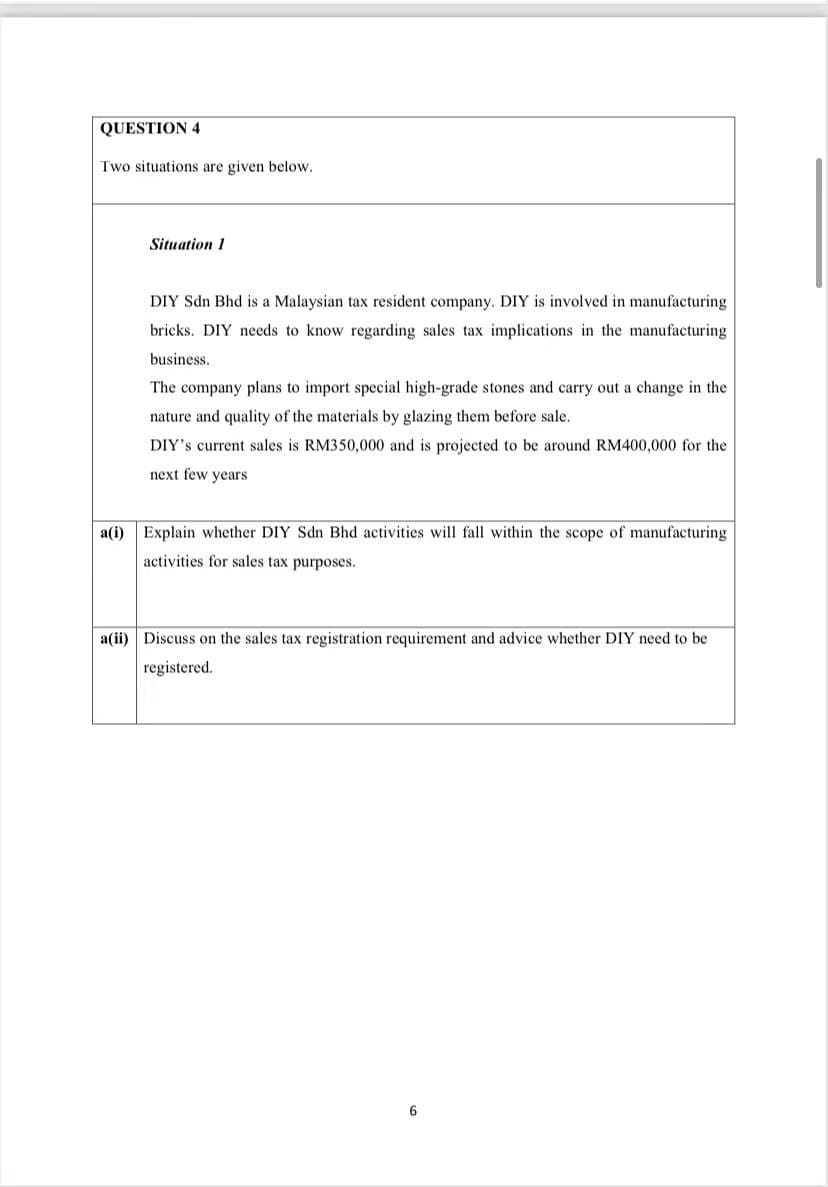

DIY Sdn Bhd is a Malaysian tax resident company. DIY is involved in manufacturing bricks. DIY needs to know regarding sales tax implications in the manufacturing business. The company plans to import special high-grade stones and carry out a change in the nature and quality of the materials by glazing them before sale. DIY's current sales is RM350,000 and is projected to be around RM400,000 for the next few years

Q: NextGen Wealth Ltd is a large manufacturing firm Ghana, that was created 20 years ago by Opanin…

A: d. The primary market is where securities are created, while the secondary market is where those…

Q: B&G Co. is planning a project in France. It would lease space for one year in a shopping mall to…

A: Required rate of return = 25% Initial investment = $320,000 (i) Expected pre tax earnings = 650,000…

Q: Amman Ltd. is a manufacturing company that produces peper cups and plates in Nuwa. The company was…

A: Average Payment Period =365/ creditors Turnover Ratio Creditors Turnover Ratio = Credit Purchase /…

Q: WanKea Berhad is the biggest retailer of ofice stationeries in Malaysia. The company buys the…

A: Financial reports provide accurate financial decisions if reports are free from misstatement.

Q: 1. Mr. Abu, a Japanese engineer residing in Tokyo, Japan, was contracted by a domestic corporation…

A: In this case the income has been accrued in two different countries that is Japan and Philippines.…

Q: Consider the following transactions that take place in 2021. A rancher in Alberta takes $100 worth…

A: GDP is a common indicator of the cost added created by a country's output of goods and services over…

Q: CONVEX Ltd. is a new company that was established on 1st January, 2020 to oversee the production of…

A: Financial statement includes the different types of statements which are prepared to analyze and…

Q: Spotless Cleaning Ltd wishes to evaluate an investment on a particular washing machine. In your role…

A: Net present value is the difference between present value of cash inflows and present value of cash…

Q: Prime Limited is a manufacturer of multimedia projectors. The company invests heavily in research…

A: The expenses incurred for an intangible asset are capitalised to its cost when it meets the…

Q: VEX Ltd. is a new company that was established on 1st January, 2020 to oversee the production of…

A: In the given situation, Convex Ltd acquired 75% shares in Concave Ltd to speed up the corona virus…

Q: Within the year, CONVEX Ltd. sold pharmaceutical products worth GH¢8 million to CONCAVE Ltd. CONVEX…

A: Retained Earnings is cumulative of the net income amount. It is generated by the company's Profit…

Q: n of coronavirus vaccines for Ghana. On 1st July, 2020, CONVEX Ltd. acquired 75% shares in CONCAVE…

A: Convex Ltd has acquired 75% shares in Concave Ltd. Convex Ltd is planning to sell 30% of their…

Q: Phoney Communications Ltd pays income as franked dividends usable by Australian resident…

A: Terminal cash flows means cash flow occurred at the end of the project. Given: Initial investment =…

Q: Due to rising labor costs in Malaysia, Domain Computer, based in Singapore, is considering shorting…

A: The benefit cost ratio is the relationship between Present Value of Expected benefits and the…

Q: JRB International, located in Dallas, Texas, is the world’s largest manufacturer of electronic…

A: Foreign Translation Foreign translation which are specified in the IAS 21 in the accounting standard…

Q: Without prejudice to your answers to previous questions, and assume that Davao plans to market its…

A: For maintaining same income after taxes, an entity need to compensate, additional promotion program…

Q: Selasih Company manufactures aluminium containers for restaurants. The owner of Selasih, Puan…

A: Breakeven sales revenue is that level of sales revenue at which business is fully covering it's…

Q: Acme Inc. makes anvils at its factory in the southwest, Total revenues from sales of anvils are…

A: Economic profit is the difference between the revenue received from sales and all the input costs…

Q: wco) in Malaysia in order to apply for Pioneer Status or Investment Tax Allowance for its…

A: A) Both Branch and subsidiary setting in Malaysia is a good choice, but the choice may depend on the…

Q: st year are 15.4 million if your Belgian subsidiary survives and 1.2 million if the local government…

A: Net present value is defined as the discounted cash flow technique which applies to weight the items…

Q: CONVEX Ltd. is a new company that was established on 1st January, 2020 to oversee the production of…

A: Introduction: Equity shares are the shares which represent the ownership of the shareholders in the…

Q: wco will expand its operation if necessary. However, Newco is still undecided on the timing of…

A: Both Branch and subsidiary setting in Malaysia is a good choice, but the choice may depend on the…

Q: deliver £750 m in savings for Lidl, but it is valueless to any other company. SAP needs to make an…

A: Hold up money that is what was agreed but lesser amount is paid due to any prevailing situation of…

Q: DIY Sdn Bhd is a Malaysian tax resident company. DIY is involved in manufacturing bricks. DIY needs…

A: The government levies a tax on the consumption of various products and services, which is known as a…

Q: Buffalo Environmental Service expects to generate a taxable income of$350,000 from its regular…

A: Concept: The tax rate which is applied on the additional income of an individual is referred as…

Q: CONVEX Ltd. is a new company that was established on 1st January, 2020 to oversee the production of…

A: Profitability of an entity refers to the ability to generate earnings with specified resource…

Q: CONVEX Ltd. is a new company that was established on 1st January, 2020 to oversee the production of…

A: While scrutinizing the situation given above it was observed that 75% of the shares were acquired by…

Q: CONVEX Ltd. is a new company that was established on 1st January, 2020 to oversee the production of…

A: SOLUTION- CONCAVE Ltd. acquired land for GH¢50,000 and sold it to CONVEX Ltd. for GH¢55,000 .…

Q: CONVEX Ltd. is a new company that was established on 1st January, 2020 to oversee the production of…

A: a) Issue A In this question As per GAAP all majority owned subsidiaries must be consolidated except…

Q: Racton Pte Ltd (Racton), is a foreign company incorporated in America. Racton is attracted to the…

A: Here Retcon Pte Ltd is a foreign company incorporated in America. Due to the tax attraction…

Q: Dianthus Ltd is a multinational company with headquarters in Queensland, Australia. It is, however,…

A: As per the given situation, Dianthus ltd is listed in two countries- Australia and Taiwan. Its…

Q: Oman Chips company have noticed that the demand of their products increased in last few quarters.…

A: With respect to corporate governance, the company has to disclose their positive and negative impact…

Q: ABC Inc. produces home appliances and sells them in the U.S. It outsources the production of the…

A: Exposure refers to risk involved due to presence of certain factors in environment. In finance,…

Q: You are the CEO of Megah Holding. Four years ago, your company purchased machine XYZ. Because of…

A: Defender Challenger Original cost RM 9,000 RM 11,000 Maintenance cost(For Defender increase…

Q: Explain why proponents of LIFO argue that it provides a better match of revenue and expenses. In…

A: Inventory Valuation: An inventory valuation is the financial sum related to the products in the…

Q: Tovar Cie is a French firm that has been asked to provide consulting services to help Gredia Company…

A: The net present value method is used to find out the profitability of a project by adding up…

Q: CONVEX Ltd. is a new company that was established on 1st January, 2020 to oversee the production of…

A: SOLUTION A- The fair value of the equipment at the date of acquisition : $2,000,000 The book value…

Q: CONVEX Ltd. is a new company that was established on 1st January, 2020 to oversee the production of…

A: The question is based on the concept of business accounting.

Q: Due to rising labor costs in Malaysia, Domain Computer, based in Singapore, is considering shifting…

A: Introduction:- Cost-benefit analysis (CBA), also known as benefit-cost analysis is a systematic…

Q: Imports of $75,000 inclusive of Jmd$15,000 VAT

A: Given Imports =75000 VAT=15000

Q: ssue A At the meeting, executive members could not agree on whether CONVEX Ltd. should prepare and…

A: The first question is answered for you. Please resubmit specifying the question number you want…

Q: A Chinese automobile company is going to use one of its unused manufacturing plants in China to…

A: The details of the question are as below: Yearly Production (in units) 20,000 $…

Q: Setia Maju Bhd uses titanium in the production of its specialty drivers. Setia Maju Bhd anticipates…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Döveç Group of Companies is one of the largest Property Developing companies in Cyprus, with more…

A: Net present value is the difference between the present value of cash inflows and present value of…

Q: Billabong Fashion is based in Melbourne, Australia. Billabong Fashion has a subsidiary in Shanghai…

A: Translation Risk: When there are parent and subsidiary companies located in different countries and…

Q: Döveç Group of Companies is one of the largest Property Developing companies in Cyprus, with more…

A: Net present value is the difference between the present value of cash inflows and present value of…

Step by step

Solved in 2 steps

- DIY Sdn Bhd is a Malaysian tax resident company. DIY is involved in manufacturing bricks. DIY needs to know regarding sales tax implications in the manufacturing business. The company plans to import special high-grade stones and carry out a change in the nature and quality of the materials by glazing them before sale. DIY’s current sales is RM350,000 and is projected to be around RM400,000 for the next few years a(i) Explain whether DIY Sdn Bhd activities will fall within the scope of manufacturing activities for sales tax purposes. a(ii) Discuss on the sales tax registration requirement and advice whether DIY need to be registered.Azree an accountant, working for a foreign consultant firm and earning RM 78,000 per year is contemplating giving up his job and set up his own tax consultant firm. He estimates that renting an office would cost RM 780 per month, hiring a secretary with salary RM 1,500 per month and purchasing for required supplies would cost him RM 10,000 per annum. He estimated that his total revenues for the year would be RM 120,000. a) Calculate the explicit cost and implicit costDavao has a potential foreign customer that has offered to buy 1,500 tons at P450 per ton. Assume that all of Davao’s costs would be at the same levels and rates as last year. What net income after taxes would Davao make if it took this order and rejected some business from regular customers so as not to exceed capacity? Answer: 221,500 Without prejudice to your answers to previous questions, and assume that Davao plans to market its product in a new territory. Davao estimates that an advertising and promotion program costing P61,500 annually would need to be undertaken for the next two or three years. In addition, a P25 per ton sales commission over and above the current commission to the sales force in the new territory would be required. How many tons would have to be sold in the new territory to maintain Davao’s current after-tax income of P94,500? Answer: 307.5

- Davao has a potential foreign customer that has offered to buy 1,500 tons at P450 per ton. Assume that all of Davao’s costs would be at the same levels and rates as last year. What net income after taxes would Davao make if it took this order and rejected some business from regular customers so as not to exceed capacity? Without prejudice to your answers to previous questions, and assume that Davao plans to market its product in a new territory. Davao estimates that an advertising and promotion program costing P61,500 annually would need to be undertaken for the next two or three years. In addition, a P25 per ton sales commission over and above the current commission to the sales force in the new territory would be required. How many tons would have to be sold in the new territory to maintain Davao’s current after-tax income of P94,500? If the sales volume is estimated to be 2,100 tons in the next year, and if the prices and costs stay at the same levels and amounts next year, the…1.Davao has a potential foreign customer that has offered to buy 1,500 tons at P450 per ton. Assume that all of Davao’s costs would be at the same levels and rates as last year. What net income after taxes would Davao make if it took this order and rejected some business from regular customers so as not to exceed capacity? 2. If the sales volume is estimated to be 2,100 tons in the next year, and if the prices and costs stay at the same levels and amounts next year, the after-tax income that Davao can expect for next year is ? 3. The breakeven volume in tons of product for the year is ?QUESTION FOUR (a)Belta manufacturers in China produce car engines. They have been in the business for almost 20 years. They have been profitable enough to employ more staff and increase their production. But with a recent loan taken to facilitate automation, investors want to know how the company is doing. Their total assets are worth K3, 500,000 while they have current assets of K9, 200,000. Their current liabilities stand at K5, 000,000 while retained earnings amount to K800, 000. Earnings before Interest and Tax come to K6, 500,000. Sales total K8, 300,000 while the market value of equity is K7, 000,000.The company has 1,000,000 equity shares outstanding with par value of K5.These shares are now selling at K7 per share. Calculate the Altman z-score for the company and advise. (b)The risk incurred by a bank when the maturities of its assets and liabilities are mismatched is called interest rate risk. (i) Describe two types of interest rate risks (ii) Describe any three methods…

- 114-One of Oman based company is about to start investment in the international market. The company is very old in Oman but new in international market. It is also one of the requirements of the international market to shift accounting standards to International financial reporting standard. The company is not taking this task as challenge because a. Only terminologies will be changed b. None of the options c. The process does not require much efforts d. Training staff on shifting to this standard doesn't cost muchScenario: You have just been hired by the country of "Shorelinia" to create a tax system. Your tax system must collect at least $1,000 billion in revenue. You have three taxes to choose from; income tax, sales tax, and payroll tax. c) You must decide the SalesTax. For reference, state and local sales taxes around Seattle add up to approximately 10%, some of the highest in America. In the USA, there is no national sales tax, although a number of countries have them, also known as VATs (value added taxes) or GSTs (general sales taxes.) Sales tax revenue (in billions of $) at various tax rates 0% 2% 4% 6% 8% 10% 12% revenue $0 $60 $120 $180 $240 $300 $360 The sales tax rate in Shorelinia will be _______%. (fill in space below) d) Sales tax revenue Look up the tax revenue generated by your chosen tax rate in the table above. The sales tax revenue will be $_______billion. (fill in space below) e) Payroll Tax rate In the country of Shorelinia, the payroll tax is…16) please help me!! I don't know how to do it One of your Taiwanese suppliers has bid on a new line of molded plastic parts that is currently being assembled at your plant. The supplier has bid $0.10 per part, given a forecast you provided of 200,000 parts in year 1; 400,000 in year 2; and 500,000 in year 3. Shipping and handling of parts from the supplier's factory is estimated at $0.03 per unit. Additional inventory handling charges should amount to $0.005 per unit. Finally, administrative costs are estimated at $30 per month. Although your plant is able to continue producing the part, the plant would need to invest in another molding machine, which would cost $20,000. Direct materials can be purchased for $0.06 per unit. Direct labor is estimated at $0.05 per unit plus a 50 percent surcharge for benefits; indirect labor is estimated at $0.009 per unit plus 50 percent benefits. Up-front engineering and design costs will amount to $30,000. Finally, management has insisted that…

- question 1 JamCore Investments has completed their 2021 financial year which ran from the 1 May 2020. The company sells masks and sold 1 000 000 masks (2020:20 000) at a price of N$10 (2020:5). The company also manufactures the masks, the cost of sales in 2021 is N$ 1, 200% less than the prior. They managed to decrease the cost of sales by using cheaper and thinner fabric. a. Compare the gross profit margin for 2020 and 2021?b. Comment on any ethical considerations you may have? c.Can ethical qualities be attributed to corporations?(3 reasons to support claim)Alam Damai Sdn Bhd (Alam Damai), a well-known restaurant, hired an expert from Australia, Mr Andrew, in order to advice on work process and to give guidance on ways to improve the equipment used by Alam Damai in their kitchen, starting from 1 July 2013. In order to perform the service, Mr Andrew will be spending around 80 days in Malaysia. Alam Damai will be paying RM200,000 to Mr Andrew in 2013. There is no double tax agreement between Malaysia and Australia. Alam Damai closes its accounts annually to 30 June. 2(a)(i) With regard to Mr AndrewBy taking Mr Andrew resident status into consideration, discuss why the technical fee payable to him is derived from Malaysia 2(a)(ii) Discuss accordingly the tax mechanism and how much he will be taxed. 2(b)(i) With regard to Alam Damai Provide opinion on why fee payment made to Mr Andrew can be regarded as capital and revenue. 2(b)(ii) Alam Damai need to comply with certain tax requirement pertaining to the fee payment made to Mr Andrew, discuss…Part A A software company is considering launching a new product in the market. To record consumer behavior, the company participated in two domestic software fairs in Athens and Thessaloniki that costed €7,000. The results showed that there are two Scenarios (A and B) whose probabilities of occurrence are 60% and 40% respectively, based on consumers’ willingness to buy the new product. To start production, €100,000 is required for new machinery, plus another €2,000 for transport costs and €1,000 for installation costs. This is a state-of-the-art technology machinery, thus, its economic life is only two years. The new machinery will be fully depreciated at the end of its economic life and the company applies the straight-line depreciation method. Table 1 shows the estimated figures on sales, variable costs, selling price, management and distribution costs and working capital needs. At the end of the second year the working capital will be recovered. Table 1: Estimated financial data…