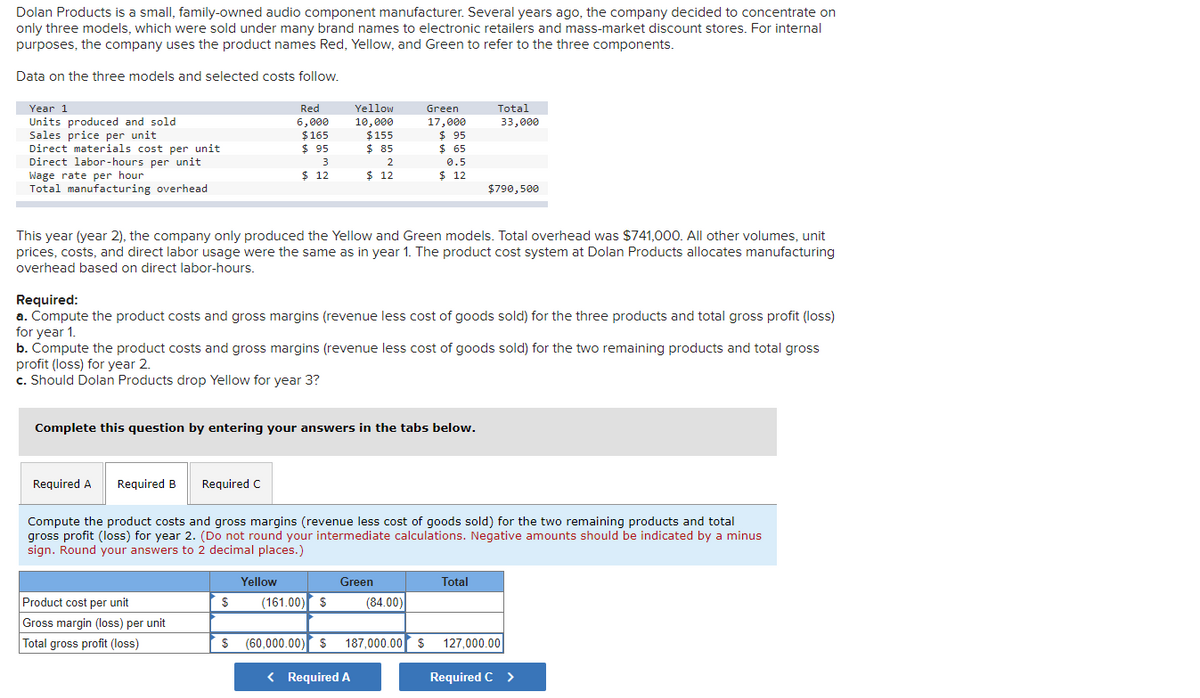

Dolan Products is a small, family-owned audio component manufacturer. Several years ago, the company decided to concentrate on only three models, which were sold under many brand names to electronic retailers and mass-market discount stores. For internal purposes, the company uses the product names Red, Yellow, and Green to refer to the three components. Data on the three models and selected costs follow. 一 Year 1 Units produced and sold Sales price per unit Direct materials cost per unit Direct labor-hours per unit Wage rate per hour Total manufacturing overhead Yellow 10,000 $155 $ 85 2 $ 12 Red Green Total 6,000 $165 $ 95 3 $ 12 33,000 17,000 $ 95 $ 65 0.5 $ 12 $790,500 This year (year 2), the company only produced the Yellow and Green models. Total overhead was $741,000. All other volumes, unit prices, costs, and direct labor usage were the same as in year 1. The product cost system at Dolan Products allocates manufacturing overhead based on direct labor-hours. Required: a. Compute the product costs and gross margins (revenue less cost of goods sold) for the three products and total gross profit (loss) for year 1. b. Compute the product costs and gross margins (revenue less cost of goods sold) for the two remaining products and total gross profit (loss) for year 2. c. Should Dolan Products drop Yellow for year 3? Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the product costs and gross margins (revenue less cost of goods sold) for the two remaining products and total gross profit (loss) for year 2. (Do not round your intermediate calculations. Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) Yellow Green Total (161.00) $ Product cost per unit Gross margin (loss) per unit Total gross profit (loss) (84.00) (60,000.00) s 187,000.00 s 127,000.00 < Required A Required C >

Dolan Products is a small, family-owned audio component manufacturer. Several years ago, the company decided to concentrate on only three models, which were sold under many brand names to electronic retailers and mass-market discount stores. For internal purposes, the company uses the product names Red, Yellow, and Green to refer to the three components. Data on the three models and selected costs follow. 一 Year 1 Units produced and sold Sales price per unit Direct materials cost per unit Direct labor-hours per unit Wage rate per hour Total manufacturing overhead Yellow 10,000 $155 $ 85 2 $ 12 Red Green Total 6,000 $165 $ 95 3 $ 12 33,000 17,000 $ 95 $ 65 0.5 $ 12 $790,500 This year (year 2), the company only produced the Yellow and Green models. Total overhead was $741,000. All other volumes, unit prices, costs, and direct labor usage were the same as in year 1. The product cost system at Dolan Products allocates manufacturing overhead based on direct labor-hours. Required: a. Compute the product costs and gross margins (revenue less cost of goods sold) for the three products and total gross profit (loss) for year 1. b. Compute the product costs and gross margins (revenue less cost of goods sold) for the two remaining products and total gross profit (loss) for year 2. c. Should Dolan Products drop Yellow for year 3? Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the product costs and gross margins (revenue less cost of goods sold) for the two remaining products and total gross profit (loss) for year 2. (Do not round your intermediate calculations. Negative amounts should be indicated by a minus sign. Round your answers to 2 decimal places.) Yellow Green Total (161.00) $ Product cost per unit Gross margin (loss) per unit Total gross profit (loss) (84.00) (60,000.00) s 187,000.00 s 127,000.00 < Required A Required C >

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter20: Inventory Management: Economic Order Quantity, Jit, And The Theory Of Constraints

Section: Chapter Questions

Problem 16E

Related questions

Question

Dolan, Need Assistance with B please

Transcribed Image Text:Dolan Products is a small, family-owned audio component manufacturer. Several years ago, the company decided to concentrate on

only three models, which were sold under many brand names to electronic retailers and mass-market discount stores. For internal

purposes, the company uses the product names Red, Yellow, and Green to refer to the three components.

Data on the three models and selected costs follow.

Year 1

Red

Yellow

Green

Total

Units produced and sold

Sales price per unit

Direct materials cost per unit

Direct labor-hours per unit

Wage rate per hour

Total manufacturing overhead

6,000

$165

$ 95

17,000

$ 95

10,000

33,000

$155

$ 85

$65

3

0.5

$ 12

$ 12

$ 12

$790,500

This year (year 2), the company only produced the Yellow and Green models. Total overhead was $741,000. All other volumes, unit

prices, costs, and direct labor usage were the same as in year 1. The product cost system at Dolan Products allocates manufacturing

overhead based on direct labor-hours.

Required:

a. Compute the product costs and gross margins (revenue less cost of goods sold) for the three products and total gross profit (loss)

for year 1.

b. Compute the product costs and gross margins (revenue less cost of goods sold) for the two remaining products and total gross

profit (loss) for year 2.

c. Should Dolan Products drop Yellow for year 3?

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Compute the product costs and gross margins (revenue less cost of goods sold) for the two remaining products and total

gross profit (loss) for year 2. (Do not round your intermediate calculations. Negative amounts should be indicated by a minus

sign. Round your answers to 2 decimal places.)

Yellow

Green

Total

Product cost per unit

2$

(161.00)

$

(84.00)

Gross margin (loss) per unit

Total gross profit (loss)

$ (60,000.00)

$

187,000.00 $

127,000.00

< Required A

Required C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning