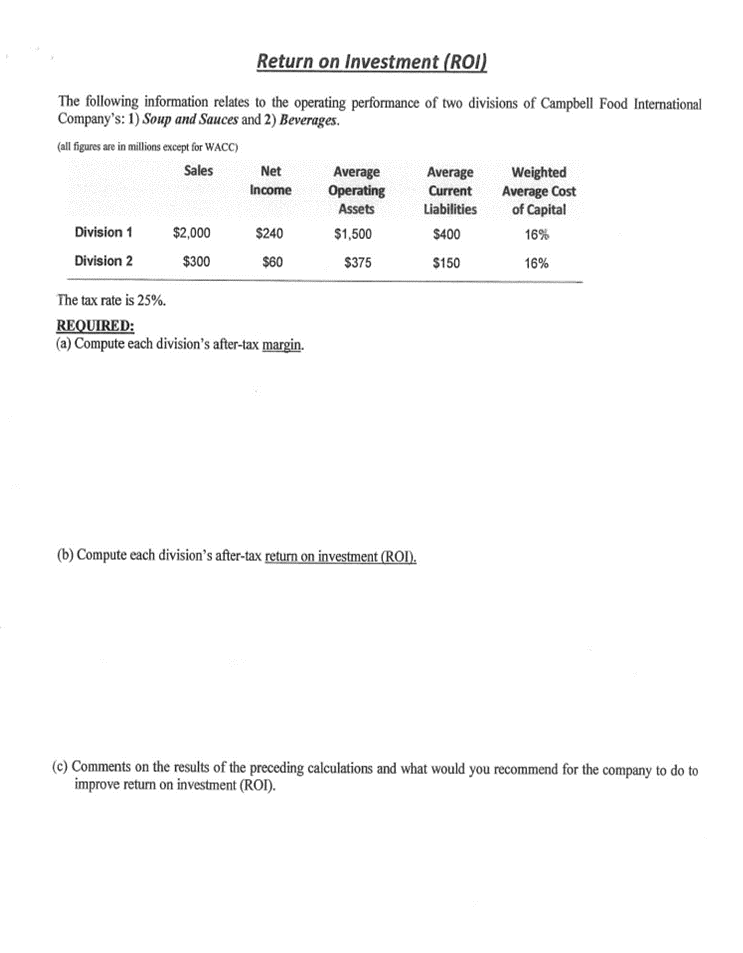

Division 1 Division 2 The tax rate is 25%. Sales $2,000 $300 Net Income $240 $60 Average Operating Assets $1,500 $375 Average Current Liabilities $400 $150 Weighted Average Cost of Capital 16% 16%

Q: Required: 1. Prepare an income statement for the year ended December 31, 2020.

A: Financial statements are the written records of company's financial activities and performances. It…

Q: Gross salaries for the period are $27,500 The CPP employer and employee rate is 5.25% The El…

A: The journal entries are related to recording the business transactions in the accounting record of…

Q: Problem 24-4A (Algo) Applying net present value and profitability index LO P3 Rowan Company is…

A: The value of same amount money received at different times is different because of time value of…

Q: France company disclosed that the depreciation policy of on machinery is as follows: A full year…

A: Depreciation expense :— It is the allocation of depreciable cost of asset over the life of assets.…

Q: Smith Ltd has three product lines: A, B, and C. Sales Variable costs Contribution Margin Fixed costs…

A: A B C Sales $10,000 $9,000 $12,000 Variable Costs $4,500 $7,000 $6,000 Contribution Margin…

Q: Better Burgers reported the following numbers (in millions) for the years ending February 2021 and…

A: The retention ratio is the ratio of profit retained (for business) to net profit. the profit…

Q: Cane Company manufactures two products called Alpha and Beta that sell for $170 and $130,…

A: The process of choosing the best financial course of action based on pertinent financial data and…

Q: Current Attempt in Progress The adjusted account balances of Cullumber Corporation at December 31,…

A: A P&L statement (income statement) is a financial statement that shows the earnings generated by…

Q: The following information relates to two divisions in a period of 1 month. Division N produces…

A: BREAKEVEN POINT Break Even means the volume of production or sales where there is no profit or loss.…

Q: 19. a. b. C. d. A disadvantage of decentralization is that it creates greater responsiveness to…

A: Decentralization in a company means that it has divided the organization into smaller units and…

Q: Oriole had 9,400 shares of 3%, $8 par value preferred stock and 55,000 shares of $0.50 par value…

A: As given in the question 3% of preferred stock is cumulative, so the company has to pay the arrear…

Q: The units of Manganese Plus available for sale during the year were as follows: Mar. 1 Inventory 22…

A: Lets understand the basics. The COGS (Cost of Goods Sold) computation is based on the cost of a…

Q: Craig has decided to start snow plowing during the winter months. He purchased a heavy-duty dump…

A: As per IRS publication 946, Chapter 4, Under Property Classes, the suggested life of the heavy truck…

Q: 2-a. Did the company's dividends exceed its net income? O Yes O No 2-b. Which financial statement…

A: Income Statement:— It is one of the types of financial statement that shows the performance in the…

Q: Problem 9-17A Controllability, responsibility, and balanced scorecard LO 9-1 Carol Morgan manages…

A: The company should Regularly review the budget and track the expenses to ensure that sticking to the…

Q: Physical Flow and Equivalent Units with EWIP Fleming, Fleming, and Garcia, a local CPA firm,…

A: Equivalent units refer to a measure used in process costing to determine the amount of completed…

Q: Determine the ending balances of the accounts (Cash, Supplies, Equipment, Account Payable, and Note…

A: It is the graphical representation of each General ledger account which is in the form T shape and…

Q: Current Attempt in Progress Splish Brothers Inc. purchased a commercial grade soft-serve ice cream…

A: The accumulated depreciation represents the total amount of depreciation, it arises when the company…

Q: You are required to calculate and state the missing figures represented by alphabet .…

A: ABC Ltd Ghs '000 Calculations Turnover 8,030 Cost of sales 4,818…

Q: Suppose that Ken-Z Art Gallery has annual sales of $870,000, cost of goods sold of $560,000, average…

A: This is based on financial ratio analysis. Financial ratios are based on the relationship between…

Q: Required information The Foundational 15 (Algo) [LO6-1, LO6-3, LO6-4, LO6-5, LO6-6, LO6-7, LO6-8]…

A: The contribution Margin is calculated as difference between sales and variable cost. The unit cost…

Q: On January 2, 2025, Pharoah Co. issued at par $2020000 of 6% convertible bonds. Each $1000 bond is…

A: In order to calculate a company's diluted earnings per share (EPS), convertible securities must all…

Q: During the current year, Sun Electronics, Incorporated, recorded credit sales of $730,000. Based on…

A: The balance sheet refers to the financial statement that reflects the availability of assets and…

Q: Bonita Company has two classes of capital stock outstanding: 8%, $20 par preferred and $5 par…

A: Stockholder's Equity - Stockholder's Equity includes the amount contributed by shareholders issued…

Q: Members of the local Windsor club benefit from two key support services provided by Windsor's global…

A: The step-down method of cost allocation allows the allocation of the cost of one service or support…

Q: Statement of stockholders' equity Financial information related to Organic Products Company for the…

A: Stockholders' equity is the section that is included in the financial statement i.e. balance sheet.…

Q: Jun. 20 Jun. 20 Jul. 4 Jul. 14 Jul. 16 Jul. 18 Jul. 24 Purchased inventory of $5,600 on account from…

A: The journal entries are prepared to record the transactions on regular basis. The perpetual…

Q: Markus Company's common stock sold for $5.75 per share at the end of this year. dividend of $0.69…

A: Return on equity is calculated by dividing net income to the average shareholder's equity

Q: Pinnacle Inc. manufactures curtains to client specifications. It has two cost categories that are…

A: Predetermined Overhead Rate :— It is the rate used to allocate manufacturing overhead cost to cost…

Q: Marcy Tucker received the following items this year. Determine to what extent each item is included…

A: In order to determine the adjusted gross income, the adjustments are required to be subtracted from…

Q: ets was $2,100,000, ontrolling interest shares of llar amount of noncontrollir

A: Amount of non controlling interest that should appear in consolidate balance sheet =…

Q: Compute the missing amounts for the following table. Question content area bottom Part 1 Compute the…

A: BREAKEVEN POINT Break Even means the volume of production or sales where there is no profit or loss.…

Q: Klumper Corporation is a diversified manufacturer of industrial goods. The company's activity-based…

A: Overhead cost for each activity cost pool = Activity rate × Expected activity

Q: The General Ledger Question: What is the Account Number found in the General Ledger, (Ex. No.101,…

A: The General Ledger is a central component of the accounting system in which all financial…

Q: The General Ledger Question: What does the general ledger debit/credit account number mean? It is…

A: The general ledger can be defined as the way of recording the company's total financial assets. The…

Q: Sales + Less: 2 Manufacturing costs Depreciation Shipping and administrative costs Income before…

A: PAYBACK PERIOD Payback Period is one of the important Capital Budgeting Technique. Payback Period is…

Q: Each airline customer spends $480 per year to receive access to the VIP waiting area at the airport.…

A: Since you have asked multiple questions we will answer only the first question as per our rules, in…

Q: Sandhill Inc. has following information for its finished goods at December 31, 2025: Replacement…

A: According to the International Accounting Standard 2 (IAS 2), the recognition of inventory should be…

Q: A machine cost $1104000, has annual depreciation of $184000, and has accumulated depreciation of…

A: If exchange has commercial substance, the value of assets will be recorded at the fair value of the…

Q: 10. Property valued at $130 000 is assessed at 2/13 of its value. What is the amount of tax due for…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want…

Q: Recording and Reporting Multiple Temporary Differences The records of Cross Corporation provided the…

A: Deferred Tax Asset: Also known as deductible temporary differences. It arises in two cases: 1. When…

Q: ROBLEM 3 Sarah Company decided to change the depreciation method of an asset to SYD from SLM on…

A: Depreciation expenses :— It is the allocation of depreciable cost of asset over the life of asset.…

Q: On July 1, 2023, Sheffield Aggregates Ltd. purchased 7% bonds with a maturity value of $135,000 for…

A: Journal entry is the initial record of the transactions in the books of accounts it includes at…

Q: Explain the concept of materiality in accounting and its role in financial reporting. Provide…

A: In the field of accounting, materiality is a fundamental concept that guides the preparation and…

Q: What factors or variables are considered when estimating the depletion base for an asset? Can you…

A: Estimating the depletion base for an asset refers to the process of determining the total value of…

Q: Sunland Corporation manufactures a single product. Monthly production costs incurred in the…

A: The entity incurs different types of costs. The cast has different behaviors some costs are fixed…

Q: The following data from the just completed year are taken from the accounting records of Mason…

A: The income statement is prepared to show the result of the business operations in terms of profit or…

Q: Windsor Motors is a division of Windsor Products Corporation. The division manufactures and sells an…

A: Income statement :— It is one of the financial statement that shows profitability, total revenue and…

Q: Wildhorse, Inc. purchased equipment in 2024 for $901000. Two years later it became apparent to…

A: Impairment loss refers to the reduction in the value of an asset when its carrying amount exceeds…

Q: Bentley Manufacturing produces luxury dog houses. Each dog house requires 1.0 hours of machine time…

A: Standard hours for actual production = (standard hours per unit * Actual production) = (1*1900)…

Step by step

Solved in 3 steps

- Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).Katayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?Papa Johns International, Inc. (PZZA), operates over 5,000 restaurants in the United States and 45 countries. The company operates primarily as a franchisor with 4,353 franchised restaurants and 744 company-operated restaurants. Recent data (in millions) for the company-operated and North America franchised restaurants are as follows: a. Determine the profit margin for each segment. Round to one decimal place. b. Determine the investment turnover for each segment. Round to two decimal places. c. Use the DuPont formula to determine the return on investment for each segment. Round to one decimal place. d. Analyze and interpret the results of (a), (b), and (c).

- The condensed income statement for the Consumer Products Division of Tri-State Industries Inc. is as follows (assuming no support department allocations): The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that 143,750,000 of assets have been invested in the Consumer Products Division. b. If expenses could be reduced by 3,450,000 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on investment for the Consumer Products Division?Cost-Volume-Profit, Margin of Safety Victoria Company produces a single product. Last years income statement is as follows: Required: 1. Compute the break-even point in units and sales dollars calculated using the break-even units. 2. What was the margin of safety for Victoria last year in sales dollars? 3. Suppose that Victoria is considering an investment in new technology that will increase fixed cost by 250,000 per year but will lower variable costs to 45% of sales. Units sold will remain unchanged. Prepare a budgeted income statement assuming that Victoria makes this investment. What is the new break-even point in sales dollars, assuming that the investment is made?Standard Media has a required rate of return of 5 percent, a cost of capital of 4 percent, and an income tax rate of 30 percent. The following information about its two divisions has been provided by management: Audio Division Video Division NOPAT $1,400,000 $2,000,000 Sales $10,000,000 $12,500,000 Invested capital $15,000,000 $17,500,000 How much is the ROI of the Audio Division?

- Gabbe Industries is a division of a major corporation. Last year the division had total sales of $27,311,900, net operating income of $2,840,438, and average operating assets of $7,094,000. The company's minimum required rate of return is 15%. Required: a. What is the division's margin? (Round your percentage answer to 2 decimal places.) b. What is the division's turnover? (Round your answer to 2 decimal places.) c. What is the division's return on investment (ROI)? (Round percentage your answer to 2 decimal places.)The following information is available about the status and operations of Big Shot Corp., which has a required ROI of 15% and discount rate of 12%: Division A Division B Divisional Investment P 500,000 P 1,250,000 Divisional Profit P 350,000 P 625,000 Variable Cost P 500,000 P 3,500,000 Divisional Sales P1, 500,000 P 5,500,000 Division A could increase its sales by P 300,000 by increasing its investment by P300,000. Compute its ROI. Division A could increase its sales by P150,000 by increasing its investment by P400,000. Compute its total residual income. Division B could reduce its investment so that its asset turnover increased by 2, while holding total sales constant. Compute its residual income.The following information is available about the status and operations of Jay Arr Company, which has a required ROI of 15% and discount rate of 12%: Division A Division B Divisional Investment P 500,000 P 1,250,000 Divisional Profit P 350,000 P 625,000 Variable Cost P 500,000 P 3,500,000 Divisional Sales P1, 500,000 P 5,500,000 Division A could increase its sales by P 300,000 by increasing its investment by P300,000. Compute its ROI. Division A could increase its sales by P150,000 by increasing its investment by P400,000. Compute its total residual income. Division B could reduce its investment so that its asset turnover increased by 2, while holding total sales constant. Compute its residual income.

- Profit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales $540,000 Cost of goods sold 243,000 Gross profit $297,000 Administrative expenses 135,000 Income from operations $162,000 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,350,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin fill in the blank 1 % Investment turnover fill in the blank 2 Rate of return on investment fill in the blank 3 % b. If expenses could be reduced by $27,000 without decreasing sales, what would be the impact on the…Profit Margin, Investment Turnover, and return on investment The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges): Sales $1,026,000 Cost of goods sold 461,700 Gross profit $564,300 Administrative expenses 205,200 Income from operations $359,100 The manager of the Consumer Products Division is considering ways to increase the return on investment. a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $1,710,000 of assets have been invested in the Consumer Products Division. Round the investment turnover to one decimal place. Profit margin % Investment turnover Rate of return on investment % b. If expenses could be reduced by $51,300 without decreasing sales, what would be the impact on the profit margin, investment turnover, and return on…The Break Division of Zoe motors Company had the following financial data for the year: Assets available for use P 1,000,000 BV P1,500,000 MV Residual income P 100,000 Return on investment 15% A. What was the Break Division’s segment income? B. If the manager of the Break Division is evaluated based on return on investment, how much would she willing to pay for an investment that promise to increase net segment income by P50,000?