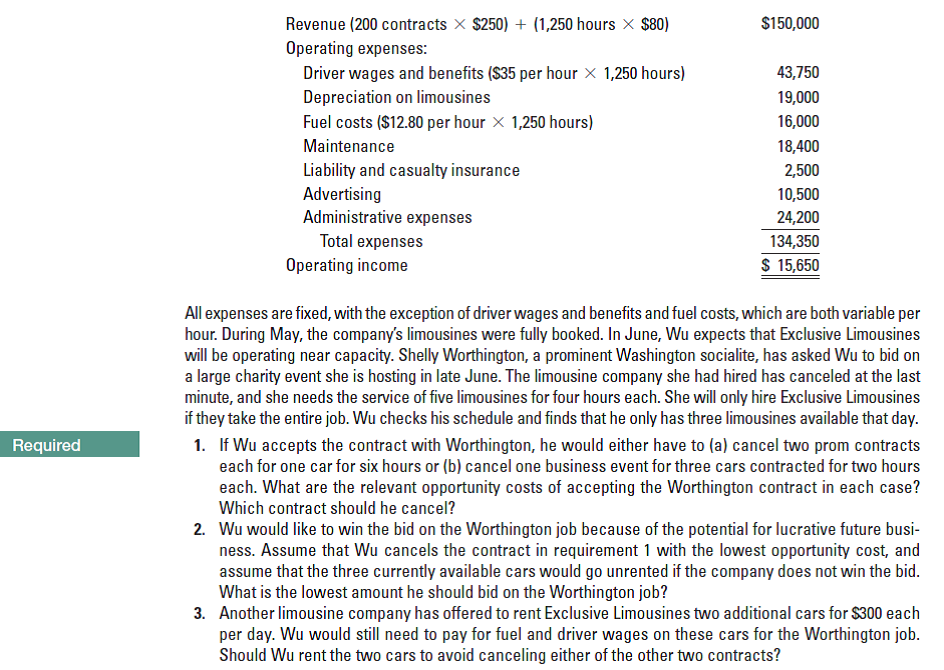

$150,000 Revenue (200 contracts x $250) + (1,250 hours × $80) Operating expenses: Driver wages and benefits (S35 per hour x 1,250 hours) Depreciation on limousines 43,750 19,000 16,000 Fuel costs ($12.80 per hour x 1,250 hours) Maintenance 18,400 Liability and casualty insurance Advertising Administrative expenses 2,500 10,500 24,200 Total expenses 134,350 $ 15,650 Operating income All expenses are fixed, with the exception of driver wages and benefits and fuel costs, which are both variable per hour. During May, the company's limousines were fully booked. In June, Wu expects that Exclusive Limousines will be operating near capacity. Shelly Worthington, a prominent Washington socialite, has asked Wu to bid on a large charity event she is hosting in late June. The limousine company she had hired has canceled at the last minute, and she needs the service of five limousines for four hours each. She will only hire Exclusive Limousines if they take the entire job. Wu checks his schedule and finds that he only has three limousines available that day. 1. If Wu accepts the contract with Worthington, he would either have to (a) cancel two prom contracts each for one car for six hours or (b) cancel one business event for three cars contracted for two hours each. What are the relevant opportunity costs of accepting the Worthington contract in each case? Which contract should he cancel? Required 2. Wu would like to win the bid on the Worthington job because of the potential for lucrative future busi- ness. Assume that Wu cancels the contract in requirement 1 with the lowest opportunity cost, and assume that the three currently available cars would go unrented if the company does not win the bid. What is the lowest amount he should bid on the Worthington job? 3. Another limousine company has offered to rent Exclusive Limousines two additional cars for $300 each per day. Wu would still need to pay for fuel and driver wages on these cars for the Worthington job. Should Wu rent the two cars to avoid canceling either of the other two contracts?

$150,000 Revenue (200 contracts x $250) + (1,250 hours × $80) Operating expenses: Driver wages and benefits (S35 per hour x 1,250 hours) Depreciation on limousines 43,750 19,000 16,000 Fuel costs ($12.80 per hour x 1,250 hours) Maintenance 18,400 Liability and casualty insurance Advertising Administrative expenses 2,500 10,500 24,200 Total expenses 134,350 $ 15,650 Operating income All expenses are fixed, with the exception of driver wages and benefits and fuel costs, which are both variable per hour. During May, the company's limousines were fully booked. In June, Wu expects that Exclusive Limousines will be operating near capacity. Shelly Worthington, a prominent Washington socialite, has asked Wu to bid on a large charity event she is hosting in late June. The limousine company she had hired has canceled at the last minute, and she needs the service of five limousines for four hours each. She will only hire Exclusive Limousines if they take the entire job. Wu checks his schedule and finds that he only has three limousines available that day. 1. If Wu accepts the contract with Worthington, he would either have to (a) cancel two prom contracts each for one car for six hours or (b) cancel one business event for three cars contracted for two hours each. What are the relevant opportunity costs of accepting the Worthington contract in each case? Which contract should he cancel? Required 2. Wu would like to win the bid on the Worthington job because of the potential for lucrative future busi- ness. Assume that Wu cancels the contract in requirement 1 with the lowest opportunity cost, and assume that the three currently available cars would go unrented if the company does not win the bid. What is the lowest amount he should bid on the Worthington job? 3. Another limousine company has offered to rent Exclusive Limousines two additional cars for $300 each per day. Wu would still need to pay for fuel and driver wages on these cars for the Worthington job. Should Wu rent the two cars to avoid canceling either of the other two contracts?

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 5MC: Ngo Company purchased a truck for $54,000. Sales tax amounted to $5,400; shipping costs amounted to...

Related questions

Question

Opportunity costs and relevant costs. Jason Wu operates Exclusive Limousines, a fleet of 10 limousines used for weddings, proms, and business events in Washington, D.C. Wu charges customers a flat fee of $250 per car taken on contract plus an hourly fee of $80. His income statement for May follows:

Transcribed Image Text:$150,000

Revenue (200 contracts x $250) + (1,250 hours × $80)

Operating expenses:

Driver wages and benefits (S35 per hour x 1,250 hours)

Depreciation on limousines

43,750

19,000

16,000

Fuel costs ($12.80 per hour x 1,250 hours)

Maintenance

18,400

Liability and casualty insurance

Advertising

Administrative expenses

2,500

10,500

24,200

Total expenses

134,350

$ 15,650

Operating income

All expenses are fixed, with the exception of driver wages and benefits and fuel costs, which are both variable per

hour. During May, the company's limousines were fully booked. In June, Wu expects that Exclusive Limousines

will be operating near capacity. Shelly Worthington, a prominent Washington socialite, has asked Wu to bid on

a large charity event she is hosting in late June. The limousine company she had hired has canceled at the last

minute, and she needs the service of five limousines for four hours each. She will only hire Exclusive Limousines

if they take the entire job. Wu checks his schedule and finds that he only has three limousines available that day.

1. If Wu accepts the contract with Worthington, he would either have to (a) cancel two prom contracts

each for one car for six hours or (b) cancel one business event for three cars contracted for two hours

each. What are the relevant opportunity costs of accepting the Worthington contract in each case?

Which contract should he cancel?

Required

2. Wu would like to win the bid on the Worthington job because of the potential for lucrative future busi-

ness. Assume that Wu cancels the contract in requirement 1 with the lowest opportunity cost, and

assume that the three currently available cars would go unrented if the company does not win the bid.

What is the lowest amount he should bid on the Worthington job?

3. Another limousine company has offered to rent Exclusive Limousines two additional cars for $300 each

per day. Wu would still need to pay for fuel and driver wages on these cars for the Worthington job.

Should Wu rent the two cars to avoid canceling either of the other two contracts?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College