$20,000. Fervor incurred a net capital loss of $3,000. What is the taxable income before NOL & DRD?

$20,000. Fervor incurred a net capital loss of $3,000. What is the taxable income before NOL & DRD?

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 48P

Related questions

Question

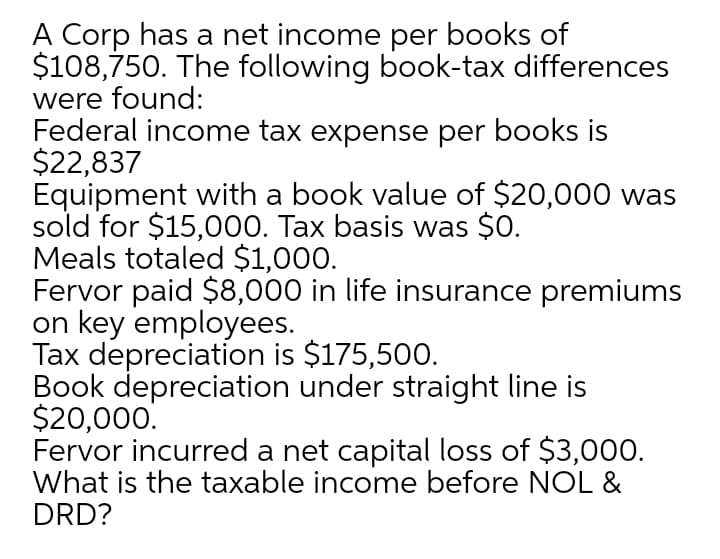

Transcribed Image Text:A Corp has a net income per books of

$108,750. The following book-tax differences

were found:

Federal income tax expense per books is

$22,837

Equipment with a book value of $20,000 was

sold for $15,000. Tax basis was $0.

Meals totaled $1,000.

Fervor paid $8,000 in life insurance premiums

on key employees.

Tax depreciation is $175,500.

Book depreciation under straight line is

$20,000.

Fervor incurred a net capital loss of $3,000.

What is the taxable income before NOL &

DRD?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT