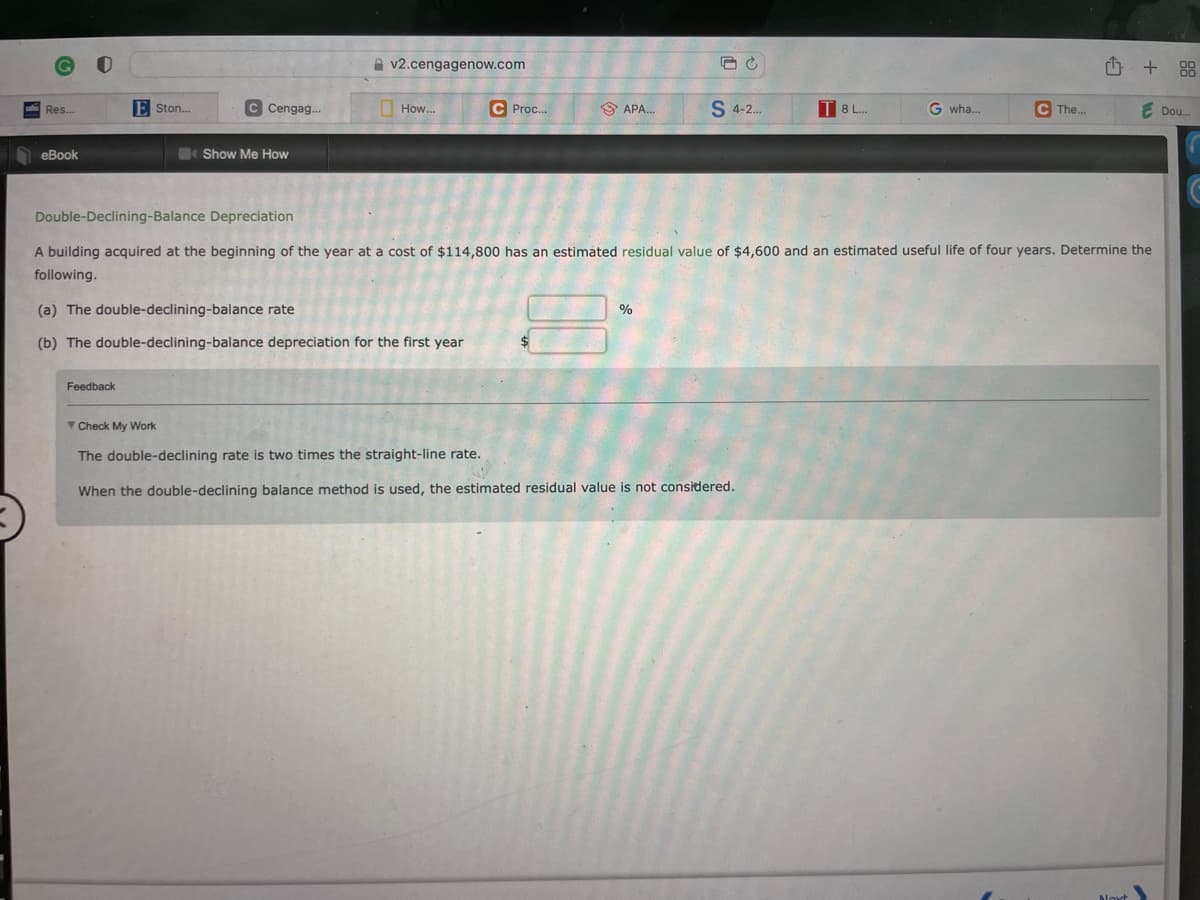

Double-Declining-Balance Depreciation A building acquired at the beginning of the year at a cost of $114,800 has an estimated residual value of $4,600 and an estimated useful life of four years. Determine the following. % (a) The double-declining-balance rate (b) The double-declining-balance depreciation for the first year Feedback

Double-Declining-Balance Depreciation A building acquired at the beginning of the year at a cost of $114,800 has an estimated residual value of $4,600 and an estimated useful life of four years. Determine the following. % (a) The double-declining-balance rate (b) The double-declining-balance depreciation for the first year Feedback

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.23E: Adjustment for depreciation The estimated amount of depredation on equipment for the current year is...

Related questions

Question

Help

Transcribed Image Text:v2.cengagenow.com

+

Dou....

How...

C Proc...

E Ston...

APA...

S 4-2...

T8 L...

G wha...

C The...

Res..

eBook

Show Me How

Double-Declining-Balance Depreciation

A building acquired at the beginning of the year at a cost of $114,800 has an estimated residual value of $4,600 and an estimated useful life of four years. Determine the

following.

%

(a) The double-declining-balance rate

$

(b) The double-declining-balance depreciation for the first year

Feedback

Check My Work

The double-declining rate is two times the straight-line rate.

When the double-declining balance method is used, the estimated residual value is not considered.

C Cengag...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning