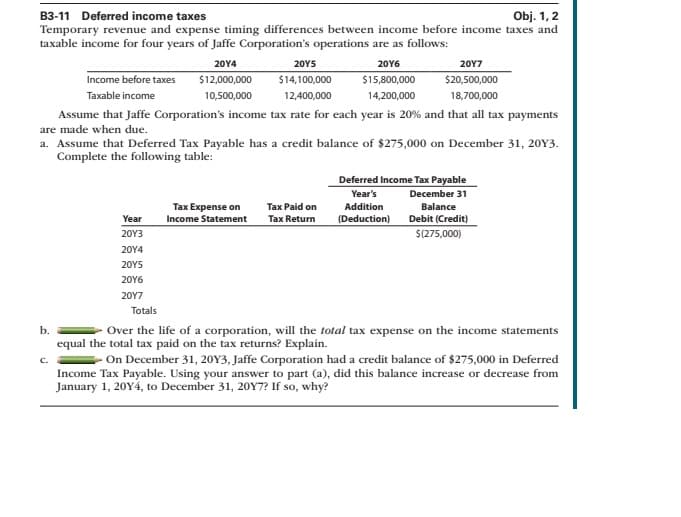

me taxes bj. Temporary revenue and expense timing differences between income before income taxes and taxable income for four years of Jaffe Corporation's operations are as follows: Income before taxes Taxable income b. C. 2014 $12,000,000 10,500,000 Assume that Jaffe Corporation's income tax rate for each year is 20% and that all tax payments are made when due. a. Assume that Deferred Tax Payable has a credit balance of $275,000 on December 31, 20Y3. Complete the following table: Year 2013 2014 2015 20Y6 2017 20Y5 20Y6 $14,100,000 $15,800,000 12,400,000 14,200,000 Tax Expense on Income Statement 2017 $20,500,000 18,700,000 Tax Paid on Tax Return Deferred Income Tax Payable Year's Addition (Deduction) December 31 Balance Debit (Credit) $(275,000) Totals Over the life of a corporation, will the total tax expense on the income statements equal the total tax paid on the tax returns? Explain. On December 31, 20Y3, Jaffe Corporation had a credit balance of $275,000 in Deferred Income Tax Payable. Using your answer to part (a), did this balance increase or decrease from January 1, 20Y4, to December 31, 20Y7? If so, why?

me taxes bj. Temporary revenue and expense timing differences between income before income taxes and taxable income for four years of Jaffe Corporation's operations are as follows: Income before taxes Taxable income b. C. 2014 $12,000,000 10,500,000 Assume that Jaffe Corporation's income tax rate for each year is 20% and that all tax payments are made when due. a. Assume that Deferred Tax Payable has a credit balance of $275,000 on December 31, 20Y3. Complete the following table: Year 2013 2014 2015 20Y6 2017 20Y5 20Y6 $14,100,000 $15,800,000 12,400,000 14,200,000 Tax Expense on Income Statement 2017 $20,500,000 18,700,000 Tax Paid on Tax Return Deferred Income Tax Payable Year's Addition (Deduction) December 31 Balance Debit (Credit) $(275,000) Totals Over the life of a corporation, will the total tax expense on the income statements equal the total tax paid on the tax returns? Explain. On December 31, 20Y3, Jaffe Corporation had a credit balance of $275,000 in Deferred Income Tax Payable. Using your answer to part (a), did this balance increase or decrease from January 1, 20Y4, to December 31, 20Y7? If so, why?

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter21: Corporations: Taxes, Earnings, Distributions, And The Statement Of Retained Earnings

Section: Chapter Questions

Problem 1SEA: CORPORATE INCOME TAX Stanton Company estimates that its 20-1 income tax will be 80,000. Based on...

Related questions

Question

All the three parts should be answered

Transcribed Image Text:Obj. 1,2

B3-11 Deferred income taxes

Temporary revenue and expense timing differences between income before income taxes and

taxable income for four years of Jaffe Corporation's operations are as follows:

Income before taxes

Taxable income

b.

C.

2014

$12,000,000

10,500,000

Assume that Jaffe Corporation's income tax rate for each year is 20% and that all tax payments

are made when due.

Year

20Y3

20Y4

a. Assume that Deferred Tax Payable has a credit balance of $275,000 on December 31, 20Y3.

Complete the following table:

20Y5

20Y6

20Y7

20Y5

$14,100,000

12,400,000

Tax Expense on

Income Statement

20Y6

$15,800,000

14,200,000

20Y7

$20,500,000

18,700,000

Tax Paid on

Tax Return

Deferred Income Tax Payable

Year's

Addition

(Deduction)

December 31

Balance

Debit (Credit)

$(275,000)

Totals

Over the life of a corporation, will the total tax expense on the income statements

equal the total tax paid on the tax returns? Explain.

On December 31, 20Y3, Jaffe Corporation had a credit balance of $275,000 in Deferred

Income Tax Payable. Using your answer to part (a), did this balance increase or decrease from

January 1, 20Y4, to December 31, 20Y7? If so, why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage