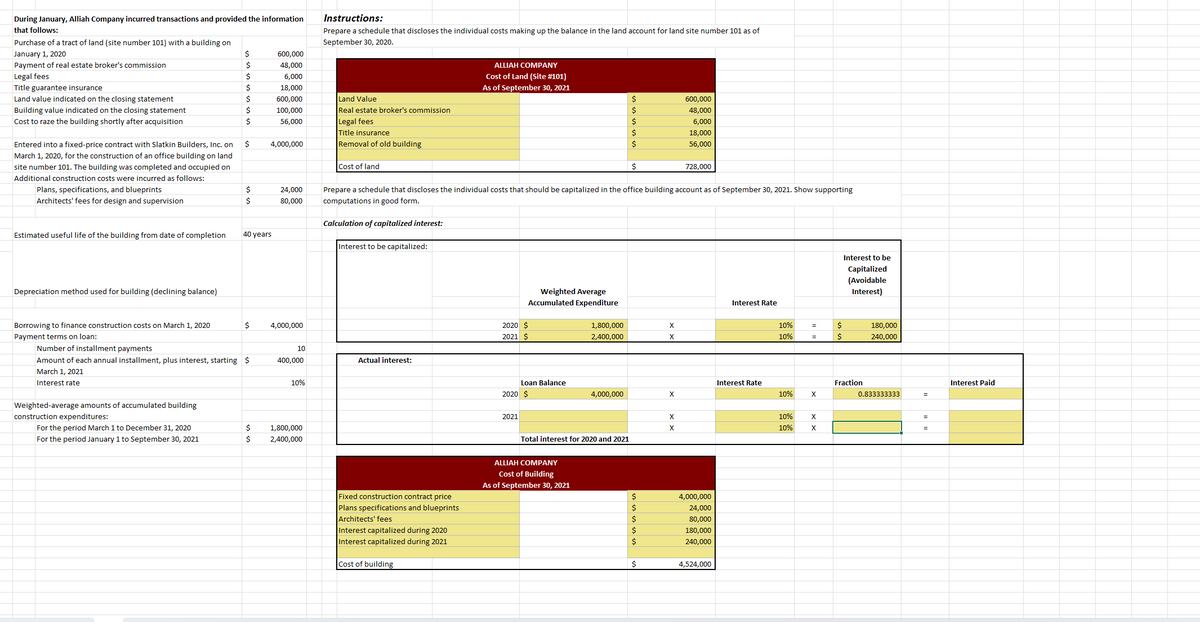

$ 600,000 $ 48,000 $ 6,000 $ 18,000 During January, Alliah Company incurred transactions and provided the information that follows: Purchase of a tract of land (site number 101) with a building on January 1, 2020 Payment of real estate broker's commission Legal fees Title guarantee insurance Instructions: Prepare a schedule that discloses the individual costs making up the balance in the land account for land site number 101 as of September 30, 2020. ALLIAH COMPANY Cost of Land (Site #101) As of September 30, 2021 Land value indicated on the closing statement Building value indicated on the closing statement Cost to raze the building shortly after acquisition $ 600,000 Land Value $ 600,000 $ 100,000 $ 56,000 Real estate broker's commission Legal fees $ 48,000 S 6,000 Title insurance $ 18,000 Entered into a fixed-price contract with Slatkin Builders, Inc. on March 1, 2020, for the construction of an office building on land site number 101. The building was completed and occupied on Additional construction costs were incurred as follows: $ 4,000,000 Removal of old building $ 56,000 Cost of land $ 728,000 Plans, specifications, and blueprints Architects' fees for design and supervision $ 24,000 $ 80,000 Prepare a schedule that discloses the individual costs that should be capitalized in the office building account as of September 30, 2021. Show supporting computations in good form. Calculation of capitalized interest: Estimated useful life of the building from date of completion 40 years Depreciation method used for building (declining balance) Interest to be capitalized: Borrowing to finance construction costs on March 1, 2020 Payment terms on loan: $ 4,000,000 Number of installment payments 10 Amount of each annual installment, plus interest, starting $ March 1, 2021 400,000 Actual interest: Interest rate 10% Weighted-average amounts of accumulated building construction expenditures: For the period March 1 to December 31, 2020 $ For the period January 1 to September 30, 2021 $ 1,800,000 2,400,000 Fixed construction contract price Plans specifications and blueprints Architects' fees Interest capitalized during 2020 Interest capitalized during 2021 Cost of building Weighted Average Accumulated Expenditure 2020 $ 2021 $ 1,800,000 2,400,000 X Interest Rate Interest to be Capitalized (Avoidable Interest) 10% 10% = $ = $ 180,000 240,000 Loan Balance Interest Rate Fraction Interest Paid 2020 $ 4,000,000 X 10% X 0.833333333 = 2021 X X Total interest for 2020 and 2021 ALLIAH COMPANY Cost of Building As of September 30, 2021 $ 4,000,000 $ 24,000 $ 80,000 $ 180,000 $ 240,000 $ 4,524,000 10% X 10% X

$ 600,000 $ 48,000 $ 6,000 $ 18,000 During January, Alliah Company incurred transactions and provided the information that follows: Purchase of a tract of land (site number 101) with a building on January 1, 2020 Payment of real estate broker's commission Legal fees Title guarantee insurance Instructions: Prepare a schedule that discloses the individual costs making up the balance in the land account for land site number 101 as of September 30, 2020. ALLIAH COMPANY Cost of Land (Site #101) As of September 30, 2021 Land value indicated on the closing statement Building value indicated on the closing statement Cost to raze the building shortly after acquisition $ 600,000 Land Value $ 600,000 $ 100,000 $ 56,000 Real estate broker's commission Legal fees $ 48,000 S 6,000 Title insurance $ 18,000 Entered into a fixed-price contract with Slatkin Builders, Inc. on March 1, 2020, for the construction of an office building on land site number 101. The building was completed and occupied on Additional construction costs were incurred as follows: $ 4,000,000 Removal of old building $ 56,000 Cost of land $ 728,000 Plans, specifications, and blueprints Architects' fees for design and supervision $ 24,000 $ 80,000 Prepare a schedule that discloses the individual costs that should be capitalized in the office building account as of September 30, 2021. Show supporting computations in good form. Calculation of capitalized interest: Estimated useful life of the building from date of completion 40 years Depreciation method used for building (declining balance) Interest to be capitalized: Borrowing to finance construction costs on March 1, 2020 Payment terms on loan: $ 4,000,000 Number of installment payments 10 Amount of each annual installment, plus interest, starting $ March 1, 2021 400,000 Actual interest: Interest rate 10% Weighted-average amounts of accumulated building construction expenditures: For the period March 1 to December 31, 2020 $ For the period January 1 to September 30, 2021 $ 1,800,000 2,400,000 Fixed construction contract price Plans specifications and blueprints Architects' fees Interest capitalized during 2020 Interest capitalized during 2021 Cost of building Weighted Average Accumulated Expenditure 2020 $ 2021 $ 1,800,000 2,400,000 X Interest Rate Interest to be Capitalized (Avoidable Interest) 10% 10% = $ = $ 180,000 240,000 Loan Balance Interest Rate Fraction Interest Paid 2020 $ 4,000,000 X 10% X 0.833333333 = 2021 X X Total interest for 2020 and 2021 ALLIAH COMPANY Cost of Building As of September 30, 2021 $ 4,000,000 $ 24,000 $ 80,000 $ 180,000 $ 240,000 $ 4,524,000 10% X 10% X

Corporate Financial Accounting

15th Edition

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Carl Warren, Jeff Jones

Chapter9: Long-Term Assets: Fixed And Intangible

Section: Chapter Questions

Problem 9.1BPR: Allocating payments and receipts to fixed asset accounts The following payments and receipts are...

Related questions

Question

What do i enter for the actual interest part

Transcribed Image Text:$

600,000

$

48,000

$

6,000

$

18,000

During January, Alliah Company incurred transactions and provided the information

that follows:

Purchase of a tract of land (site number 101) with a building on

January 1, 2020

Payment of real estate broker's commission

Legal fees

Title guarantee insurance

Instructions:

Prepare a schedule that discloses the individual costs making up the balance in the land account for land site number 101 as of

September 30, 2020.

ALLIAH COMPANY

Cost of Land (Site #101)

As of September 30, 2021

Land value indicated on the closing statement

Building value indicated on the closing statement

Cost to raze the building shortly after acquisition

$

600,000

Land Value

$

600,000

$

100,000

$

56,000

Real estate broker's commission

Legal fees

$

48,000

S

6,000

Title insurance

$

18,000

Entered into a fixed-price contract with Slatkin Builders, Inc. on

March 1, 2020, for the construction of an office building on land

site number 101. The building was completed and occupied on

Additional construction costs were incurred as follows:

$

4,000,000

Removal of old building

$

56,000

Cost of land

$

728,000

Plans, specifications, and blueprints

Architects' fees for design and supervision

$

24,000

$

80,000

Prepare a schedule that discloses the individual costs that should be capitalized in the office building account as of September 30, 2021. Show supporting

computations in good form.

Calculation of capitalized interest:

Estimated useful life of the building from date of completion

40 years

Depreciation method used for building (declining balance)

Interest to be capitalized:

Borrowing to finance construction costs on March 1, 2020

Payment terms on loan:

$

4,000,000

Number of installment payments

10

Amount of each annual installment, plus interest, starting $

March 1, 2021

400,000

Actual interest:

Interest rate

10%

Weighted-average amounts of accumulated building

construction expenditures:

For the period March 1 to December 31, 2020

$

For the period January 1 to September 30, 2021

$

1,800,000

2,400,000

Fixed construction contract price

Plans specifications and blueprints

Architects' fees

Interest capitalized during 2020

Interest capitalized during 2021

Cost of building

Weighted Average

Accumulated Expenditure

2020 $

2021 $

1,800,000

2,400,000

X

Interest Rate

Interest to be

Capitalized

(Avoidable

Interest)

10%

10%

=

$

=

$

180,000

240,000

Loan Balance

Interest Rate

Fraction

Interest Paid

2020 $

4,000,000

X

10%

X

0.833333333

=

2021

X

X

Total interest for 2020 and 2021

ALLIAH COMPANY

Cost of Building

As of September 30, 2021

$

4,000,000

$

24,000

$

80,000

$

180,000

$

240,000

$

4,524,000

10%

X

10%

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning