$83,000 $42,000 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing overhead Variable selling expense Fixed selling expense Total selling expense Variable administrative $20,600 32,200 $52,800 $14,800 23,600 $38,400 $ 5,400 expense Fixed administrative 27,800 expense Total administrative $33,200 expense

$83,000 $42,000 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing overhead Variable selling expense Fixed selling expense Total selling expense Variable administrative $20,600 32,200 $52,800 $14,800 23,600 $38,400 $ 5,400 expense Fixed administrative 27,800 expense Total administrative $33,200 expense

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 21E: Ellerson Company provided the following information for the last calendar year: During the year,...

Related questions

Question

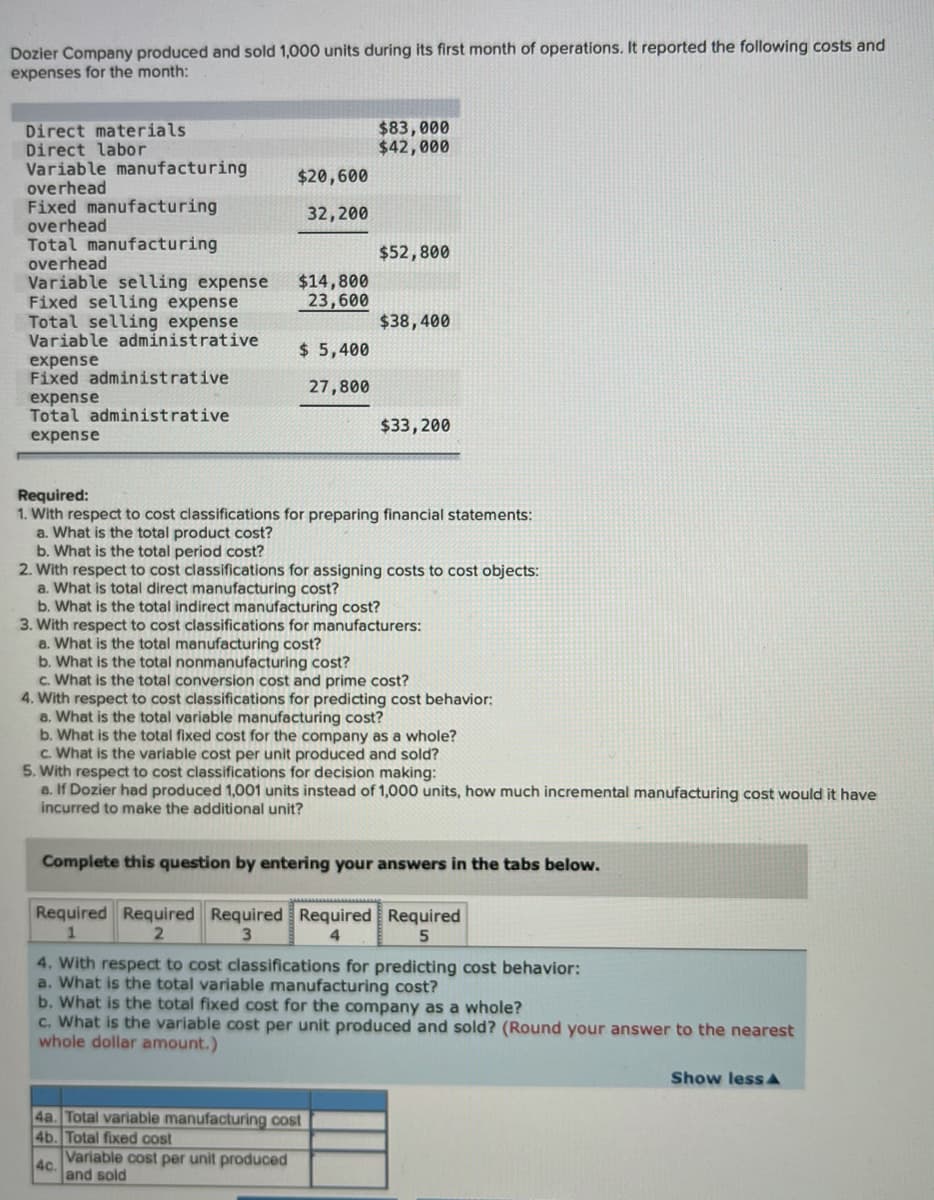

Transcribed Image Text:Dozier Company produced and sold 1,000 units during its first month of operations. It reported the following costs and

expenses for the month:

$83,000

$42,000

Direct materials

Direct labor

Variable manufacturing

overhead

Fixed manufacturing

overhead

Total manufacturing

overhead

Variable selling expense

Fixed selling expense

Total selling expense

Variable administrative

$20,600

32,200

$52,800

$14,800

23,600

$38,400

$ 5,400

expense

Fixed administrative

expense

Total administrative

27,800

$33,200

expense

Required:

1. With respect to cost classifications for preparing financial statements:

a. What is the total product cost?

b. What is the total period cost?

2. With respect to cost classifications for assigning costs to cost objects:

a. What is total direct manufacturing cost?

b. What is the total indirect manufacturing cost?

3. With respect to cost classifications for manufacturers:

a. What is the total manufacturing cost?

b. What is the total nonmanufacturing cost?

c. What is the total conversion cost and prime cost?

4. With respect to cost classifications for predicting cost behavior:

a. What is the total variable manufacturing cost?

b. What is the total fixed cost for the company as a whole?

c. What is the variable cost per unit produced and sold?

5. With respect to cost classifications for decision making:

a. If Dozier had produced 1,001 units instead of 1,000 units, how much incremental manufacturing cost would it have

incurred to make the additional unit?

Complete this question by entering your answers in the tabs below.

Required Required Required Required Required

3.

5

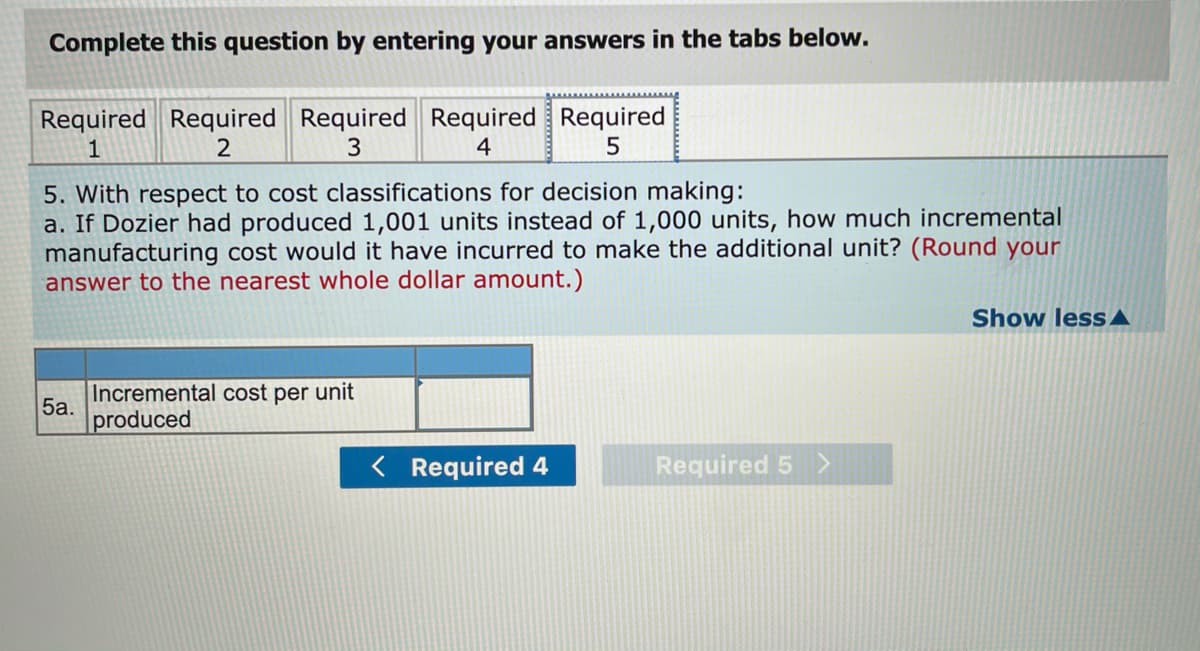

4. With respect to cost classifications for predicting cost behavior:

a. What is the total variable manufacturing cost?

b. What is the total fixed cost for the company as a whole?

c. What is the variable cost per unit produced and sold? (Round your answer to the nearest

whole dollar amount.)

Show less A

4a. Total variable manufacturing cost

4b. Total fixed cost

Variable cost per unit produced

4c.

and sold

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required Required Required Required Required

1

2

3

4

5. With respect to cost classifications for decision making:

a. If Dozier had produced 1,001 units instead of 1,000 units, how much incremental

manufacturing cost would it have incurred to make the additional unit? (Round your

answer to the nearest whole dollar amount.)

Show lessA

Incremental cost per unit

5а.

produced

< Required 4

Required 5 >

Expert Solution

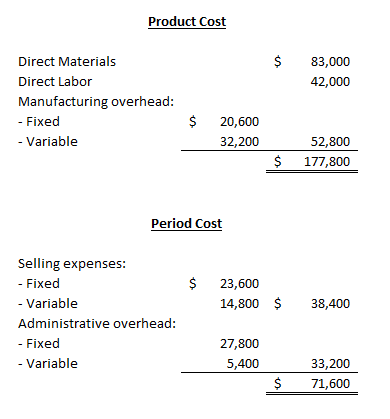

Step 1: Product and Period Cost

Product cost: Product cost of a product refers to the manufacturing cost of producing one unit of a product. It includes, direct material cost, direct labor cost, and factory or manufacturing overhead.

Period cost: Period costs are the costs which are not allocable to a particular unit of product and hence to be charged off against the revenue at the end of a period. It includes all the general selling and administrative overhead.

Total product cost: $177,800

Total period cost: $71,600

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,