$10,000 Sales (100 units at $100 a unit). Manufacturing cost of good sold Direct Labor. . Direct Materials Used... Variable Factory Overhead.. Fixed Factory Overhead... $1,500 ... 1,400 1,000 500 14 4,400

$10,000 Sales (100 units at $100 a unit). Manufacturing cost of good sold Direct Labor. . Direct Materials Used... Variable Factory Overhead.. Fixed Factory Overhead... $1,500 ... 1,400 1,000 500 14 4,400

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter18: Pricing And Profitability Analysis

Section: Chapter Questions

Problem 3CE: Pattison Products, Inc., began operations in October and manufactured 40,000 units during the month...

Related questions

Question

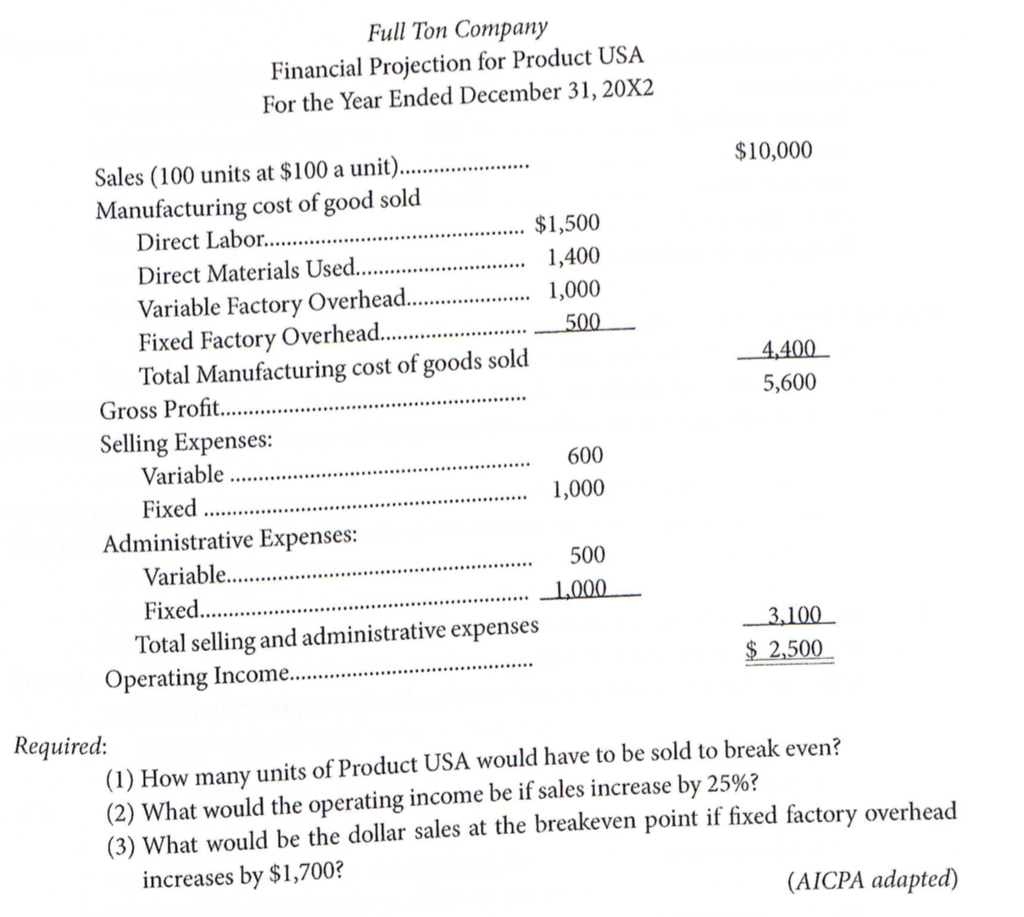

Transcribed Image Text:Full Ton Company

Financial Projection for Product USA

For the Year Ended December 31, 20X2

Sales (100 units at $100 a unit)...

$10,000

Manufacturing cost of good sold

Direct Labor.

$1,500

Direct Materials Used..

1,400

Variable Factory Overhead.

Fixed Factory Overhead..

Total Manufacturing cost of goods sold

Gross Profit...

1,000

500

4,400

5,600

Selling Expenses:

Variable.

600

Fixed

1,000

Administrative Expenses:

Variable.

500

Fixed....

1,000

Total selling and administrative expenses

Operating Income..

_3,100

$ 2,500

Required:

(1) How many units of Product USA would have to be sold to break even?

(2) What would the operating income be if sales increase by 25%?

(3) What would be the dollar sales at the breakeven point if fixed factory overhead

increases by $1,700?

(AICPA adapted)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College