Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 52CE: Asset Efficiency Ratios Selected financial statement numbers for Rutherford Company follow....

Related questions

Question

Is the estimate of $35 to $40 for Owen’s shares a fair evaluation? Explain. Type a three- to four-sentence response below.

|

Ratio Type |

2012 |

2013 |

|

Current (times) |

3.40 |

3.43 |

|

Quick (times) |

2.18 |

1.83 |

|

Debt (%) |

37.65% |

35.31% |

|

Times interest earned (times) |

8.50 |

11.61 |

|

Inventory turnover (times) |

6.99 |

4.79 |

|

Total asset turnover (times) |

2.78 |

2.71 |

|

Average collections period (days) |

50.14 |

50.99 |

|

|

11.60 |

10.81 |

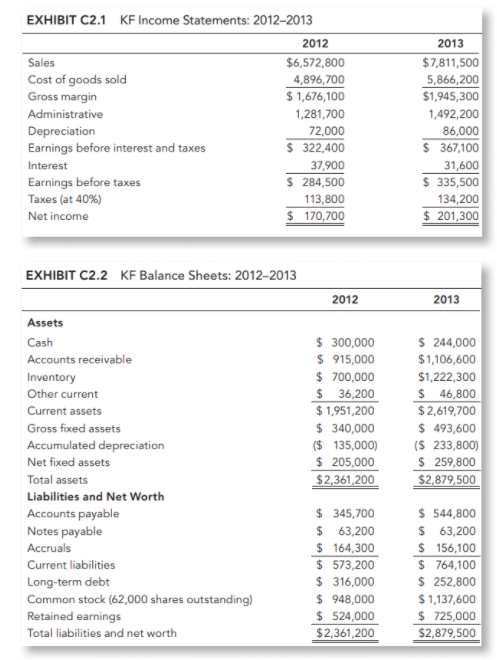

Transcribed Image Text:EXHIBIT C2.1 KF Income Statements: 2012–2013

2012

2013

Sales

$6,572,800

$7,811,500

5,866,200

Cost of goods sold

Gross margin

4,896,700

$ 1,676,100

$1,945,300

Administrative

1,281,700

1,492,200

Depreciation

Earnings before interest and taxes

72,000

$ 322,400

86,000

$ 367,100

31,600

$ 335,500

Interest

37,900

$ 284,500

Earnings before taxes

Taxes (at 40%)

113,800

134,200

$ 170,700

$ 201,300

Net income

EXHIBIT C2.2 KF Balance Sheets: 2012–2013

2012

2013

Assets

$ 300,000

$ 915,000

$ 700,000

$ 36,200

$ 1,951,200

$ 340,000

($ 135,000)

$ 205,000

$2,361,200

$ 244,000

$1,106,600

$1,222,300

$ 46,800

Cash

Accounts receivable

Inventory

Other current

Current assets

$2,619,700

$ 493,600

($ 233,800)

$ 259,800

Gross fixed assets

Accumulated depreciation

Net fixed assets

Total assets

$2,879,500

Liabilities and Net Worth

$ 345,700

$ 63,200

$ 164,300

$ 573,200

$ 316,000

$ 948,000

$ 524,000

$2,361,200

$ 544,800

$ 63,200

$ 156,100

$ 764,100

$ 252,800

$ 1,137,600

$ 725,000

$2,879,500

Accounts payable

Notes payable

Accruals

Current liabilities

Long-term debt

Common stock (62,000 shares outstanding)

Retained earnings

Total liabilities and net worth

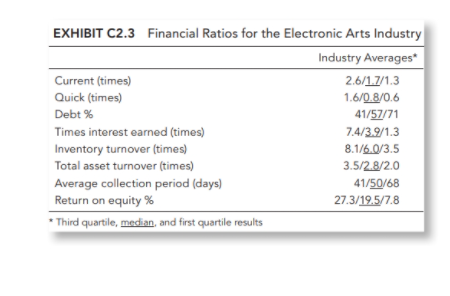

Transcribed Image Text:EXHIBIT C2.3 Financial Ratios for the Electronic Arts Industry

Industry Averages

Current (times)

2.6/1.7/1.3

Quick (times)

1.6/0.8/0.6

Debt %

41/57/71

Times interest earned (times)

7.4/3.9/1.3

Inventory turnover (times)

Total asset turnover (times)

8.1/6.0/3.5

3.5/2.8/2.0

Average collection period (days)

Return on equity %

41/50/68

27.3/19.5/7.8

* Third quartile, median, and first quartile results

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning