Drawings: J.Durango Cash Trade Debtors Trading Inventory 1/8/2018 Prepaid Insurance Prepaid Rentals Trade Creditors Total 45,000 78,235 10,350 70,650 1,620 10,800 Additional Information st i. The enterprise took out a fire insurance policy on 1 April, 2019 and paid a premium of Kshs. 1,620 for the 12 months to 31 March, 2020. 755,755 st ii. On 1 February 2019, Durango Traders entered into a rental contract and paid a year's rental Kshs. 10,800 in advance REQUIRED:- 18,000 755,755 st iii. Depreciation of Kshs. 3,375 must still be provided for the year ended 31 July 2019 on office furniture a) iv. On 31 July 2019, the trading inventory amounted to Kshs. 59,400 (at cost price) b) C) 2019 st Prepare the necessary journal entries to give effect to the adjustment at the year end. Prepare the Income Statement for the enterprise for the year ended 31 July, 2019 Prepare a balance sheet of the business at 31 July st

Drawings: J.Durango Cash Trade Debtors Trading Inventory 1/8/2018 Prepaid Insurance Prepaid Rentals Trade Creditors Total 45,000 78,235 10,350 70,650 1,620 10,800 Additional Information st i. The enterprise took out a fire insurance policy on 1 April, 2019 and paid a premium of Kshs. 1,620 for the 12 months to 31 March, 2020. 755,755 st ii. On 1 February 2019, Durango Traders entered into a rental contract and paid a year's rental Kshs. 10,800 in advance REQUIRED:- 18,000 755,755 st iii. Depreciation of Kshs. 3,375 must still be provided for the year ended 31 July 2019 on office furniture a) iv. On 31 July 2019, the trading inventory amounted to Kshs. 59,400 (at cost price) b) C) 2019 st Prepare the necessary journal entries to give effect to the adjustment at the year end. Prepare the Income Statement for the enterprise for the year ended 31 July, 2019 Prepare a balance sheet of the business at 31 July st

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 60APSA

Related questions

Question

Transcribed Image Text:dbm 105 fund x DBM 105.pdf

Home

Question Z

Not yet answered

tps://eclass.uonbi.ac.ke/mod/quiz/attempt.php?attempt=876769&cmid=38254&page=1

Marked out of

10.00

Flag question

IO

X

Events

Dashboard

My Courses

This course

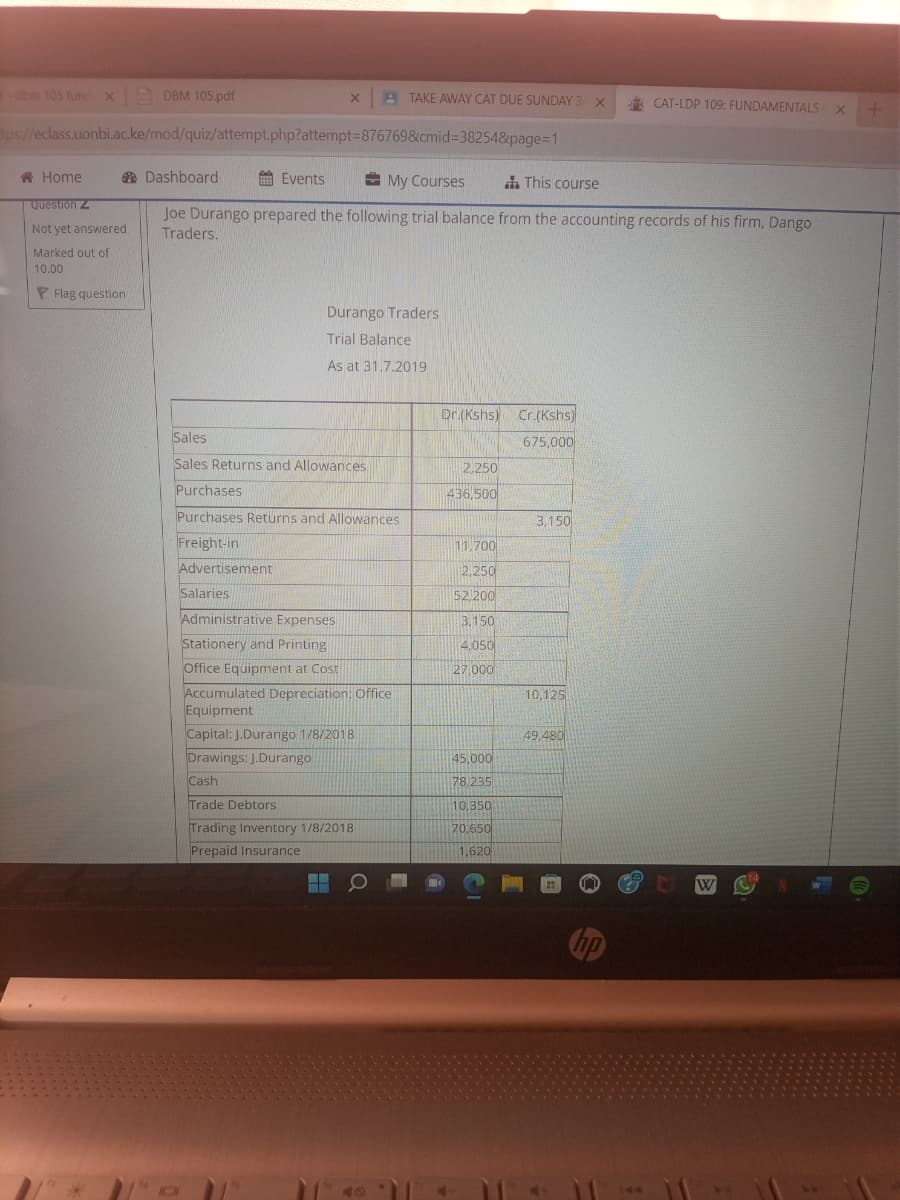

Joe Durango prepared the following trial balance from the accounting records of his firm, Dango

Traders.

TAKE AWAY CAT DUE SUNDAY 3 X

Sales

Sales Returns and Allowances

-

Durango Traders

Trial Balance

As at 31.7.2019

Purchases

Purchases Returns and Allowances

Freight-in

Advertisement

Salaries

Administrative Expenses

Stationery and Printing

Office Equipment at Cost

Accumulated Depreciation: Office

Equipment

Capital: J.Durango 1/8/2018

Drawings: J.Durango

Cash

Trade Debtors

Trading Inventory 1/8/2018

Prepaid Insurance

Dr.(Kshs) Cr.(Kshs)

675,000

2,250

436,500

11,700

2,250

52,200

3.150

4.050

27,000

45,000

78,235

10,350

70,650

1,620

3,150

10,125

49.480

CAT-LDP 109: FUNDAMENTALS x +

X

hp

W

Transcribed Image Text:DEM 105.pdf

Dashboard

/mod/quiz/attempt.php?attempt=876769&cmid=38254&page=1

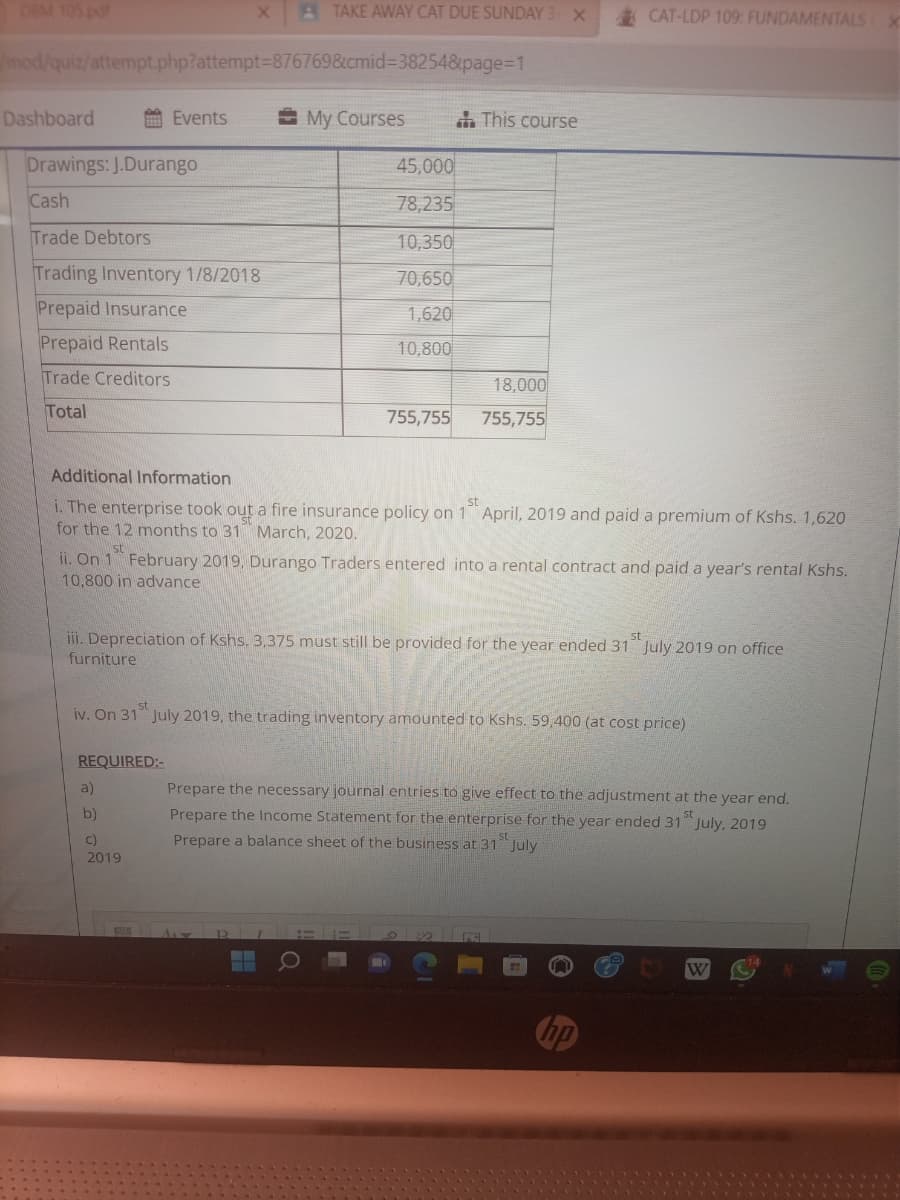

Drawings: J.Durango

Cash

Trade Debtors

Trading Inventory 1/8/2018

Prepaid Insurance

Prepaid Rentals

Trade Creditors

Total

X

Events

REQUIRED:-

TAKE AWAY CAT DUE SUNDAY 3 X

a)

b)

C)

2019

My Courses

45,000

78,235

10,350

70,650

1,620

10,800

755,755

Additional Information

st

i. The enterprise took out a fire insurance policy on 1 April, 2019 and paid a premium of Kshs. 1,620

for the 12 months to 31 March, 2020.

st

ii. On 1 February 2019, Durango Traders entered into a rental contract and paid a year's rental Kshs.

10,800 in advance

--

This course

st

iii. Depreciation of Kshs. 3,375 must still be provided for the year ended 31 July 2019 on office

furniture

18,000

755,755

iv. On 31 July 2019, the trading inventory amounted to Kshs. 59,400 (at cost price)

CAT-LDP 109: FUNDAMENTALS

R

Prepare the necessary journal entries to give effect to the adjustment at the year end.

Prepare the Income Statement for the enterprise for the year ended 31st July, 2019

Prepare a balance sheet of the business at 31 July

x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning