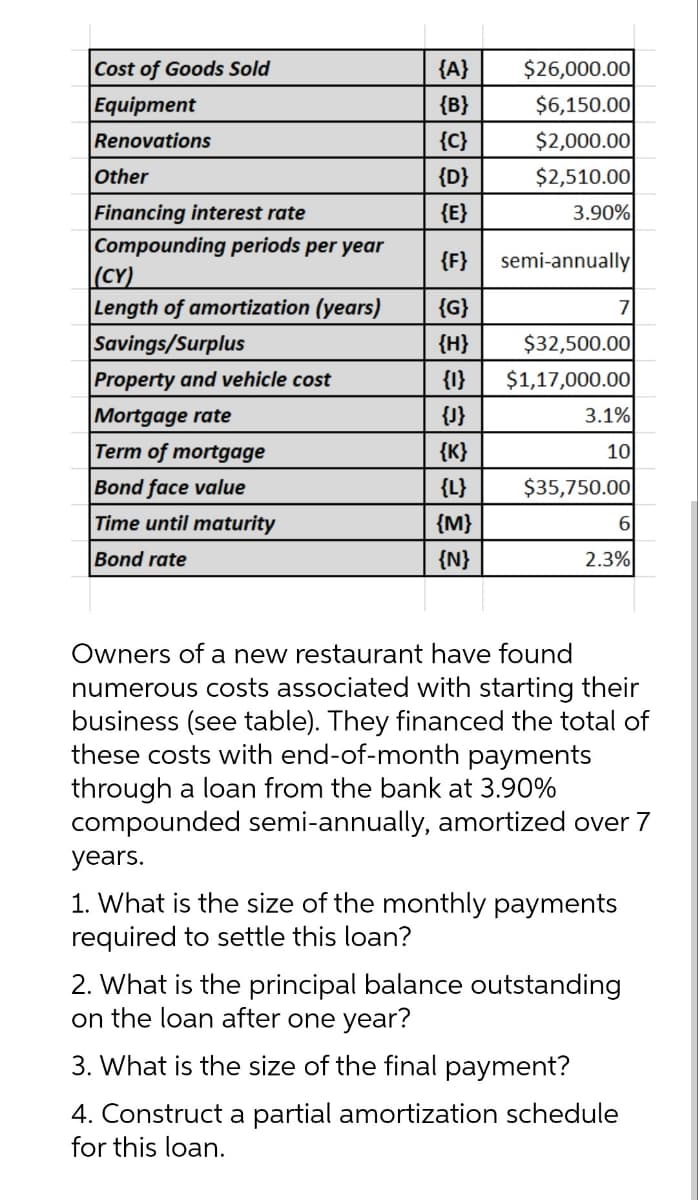

$26,000.00 $6,150.00 $2,000.00 $2,510.00 Cost of Goods Sold {A} Equipment {B} Renovations {C} Other {D} 3.90% Financing interest rate Compounding periods per year |(CY) Length of amortization (years) Savings/Surplus {E} {F} semi-annually {G} $32,500.00 $1,17,000.00 {H} Property and vehicle cost {I} Mortgage rate {J} 3.1% Term of mortgage {K} 10 Bond face value {L} $35,750.00 Time until maturity {M} 6 Bond rate {N} 2.3% Owners of a new restaurant have found numerous costs associated with starting their business (see table). They financed the total of these costs with end-of-month payments through a loan from the bank at 3.90% compounded semi-annually, amortized over 7 years. 1. What is the size of the monthly payments required to settle this loan? 2. What is the principal balance outstanding on the loan after one year? 3. What is the size of the final payment?

$26,000.00 $6,150.00 $2,000.00 $2,510.00 Cost of Goods Sold {A} Equipment {B} Renovations {C} Other {D} 3.90% Financing interest rate Compounding periods per year |(CY) Length of amortization (years) Savings/Surplus {E} {F} semi-annually {G} $32,500.00 $1,17,000.00 {H} Property and vehicle cost {I} Mortgage rate {J} 3.1% Term of mortgage {K} 10 Bond face value {L} $35,750.00 Time until maturity {M} 6 Bond rate {N} 2.3% Owners of a new restaurant have found numerous costs associated with starting their business (see table). They financed the total of these costs with end-of-month payments through a loan from the bank at 3.90% compounded semi-annually, amortized over 7 years. 1. What is the size of the monthly payments required to settle this loan? 2. What is the principal balance outstanding on the loan after one year? 3. What is the size of the final payment?

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:James A. Heintz, Robert W. Parry

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 3CE

Related questions

Question

Sir please help me urgently

Transcribed Image Text:$26,000.00

$6,150.00

$2,000.00

$2,510.00

3.90%

Cost of Goods Sold

{A}

Equipment

{B}

Renovations

{C}

Other

{D}

Financing interest rate

Compounding periods per year

|(CY)

Length of amortization (years)

{E}

{F}

semi-annually

{G}

7

Savings/Surplus

{H}

$32,500.00

$1,17,000.00

Property and vehicle cost

{1}

Mortgage rate

{J}

3.1%

Term of mortgage

{K}

10

Bond face value

{L}

$35,750.00

Time until maturity

{M}

Bond rate

{N}

2.3%

Owners of a new restaurant have found

numerous costs associated with starting their

business (see table). They financed the total of

these costs with end-of-month payments

through a loan from the bank at 3.90%

compounded semi-annually, amortized over 7

years.

1. What is the size of the monthly payments

required to settle this loan?

2. What is the principal balance outstanding

on the loan after one year?

3. What is the size of the final payment?

4. Construct a partial amortization schedule

for this loan.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub