Dr. Anita Flosz is a self-employed dentist with a well-established practice in Niagara Falls, Ontario. She has sought your advice regarding the tax deductibility of the following expenditures from her business income for tax purposes in the current taxation year:

Dr. Anita Flosz is a self-employed dentist with a well-established practice in Niagara Falls, Ontario. She has sought your advice regarding the tax deductibility of the following expenditures from her business income for tax purposes in the current taxation year:

Chapter4: Income Exclusions

Section: Chapter Questions

Problem 70IIP: In each of the following problems, identify the tax issue(s) posed by the facts presented. Determine...

Related questions

Question

1.Please Complete Solution With Details

2.Final Answer Clearly Mentioned

3.Do not give solution in image format

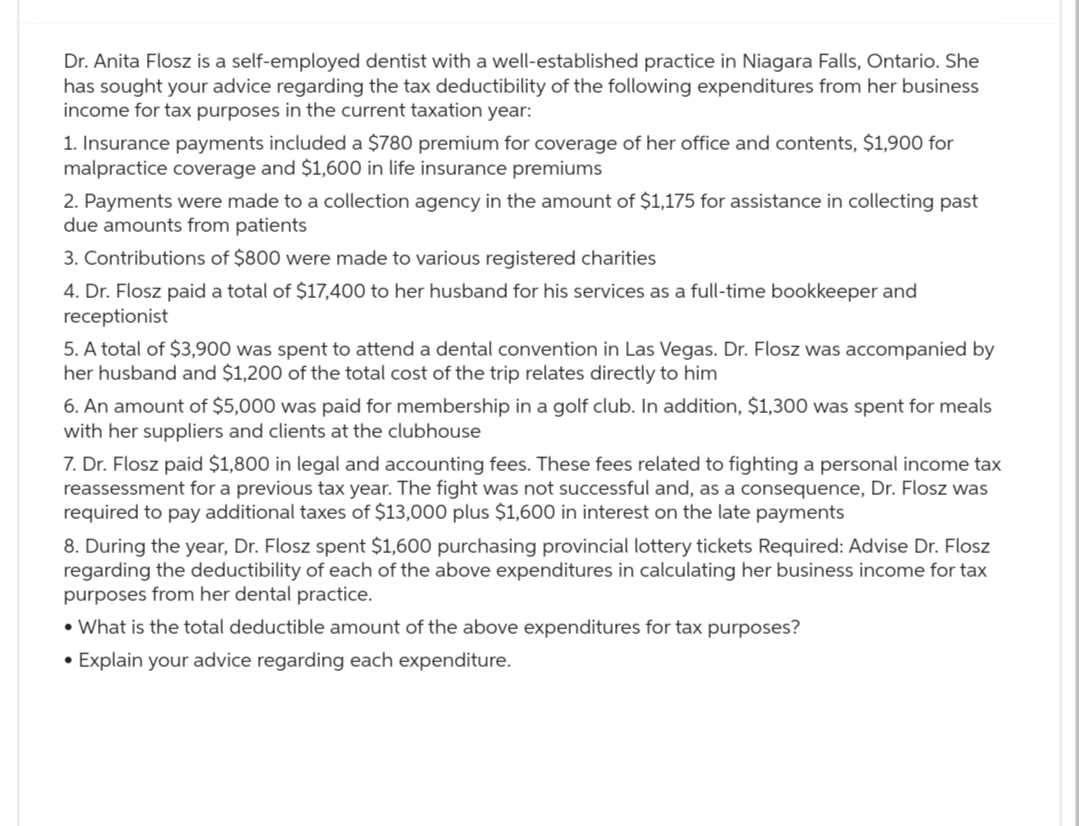

Transcribed Image Text:Dr. Anita Flosz is a self-employed dentist with a well-established practice in Niagara Falls, Ontario. She

has sought your advice regarding the tax deductibility of the following expenditures from her business

income for tax purposes in the current taxation year:

1. Insurance payments included a $780 premium for coverage of her office and contents, $1,900 for

malpractice coverage and $1,600 in life insurance premiums

2. Payments were made to a collection agency in the amount of $1,175 for assistance in collecting past

due amounts from patients

3. Contributions of $800 were made to various registered charities

4. Dr. Flosz paid a total of $17,400 to her husband for his services as a full-time bookkeeper and

receptionist

5. A total of $3,900 was spent to attend a dental convention in Las Vegas. Dr. Flosz was accompanied by

her husband and $1,200 of the total cost of the trip relates directly to him

6. An amount of $5,000 was paid for membership in a golf club. In addition, $1,300 was spent for meals

with her suppliers and clients at the clubhouse

7. Dr. Flosz paid $1,800 in legal and accounting fees. These fees related to fighting a personal income tax

reassessment for a previous tax year. The fight was not successful and, as a consequence, Dr. Flosz was

required to pay additional taxes of $13,000 plus $1,600 in interest on the late payments

8. During the year, Dr. Flosz spent $1,600 purchasing provincial lottery tickets Required: Advise Dr. Flosz

regarding the deductibility of each of the above expenditures in calculating her business income for tax

purposes from her dental practice.

• What is the total deductible amount of the above expenditures for tax purposes?

• Explain your advice regarding each expenditure.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT