$ Salesware.com, Incorporated, is a leading provider of enterprise software, delivered through the cloud, with a focus on customer relationship management, or CRM. The Company helps its customers to connect with their customers through cloud, mobile, social, blockchain, voice, advanced analytics, and artificial intelligence ("AI") technologies. Presented below are the items adapted from its recent income statement for the year ended January 31 (in millions, except per share amounts). Net earnings per share was $0.18, and the weighted-average shares used in the computation were 841 million. Cost of subscription and support revenues Cost of professional services and other revenues General and administrative expense Income tax expense Subscription and support revenues $3,269 Professional services and other revenues 1,162 Other income 1,716 Marketing and sales expense 699 Research and development expense 16,169 $ 1,180 367 7,942 2,778 Required: 1. Recognizing that Salesware has two sources of operating revenues, prepare a classified (multiple-step) income statement. 2. Which source of operating revenues produces the higher gross profit?

$ Salesware.com, Incorporated, is a leading provider of enterprise software, delivered through the cloud, with a focus on customer relationship management, or CRM. The Company helps its customers to connect with their customers through cloud, mobile, social, blockchain, voice, advanced analytics, and artificial intelligence ("AI") technologies. Presented below are the items adapted from its recent income statement for the year ended January 31 (in millions, except per share amounts). Net earnings per share was $0.18, and the weighted-average shares used in the computation were 841 million. Cost of subscription and support revenues Cost of professional services and other revenues General and administrative expense Income tax expense Subscription and support revenues $3,269 Professional services and other revenues 1,162 Other income 1,716 Marketing and sales expense 699 Research and development expense 16,169 $ 1,180 367 7,942 2,778 Required: 1. Recognizing that Salesware has two sources of operating revenues, prepare a classified (multiple-step) income statement. 2. Which source of operating revenues produces the higher gross profit?

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter13: Statement Of Cash Flows

Section: Chapter Questions

Problem 4MAD

Related questions

Question

Please Explain Proper Step by Step and Do Not Give Solution In Image Format And Fast Answering Please And Thanks In Advance

Transcribed Image Text:k

t

nces

W

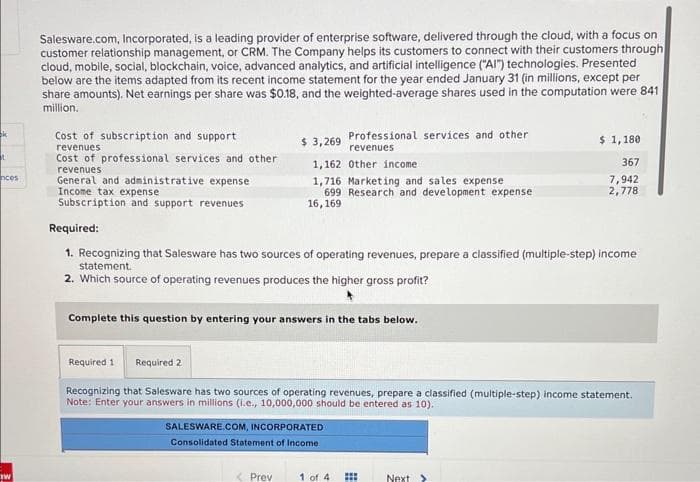

Salesware.com, Incorporated, is a leading provider of enterprise software, delivered through the cloud, with a focus on

customer relationship management, or CRM. The Company helps its customers to connect with their customers through

cloud, mobile, social, blockchain, voice, advanced analytics, and artificial intelligence ("AI") technologies. Presented

below are the items adapted from its recent income statement for the year ended January 31 (in millions, except per

share amounts). Net earnings per share was $0.18, and the weighted-average shares used in the computation were 841

million.

Cost of subscription and support

revenues

Cost of professional services and other

revenues

General and administrative expense

Income tax expense

Subscription and support revenues

$ 3,269

Required 1

Professional services and other

revenues

1,162 Other income

1,716 Marketing and sales expense

699 Research and development expense

16,169

Required:

1. Recognizing that Salesware has two sources of operating revenues, prepare a classified (multiple-step) income

statement.

2. Which source of operating revenues produces the higher gross profit?

Complete this question by entering your answers in the tabs below.

< Prev

Required 2

Recognizing that Salesware has two sources of operating revenues, prepare a classified (multiple-step) income statement.

Note: Enter your answers in millions (i.e., 10,000,000 should be entered as 10).

SALESWARE.COM, INCORPORATED

Consolidated Statement of Income

$ 1,180

367

7,942

2,778

1 of 4 #

Next >

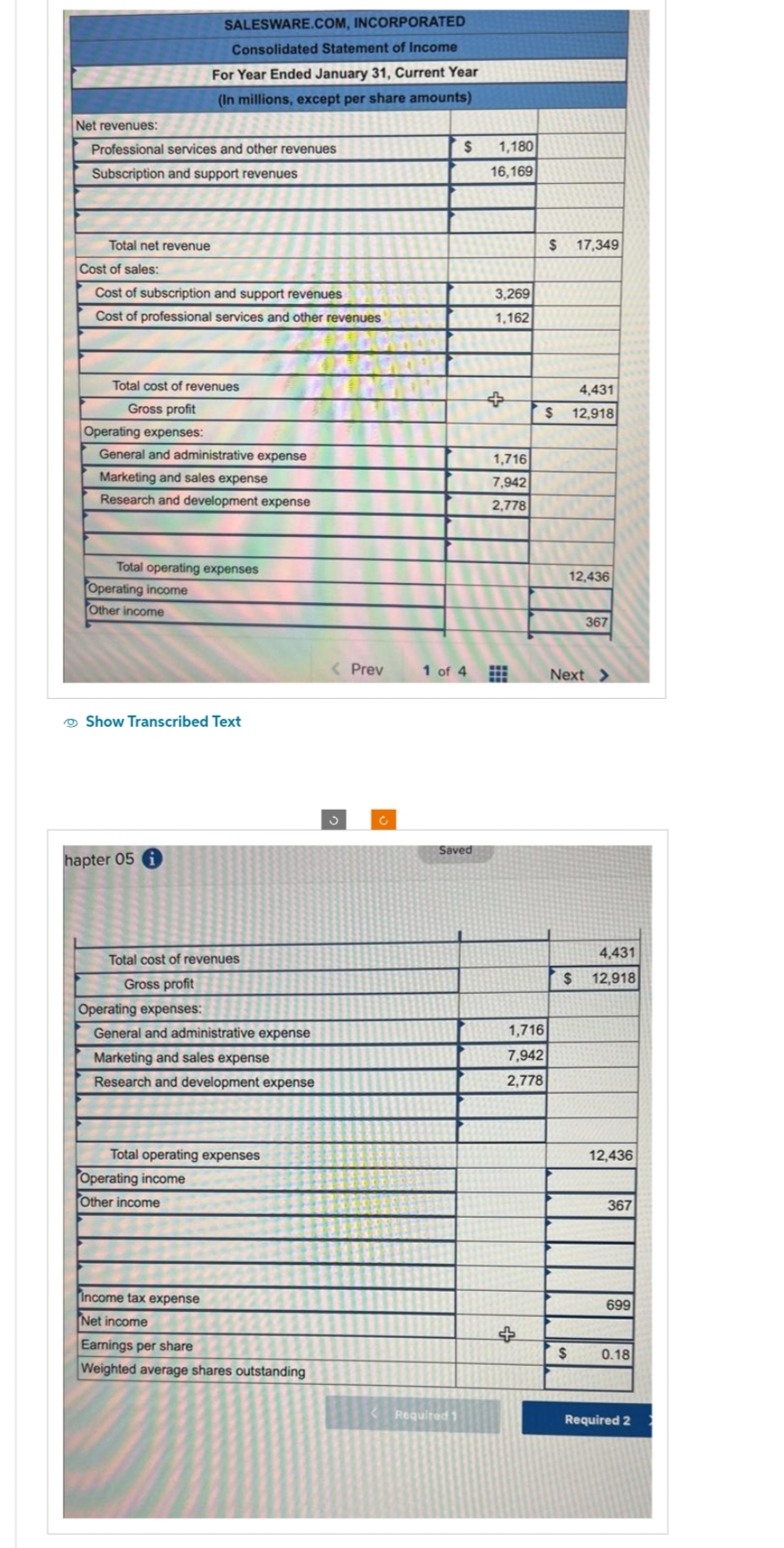

Transcribed Image Text:Net revenues:

Professional services and other revenues

Subscription and support revenues

Total net revenue

Cost of sales:

Cost of subscription and support revenues

Cost of professional services and other revenues

Total cost of revenues

Gross profit

Operating expenses:

General and administrative expense

SALESWARE.COM, INCORPORATED

Consolidated Statement of Income

For Year Ended January 31, Current Year

(In millions, except per share amounts)

Marketing and sales expense

Research and development expense

Total operating expenses

Operating income

Other income

Show Transcribed Text

hapter 05

Total cost of revenues

Gross profit

Operating expenses:

General and administrative expense

Marketing and sales expense

Research and development expense

Total operating expenses

Operating income

Other income

Income tax expense

Net income

Earnings per share

Weighted average shares outstanding

< Prev

S

$

Saved

Required 1

1,180

16,169

3,269

1,162

1 of 4 ⠀

1,716

7,942

2,778

1,716

7,942

2,778

$ 17,349

$

4,431

12,918

12,436

$

367

Next >

4,431

$ 12,918

12,436

367

699

0.18

Required 2

900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning