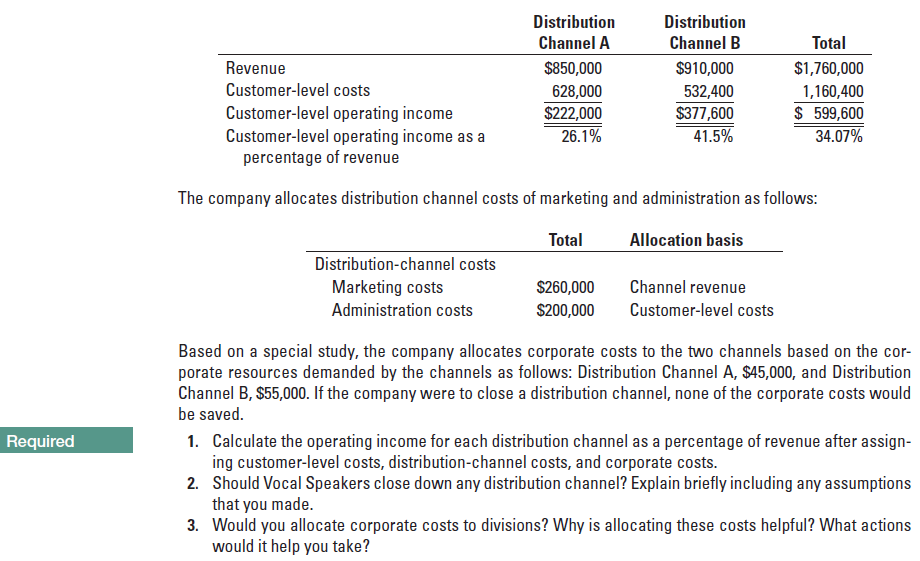

Distribution Distribution Total Channel A Channel B Revenue $850,000 $910,000 $1,760,000 Customer-level costs 628,000 $222,000 26.1% 532,400 $377,600 41.5% 1,160,400 $ 599,600 34.07% Customer-level operating income Customer-level operating income as a percentage of revenue The company allocates distribution channel costs of marketing and administration as follows: Total Allocation basis Distribution-channel costs Marketing costs $260,000 Channel revenue Administration costs S200,000 Customer-level costs Based on a special study, the company allocates corporate costs to the two channels based on the cor- porate resources demanded by the channels as follows: Distribution Channel A, $45,000, and Distribution Channel B, $55,000. If the company were to close a distribution channel, none of the corporate costs would be saved. 1. Calculate the operating income for each distribution channel as a percentage of revenue after assign- ing customer-level costs, distribution-channel costs, and corporate costs. 2. Should Vocal Speakers close down any distribution channel? Explain briefly including any assumptions that you made. 3. Would you allocate corporate costs to divisions? Why is allocating these costs helpful? What actions would it help you take? Required

Distribution Distribution Total Channel A Channel B Revenue $850,000 $910,000 $1,760,000 Customer-level costs 628,000 $222,000 26.1% 532,400 $377,600 41.5% 1,160,400 $ 599,600 34.07% Customer-level operating income Customer-level operating income as a percentage of revenue The company allocates distribution channel costs of marketing and administration as follows: Total Allocation basis Distribution-channel costs Marketing costs $260,000 Channel revenue Administration costs S200,000 Customer-level costs Based on a special study, the company allocates corporate costs to the two channels based on the cor- porate resources demanded by the channels as follows: Distribution Channel A, $45,000, and Distribution Channel B, $55,000. If the company were to close a distribution channel, none of the corporate costs would be saved. 1. Calculate the operating income for each distribution channel as a percentage of revenue after assign- ing customer-level costs, distribution-channel costs, and corporate costs. 2. Should Vocal Speakers close down any distribution channel? Explain briefly including any assumptions that you made. 3. Would you allocate corporate costs to divisions? Why is allocating these costs helpful? What actions would it help you take? Required

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Cost-hierarchy income statement and allocation of corporate, division, and channel costs to customers. Vocal Speakers makes wireless speakers that are sold to different customers in two main distribution channels. Recently, the company’s profitability has decreased. Management would like to analyze the profitability of each channel based on the following information:

Transcribed Image Text:Distribution

Distribution

Total

Channel A

Channel B

Revenue

$850,000

$910,000

$1,760,000

Customer-level costs

628,000

$222,000

26.1%

532,400

$377,600

41.5%

1,160,400

$ 599,600

34.07%

Customer-level operating income

Customer-level operating income as a

percentage of revenue

The company allocates distribution channel costs of marketing and administration as follows:

Total

Allocation basis

Distribution-channel costs

Marketing costs

$260,000

Channel revenue

Administration costs

S200,000

Customer-level costs

Based on a special study, the company allocates corporate costs to the two channels based on the cor-

porate resources demanded by the channels as follows: Distribution Channel A, $45,000, and Distribution

Channel B, $55,000. If the company were to close a distribution channel, none of the corporate costs would

be saved.

1. Calculate the operating income for each distribution channel as a percentage of revenue after assign-

ing customer-level costs, distribution-channel costs, and corporate costs.

2. Should Vocal Speakers close down any distribution channel? Explain briefly including any assumptions

that you made.

3. Would you allocate corporate costs to divisions? Why is allocating these costs helpful? What actions

would it help you take?

Required

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education