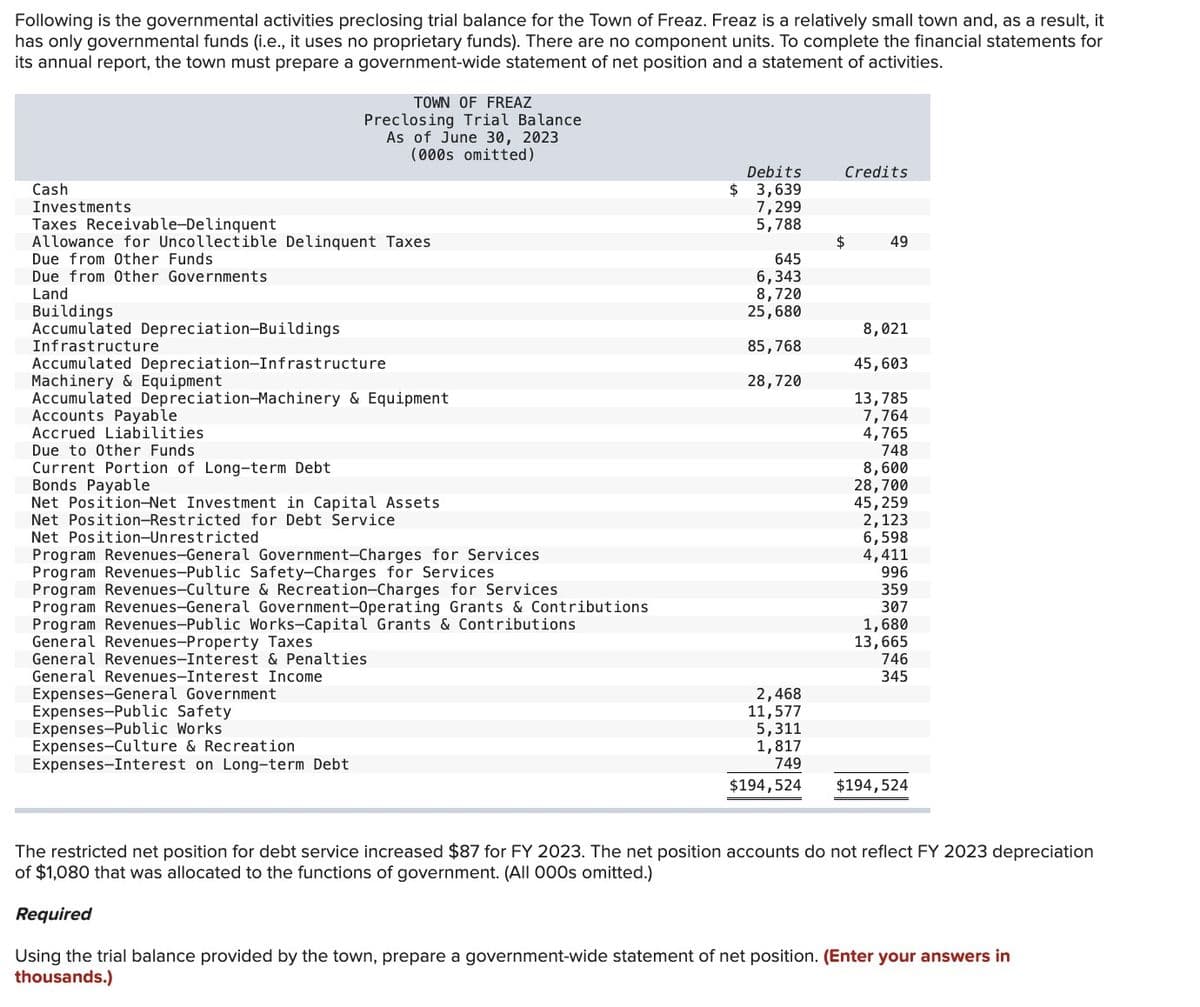

Following is the governmental activities preclosing trial balance for the Town of Freaz. Freaz is a relatively small town and, as a result, it has only governmental funds (i.e., it uses no proprietary funds). There are no component units. To complete the financial statements for its annual report, the town must prepare a government-wide statement of net position and a statement of activities. TOWN OF FREAZ Preclosing Trial Balance As of June 30, 2023 (000s omitted) Cash $ Investments Taxes Receivable-Delinquent Allowance for Uncollectible Delinquent Taxes Due from Other Funds Due from Other Governments Land Buildings Accumulated Depreciation-Buildings Infrastructure Debits 3,639 7,299 5,788 Credits $ 49 645 6,343 8,720 25,680 8,021 85,768 Accumulated Depreciation-Infrastructure 45,603 Machinery & Equipment 28,720 Accumulated Depreciation-Machinery & Equipment 13,785 Accounts Payable 7,764 Due to Other Funds Accrued Liabilities Current Portion of Long-term Debt Bonds Payable Net Position-Net Investment in Capital Assets Net Position-Restricted for Debt Service Net Position-Unrestricted 4,765 748 8,600 28,700 45,259 2,123 6,598 Program Revenues-General Government-Charges for Services 4,411 Program Revenues-Public Safety-Charges for Services Program Revenues-Culture & Recreation-Charges for Services Program Revenues-General Government-Operating Grants & Contributions Program Revenues-Public Works-Capital Grants & Contributions General Revenues-Property Taxes General Revenues-Interest & Penalties General Revenues-Interest Income Expenses-General Government Expenses-Public Safety Expenses-Public Works Expenses-Culture & Recreation 996 359 307 1,680 13,665 Expenses-Interest on Long-term Debt 746 345 2,468 11,577 5,311 1,817 749 $194,524 $194,524 The restricted net position for debt service increased $87 for FY 2023. The net position accounts do not reflect FY 2023 depreciation of $1,080 that was allocated to the functions of government. (All 000s omitted.) Required Using the trial balance provided by the town, prepare a government-wide statement of net position. (Enter your answers in thousands.)

Following is the governmental activities preclosing trial balance for the Town of Freaz. Freaz is a relatively small town and, as a result, it has only governmental funds (i.e., it uses no proprietary funds). There are no component units. To complete the financial statements for its annual report, the town must prepare a government-wide statement of net position and a statement of activities. TOWN OF FREAZ Preclosing Trial Balance As of June 30, 2023 (000s omitted) Cash $ Investments Taxes Receivable-Delinquent Allowance for Uncollectible Delinquent Taxes Due from Other Funds Due from Other Governments Land Buildings Accumulated Depreciation-Buildings Infrastructure Debits 3,639 7,299 5,788 Credits $ 49 645 6,343 8,720 25,680 8,021 85,768 Accumulated Depreciation-Infrastructure 45,603 Machinery & Equipment 28,720 Accumulated Depreciation-Machinery & Equipment 13,785 Accounts Payable 7,764 Due to Other Funds Accrued Liabilities Current Portion of Long-term Debt Bonds Payable Net Position-Net Investment in Capital Assets Net Position-Restricted for Debt Service Net Position-Unrestricted 4,765 748 8,600 28,700 45,259 2,123 6,598 Program Revenues-General Government-Charges for Services 4,411 Program Revenues-Public Safety-Charges for Services Program Revenues-Culture & Recreation-Charges for Services Program Revenues-General Government-Operating Grants & Contributions Program Revenues-Public Works-Capital Grants & Contributions General Revenues-Property Taxes General Revenues-Interest & Penalties General Revenues-Interest Income Expenses-General Government Expenses-Public Safety Expenses-Public Works Expenses-Culture & Recreation 996 359 307 1,680 13,665 Expenses-Interest on Long-term Debt 746 345 2,468 11,577 5,311 1,817 749 $194,524 $194,524 The restricted net position for debt service increased $87 for FY 2023. The net position accounts do not reflect FY 2023 depreciation of $1,080 that was allocated to the functions of government. (All 000s omitted.) Required Using the trial balance provided by the town, prepare a government-wide statement of net position. (Enter your answers in thousands.)

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Hardev

Transcribed Image Text:Following is the governmental activities preclosing trial balance for the Town of Freaz. Freaz is a relatively small town and, as a result, it

has only governmental funds (i.e., it uses no proprietary funds). There are no component units. To complete the financial statements for

its annual report, the town must prepare a government-wide statement of net position and a statement of activities.

TOWN OF FREAZ

Preclosing Trial Balance

As of June 30, 2023

(000s omitted)

Cash

$

Investments

Taxes Receivable-Delinquent

Allowance for Uncollectible Delinquent Taxes

Due from Other Funds

Due from Other Governments

Land

Buildings

Accumulated Depreciation-Buildings

Infrastructure

Debits

3,639

7,299

5,788

Credits

$

49

645

6,343

8,720

25,680

8,021

85,768

Accumulated Depreciation-Infrastructure

45,603

Machinery & Equipment

28,720

Accumulated Depreciation-Machinery & Equipment

13,785

Accounts Payable

7,764

Due to Other Funds

Accrued Liabilities

Current Portion of Long-term Debt

Bonds Payable

Net Position-Net Investment in Capital Assets

Net Position-Restricted for Debt Service

Net Position-Unrestricted

4,765

748

8,600

28,700

45,259

2,123

6,598

Program Revenues-General Government-Charges for Services

4,411

Program Revenues-Public Safety-Charges for Services

Program Revenues-Culture & Recreation-Charges for Services

Program Revenues-General Government-Operating Grants & Contributions

Program Revenues-Public Works-Capital Grants & Contributions

General Revenues-Property Taxes

General Revenues-Interest & Penalties

General Revenues-Interest Income

Expenses-General Government

Expenses-Public Safety

Expenses-Public Works

Expenses-Culture & Recreation

996

359

307

1,680

13,665

Expenses-Interest on Long-term Debt

746

345

2,468

11,577

5,311

1,817

749

$194,524

$194,524

The restricted net position for debt service increased $87 for FY 2023. The net position accounts do not reflect FY 2023 depreciation

of $1,080 that was allocated to the functions of government. (All 000s omitted.)

Required

Using the trial balance provided by the town, prepare a government-wide statement of net position. (Enter your answers in

thousands.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education