$6,000 $1,500 $1,200

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 33P

Related questions

Question

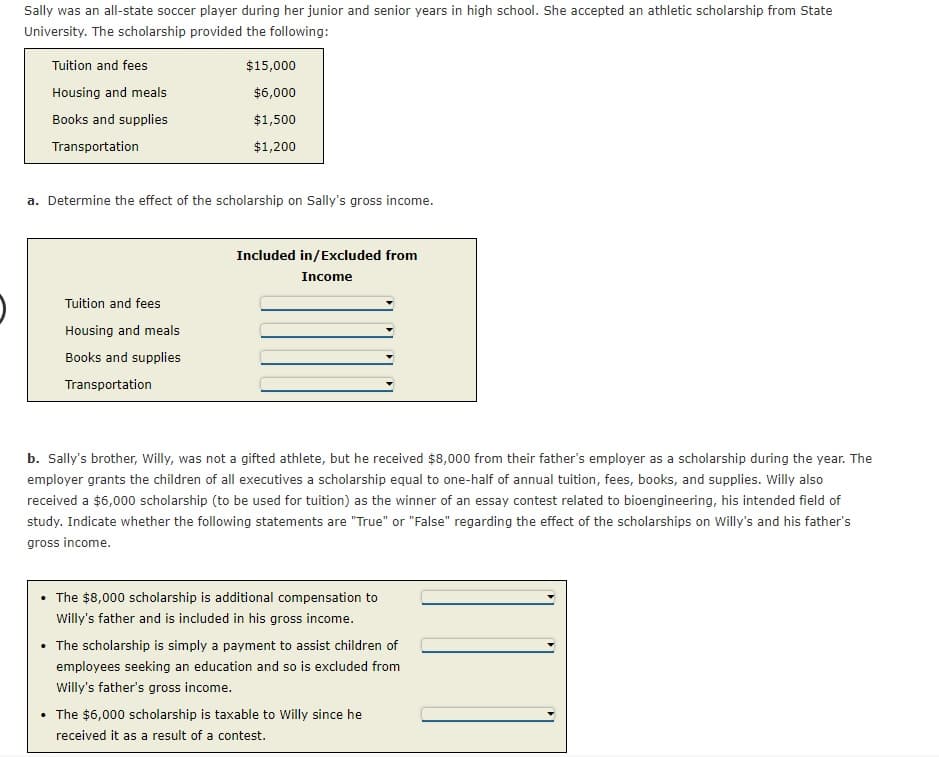

Transcribed Image Text:Sally was an all-state soccer player during her junior and senior years in high school. She accepted an athletic scholarship from State

University. The scholarship provided the following:

Tuition and fees

$15,000

Housing and meals

$6,000

Books and supplies

$1,500

Transportation

$1,200

a. Determine the effect of the scholarship on Sally's gross income.

Included in/Excluded from

Income

Tuition and fees

Housing and meals

Books and supplies

Transportation

b. Sally's brother, Willy, was not a gifted athlete, but he received $8,000 from their father's employer as a scholarship during the year. The

employer grants the children of all executives a scholarship equal to one-half of annual tuition, fees, books, and supplies. Willy also

received a $6,000 scholarship (to be used for tuition) as the winner of an essay contest related to bioengineering, his intended field of

study. Indicate whether the following statements are "True" or "False" regarding the effect of the scholarships on Willy's and his father's

gross income.

The $8,000 scholarship is additional compensation to

Willy's father and is included in his gross income.

• The scholarship is simply a payment to assist children of

employees seeking an education and so is excluded from

Willy's father's gross income.

• The $6,000 scholarship is taxable to Willy since he

received it as a result of a contest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT