dnd can také önly öne. Your cost of capital is 10.7%. The cash flows for the two projects are as follows ($ million): a. What is the IRR of each project? b. What is the NPV of each project at your cost of capital? c. At what cost of capital are you indifferent between the two projects? Nhat should you do?

dnd can také önly öne. Your cost of capital is 10.7%. The cash flows for the two projects are as follows ($ million): a. What is the IRR of each project? b. What is the NPV of each project at your cost of capital? c. At what cost of capital are you indifferent between the two projects? Nhat should you do?

Chapter10: Financial Statements And Reports

Section: Chapter Questions

Problem 4.3C

Related questions

Question

100%

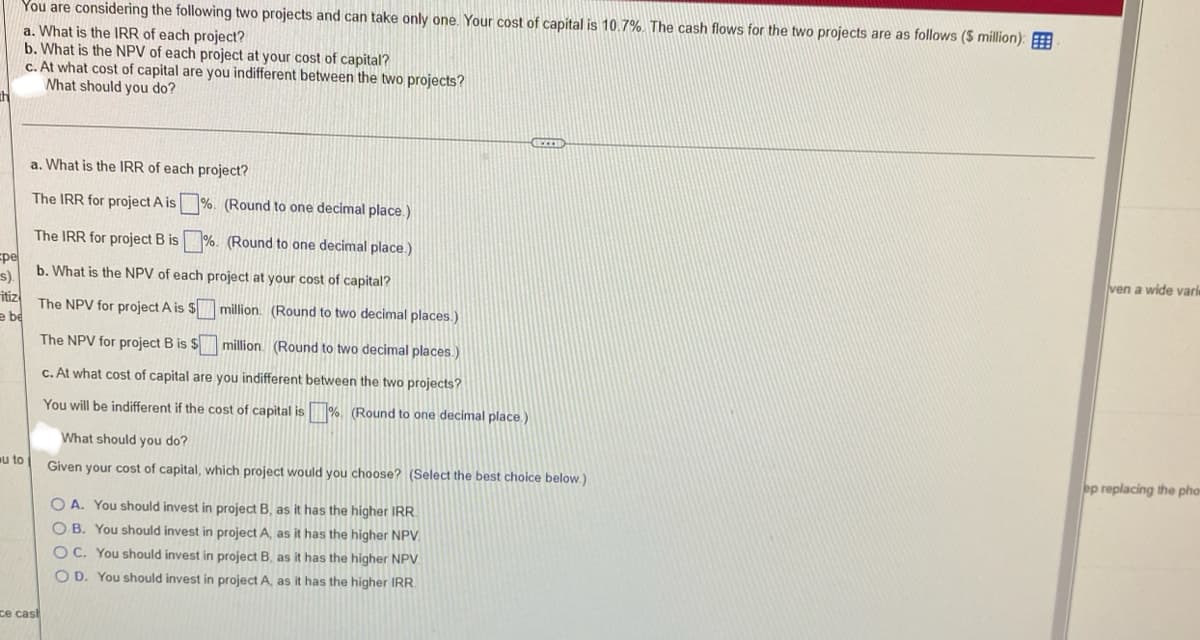

2. You are considering the following two projects and can take only one. Your cost of capital is 10.7%. The cash flows for the two projects are as follows ($ million):

a. What is the IRR of each project?

**round to one decimal place**

b. What is the NPV of each project at your cost of capital?

**round to two decimal places**

c. At what cost of capital are you indifferent between the two projects **round to one decimal place** and what should you do? (select one multiple choice answer)

Transcribed Image Text:You are considering the following two projects and can take only one. Your cost of capital is 10.7%. The cash flows for the two projects are as follows ($ million):

a. What is the IRR of each project?

b. What is the NPV of each project at your cost of capital?

c. At what cost of capital are you indifferent between the two projects?

What should you do?

a. What is the IRR of each project?

The IRR for project A is %. (Round to one decimal place.)

The IRR for project B is

%. (Round to one decimal place.)

pe

b. What is the NPV of each project at your cost of capital?

s).

ven a wide varim

itiz

The NPV for project A is $million. (Round to two decimal places.)

e be

The NPV for project B is $ million. (Round to two decimal places.)

c. At what cost of capital are you indifferent between the two projects?

You will be indifferent if the cost of capital is %. (Round to one decimal place.)

What should you do?

u to

Given your cost of capital, which project would you choose? (Select the best choice below.)

ep replacing the pho

O A. You should invest in project B, as it has the higher IRR.

O B. You should invest in project A, as it has the higher NPV.

O C. You should invest in project B, as it has the higher NPV.

O D. You should invest in project A, as it has the higher IRR.

ce cast

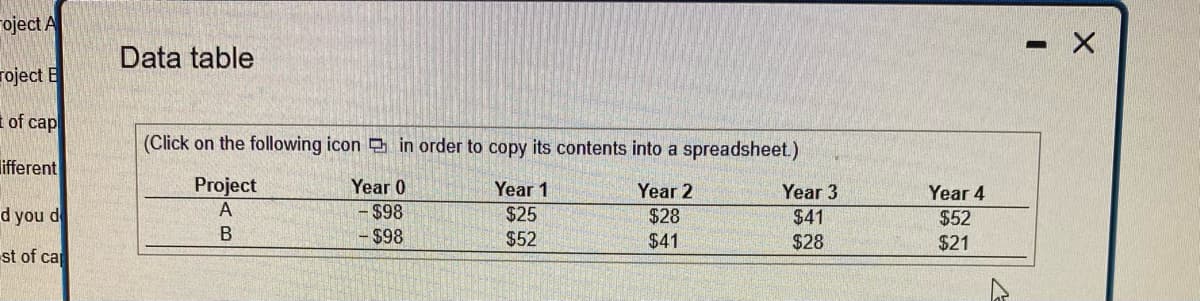

Transcribed Image Text:oject A

Data table

roject E

i of cap

(Click on the following icon in order to copy its contents into a spreadsheet.)

ifferent

Project

Year 0

Year 1

Year 2

Year 3

Year 4

d you d

- $98

$25

$28

$41

$52

B

$98

$52

$41

$28

$21

st of ca

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning