(Dollars in Millions) Current Period Prior Period Assets Federal Funds sold and securities purchased under agreements to resell Residential mortgage $176,922 $178,359 $98,022 $119,920 $110,163 $683,386 $39,112 $722,498 $32,575 $157,274 $188,846 $92,207 $105,048 $101,097 $644,472 $37,924 $682,396 $30,558 Credit card Direct/Indirect consumer Commercial Total loans and leases Other earning assets Total earning assets Cash and cash equivalents

(Dollars in Millions) Current Period Prior Period Assets Federal Funds sold and securities purchased under agreements to resell Residential mortgage $176,922 $178,359 $98,022 $119,920 $110,163 $683,386 $39,112 $722,498 $32,575 $157,274 $188,846 $92,207 $105,048 $101,097 $644,472 $37,924 $682,396 $30,558 Credit card Direct/Indirect consumer Commercial Total loans and leases Other earning assets Total earning assets Cash and cash equivalents

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter22: Corporations: Bonds

Section: Chapter Questions

Problem 13SPB

Related questions

Question

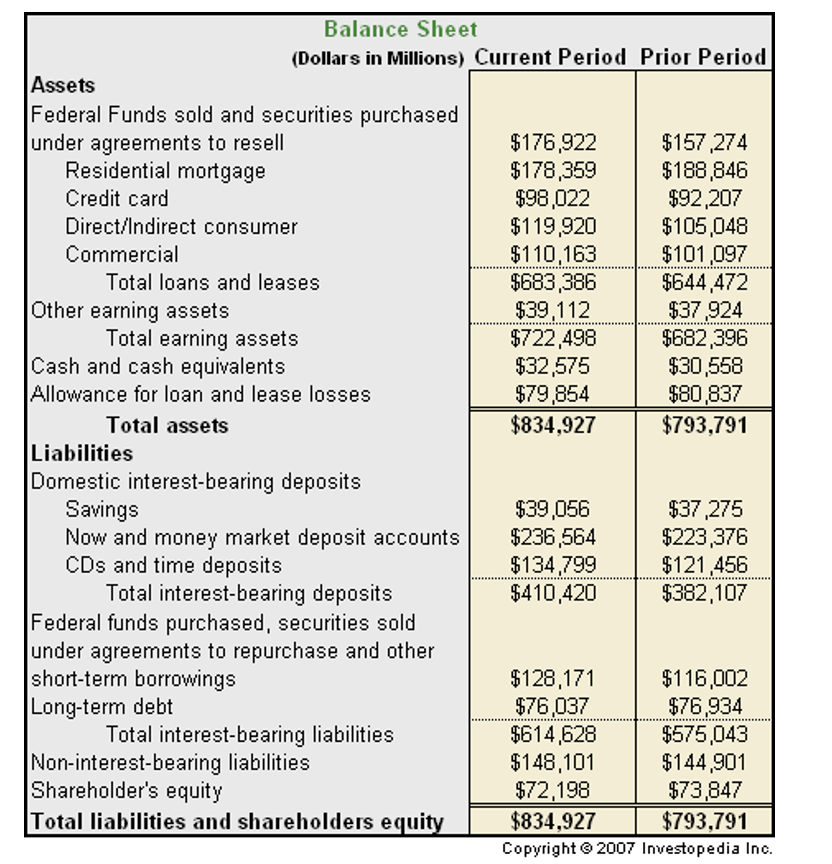

Calculate leverage ratio of the following bank.

Transcribed Image Text:Balance Sheet

(Dollars in Millions) Current Period Prior Period

Assets

Federal Funds sold and securities purchased

under agreements to resell

Residential mortgage

$176,922

$178,359

$98,022

$119,920

$110,163

$683,386

$39,112

$722,498

$32,575

$79,854

$834,927

$157,274

$188,846

$92,207

$105,048

$101 ,097

$644,472

$37,924

$682,396

$30,558

$80,837

$793,791

Credit card

Direct/Indirect consumer

Commercial

Total loans and leases

Other earning assets

Total earning assets

Cash and cash equivalents

Allowance for loan and lease losses

Total assets

Liabilities

Domestic interest-bearing deposits

Savings

Now and money market deposit accounts

CDs and time deposits

$39,056

$236,564

$134,799

$410,420

$37,275

$223,376

$121,456

$382,107

Total interest-bearing deposits

Federal funds purchased, securities sold

under agreements to repurchase and other

short-term borrowings

Long-term debt

$128,171

$76,037

$614,628

$148,101

$72,198

$834,927

$116,002

$76,934

$575,043

$144,901

$73,847

Total interest-bearing liabilities

Non-interest-bearing liabilities

Shareholder's equity

Total liabilities and shareholders equity

$793,791

Copyright © 2007 Investopedia Inc.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub