Anna Corporation provided the following information about their product: Cost per unit: Direct Materials 7 Direct Labor Variable Factory Overhead Fixed Factory Overhead (based on a normal capacity Of 10,000 units) Fixed Factory Overhead Total Fixed Operating Cost 40,000 20,000 25/unit Variable selling and administrative expenses Selling Price 12,000 Produced unit 10,000 Sold unit 2.

Anna Corporation provided the following information about their product: Cost per unit: Direct Materials 7 Direct Labor Variable Factory Overhead Fixed Factory Overhead (based on a normal capacity Of 10,000 units) Fixed Factory Overhead Total Fixed Operating Cost 40,000 20,000 25/unit Variable selling and administrative expenses Selling Price 12,000 Produced unit 10,000 Sold unit 2.

Chapter6: Activity-based, Variable, And Absorption Costing

Section: Chapter Questions

Problem 14EB: Crafts 4 All has these costs associated with production of 12,000 units of accessory products:...

Related questions

Question

Kindly answer the ff requirements

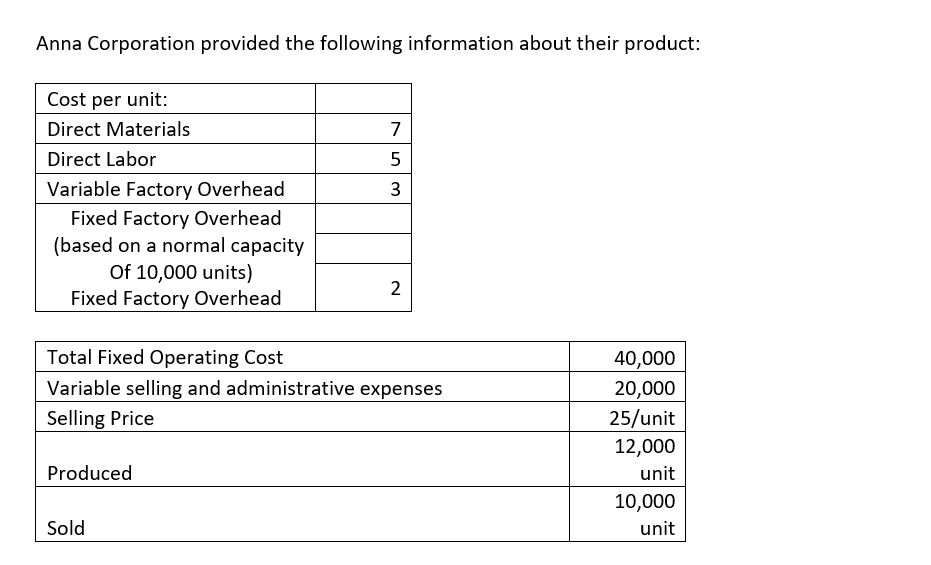

Transcribed Image Text:Anna Corporation provided the following information about their product:

Cost per unit:

Direct Materials

7

Direct Labor

Variable Factory Overhead

3

Fixed Factory Overhead

(based on a normal capacity

Of 10,000 units)

Fixed Factory Overhead

2

Total Fixed Operating Cost

40,000

20,000

25/unit

Variable selling and administrative expenses

Selling Price

12,000

Produced

unit

10,000

Sold

unit

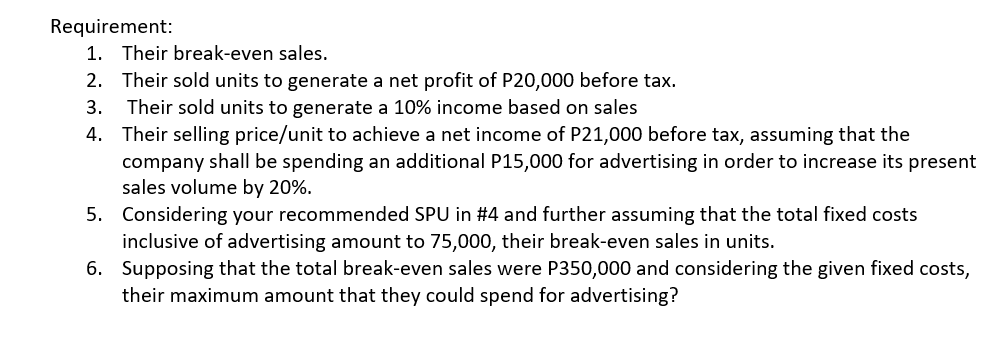

Transcribed Image Text:Requirement:

1. Their break-even sales.

2. Their sold units to generate a net profit of P20,000 before tax.

Their sold units to generate a 10% income based on sales

4. Their selling price/unit to achieve a net income of P21,000 before tax, assuming that the

company shall be spending an additional P15,000 for advertising in order to increase its present

sales volume by 20%.

3.

5. Considering your recommended SPU in #4 and further assuming that the total fixed costs

inclusive of advertising amount to 75,000, their break-even sales in units.

6. Supposing that the total break-even sales were P350,000 and considering the given fixed costs,

their maximum amount that they could spend for advertising?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning