sports clotnes, is considering adding a line of skirts and jackets. The production would take place in a part of its faciory that is currently not being used. first output would be avallable in tume The following information is available. Answer parts (a) through (d). New Product Line Information First cost in 2020 (S) Planned output (units/year) Observed, current dollar MARR before tax Study period 15,500,000 320,000 0.25 iyears Year 2020 Prices (S/unit) Materials 11 Labour 8.75 Output 35 a. What is the real internal rate of return? (This is most easily done with a spreadsheet.) The real internal rate of return is about percent. (Round to one decimal place as needed.) b. What inflation rate will make the real MARR equal to the real internal rate of return? The inflation rate would need to be about percent. (Round to two decimal places as needed.) c. Calculate the present worth of the project under three possible future inflation rates. Assume the inflation rate will be 1 percent, 2 percent, or 3 percent per year.

sports clotnes, is considering adding a line of skirts and jackets. The production would take place in a part of its faciory that is currently not being used. first output would be avallable in tume The following information is available. Answer parts (a) through (d). New Product Line Information First cost in 2020 (S) Planned output (units/year) Observed, current dollar MARR before tax Study period 15,500,000 320,000 0.25 iyears Year 2020 Prices (S/unit) Materials 11 Labour 8.75 Output 35 a. What is the real internal rate of return? (This is most easily done with a spreadsheet.) The real internal rate of return is about percent. (Round to one decimal place as needed.) b. What inflation rate will make the real MARR equal to the real internal rate of return? The inflation rate would need to be about percent. (Round to two decimal places as needed.) c. Calculate the present worth of the project under three possible future inflation rates. Assume the inflation rate will be 1 percent, 2 percent, or 3 percent per year.

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 1PB: Variety Artisans has a bottleneck in their production that occurs within the engraving department....

Related questions

Question

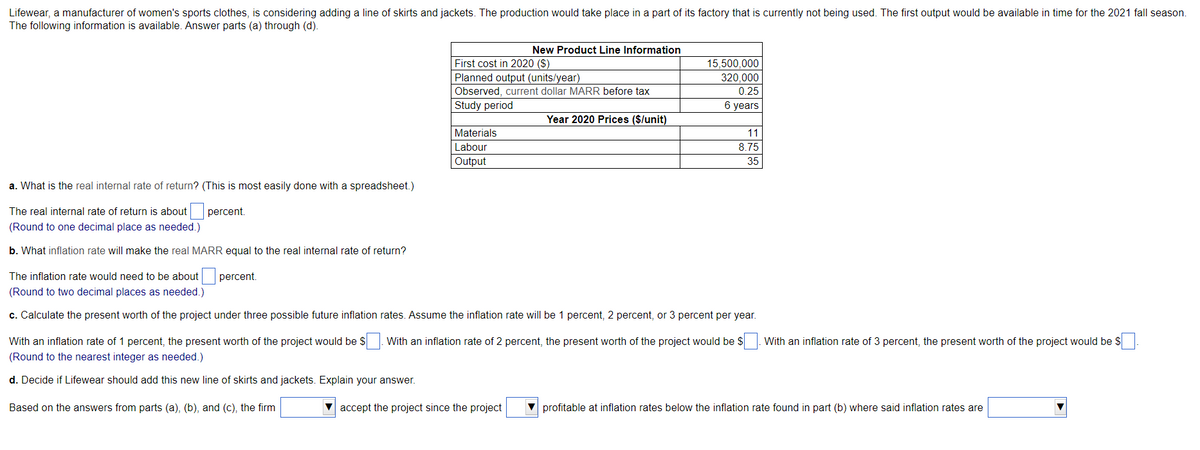

Transcribed Image Text:Lifewear, a manufacturer of women's sports clothes, is considering adding a line of skirts and jackets. The production would take place in a part of its factory that is currently not being used. The first output would be available in time for the 2021 fall season.

The following information is available. Answer parts (a) through (d).

New Product Line Information

First cost in 2020 ($)

Planned output (units/year)

15,500,000

320,000

Observed, current dollar MARR before tax

0.25

Study period

6 years

Year 2020 Prices ($/unit)

Materials

11

Labour

8.75

Output

35

a. What is the real internal rate of return? (This is most easily done with a spreadsheet.)

The real internal rate of return is about percent.

(Round to one decimal place as needed.)

b. What inflation rate will make the real MARR equal to the real internal rate of return?

The inflation rate would need to be about

percent.

(Round to two decimal places as needed.)

c. Calculate the present worth of the project under three possible future inflation rates. Assume the inflation rate will be 1 percent, 2 percent, or 3 percent per year.

With an inflation rate of 1 percent, the present worth of the project would be $. With an inflation rate of 2 percent, the present worth of the project would be $. With an inflation rate of 3 percent, the present worth of the project would be $

(Round to the nearest integer as needed.)

d. Decide if Lifewear should add this new line of skirts and jackets. Explain your answer.

Based on the answers from parts (a), (b), and (c), the firm

accept the project since the project

V profitable at inflation rates below the inflation rate found in part (b) where said inflation rates are

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College