Drill Press T Drill Press M Initial Investment S20,000 $30,000 Estimated Life 10 years 10 years Estimated Salvage Value $5,000 $7,000 Annual Operating Cost $12,000 $6,000 Annual Maintenance Cost $2,000 $4,0007

Q: A piece of new equipment has been proposed by engineers to increase the productivity of a certain…

A: Internal Rate of Return: When evaluating projects or investments, the internal rate of return is…

Q: o electric motors are being evaluated for an automated paint booth cation. Each motor have an output…

A: The annual cost is equivalent cost of operating the motor which is equivalent to initial cost…

Q: Estimates for one of two process upgrades are as follows: First Cost = Php 40,000 Annual Cost = Php…

A: Annual worth is the net revenue from the investment annually. It is calculated using the discounting…

Q: An assembly operation at a software company now requires $100,000 per year in labor costs. A robot…

A: A discount rate at which the net present worth of an investment is equal to zero is term as internal…

Q: Halcrow, Inc., expects to replace a downtime tracking system currently installed on CNC machines.…

A:

Q: You must analyze a potential new product --- a caulking compound that Korry Materials’ R&D…

A: The question is based on the concept of capital budgeting and techniques of capital budgeting. The…

Q: Consider a project to supply Detroit with 28,000 tons of machine screws annually for automobile…

A: Since you have posted a question with multiple sub-parts, we will solve the first two sub-parts for…

Q: A piece of new equipment has been proposed by engineers to increase the productivity of a certain…

A: Present Worth Present value is the present worth of any sum of money to be received in the future at…

Q: 2. As supervisor of a facilities engineering department, you consider mobile cranes to be critical…

A: PW Method The present worth approach is frequently used in various industry because it reduces all…

Q: A mining company need to decide which of the equipment models to use in a project that will last for…

A: Using excel

Q: Engine valves company is considering building an assembly plant .The decision has been narrowed down…

A: In making the decision, we can use the Present Value of costs of the given alternatives. The…

Q: An existing machine in a factory has an annual maintenance cost of Php 40,000. A new and more…

A: An existing machine in a factory has an annual maintenance cost of Php 40,000. If same cost to be…

Q: A piece of new equipment has been proposed by engineers to increase the productivity of a certain…

A: MARR = 20% Cash Flows: Year Cash Flow 1 -25000.00 2 8000.00 3 8000.00 4 8000.00 5…

Q: Raytronics wishes to use an automated environmental chamber in the manufacture of electronic…

A: For conventional cash flow pattern, both IRR and ERR provide the same result.

Q: Consider a project to supply Detroit with 27,000 tons of machine screws annually for automobile…

A:

Q: Raytheon wishes to use an automated environmental chamber in the manufacture of electronic…

A: Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: A piece of new equipment has been proposed by engineers to increase the productivity of a certain…

A: Present Worth or Net present Value refers to the difference between the discounted value of cash…

Q: A piece of new equipment has been proposed by engineers to increase theproductivity of a certain…

A: At IRR PV of cash inflows are equal to PV of cash outflows or it is the rate at which future cash…

Q: Lakeside Inc. is considering replacing old production equipment with state-of-the-art technology…

A: Annual cost savings = Monthly savings x 12 months = $10,000 x 12 = $120,000

Q: 3D Systems Corporation was assessing between two natural fibers as a reinforcing fiber to ABS…

A:

Q: Consider a project to supply Detroit with 28,000 tons of machine screws annually for automobile…

A: Calculation of Cash Outflow and Cash inflow( amount in $) Selling price per unit (a)= 344 Variable…

Q: Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with…

A: Capital budgeting refers to the evaluation of the profitability of potential investment and projects…

Q: Raytronics wishes to use an automated environmental chamber in the manufacture of electronic…

A: Installation cost = 1.4 mn Salvage value = 200000 Term = 8 years Increase sales = 650000 Operating…

Q: Production engineers of a manufacturing firm have proposed a new equipment to increase productivity…

A: As you have asked a multiple subpart question, we will answer the first three subparts for you. To…

Q: Use the PW method. Show the cash flow diagram if necessary and complete solution. Do not use excel…

A: i) Present worthIt is not worthwhile to purchase the new machine because its present worth is less…

Q: Acme Molding is examining 5 alternatives for a piece of material handling equipment. Each has an…

A: Incremental analysis involves: Ranking the alternatives on the basis of increasing capital…

Q: Tim Smunt has been asked to evaluate two machines. After some investigation, he determines that…

A: Introduction Net present value (NPV) is the term used to describe the difference between the…

Q: You are evaluating two different silicon wafer milling machines. The Techron I costs $285,000, has a…

A: Given: Techron 1 cost is $285,000 Techron 1 pre tax operating cost is $46,000 Techron 11 cost is…

Q: piece of new equipment has been proposed by engineers to increase the productivity of a certain…

A:

Q: A piece of new equipment has been proposed by engineers to increase the productivity of a certain…

A: The internal rate of return is the capital budgeting technique used to calculate the rate at which…

Q: manufacturing plant produces 5,000 units per year. The capital investment, annual expenses, salvage…

A: The present value method is an important technique to determine the probability of the projects…

Q: A company that makes food-friendly silicone (for use in cooking and baking pan coatings) is…

A: PW=-P+A(P/A,i,n)+F(P/F,i,n)where,PW=Present WorthP=The initial costA=Amount of annual net…

Q: ear after extra operating costs

A: Given information : Year Cash flows 0 -25000 1 8000 2 8000 3 8000 4 8000 5 13000…

Q: Raytheon wishes to use an automated environmental chamber in themanufacture of electronic…

A:

Q: Falk Corporation is considering two types of manufacturing systems to produce its shaft couplings…

A: IRR(Internal ROR) is rate at which NPV(Net Present Value) of any proposal is zero. At IRR, Present…

Q: The engineer of a medium scale industry was instructed to prepare to plans to be considered by…

A: Net Present value is the present value of future cash flow which is used to know whether a project…

Q: Two machines with the following cost estimates are under consideration for a dishwasher assembly…

A: Year Cash Flow Present Value of Cash Flow = Cash Flow / (1+Interest%)^Year Working 0 -300,000.00…

Q: A company is planning to install a new automated plastic-molding press. Four different presses are…

A: Answer:

Q: A piece of new equipment has been proposed by engineers to increase theproductivity of a certain…

A: PW is the present value of cash flows that are expected to occur in the future.

Q: An engineer proposes to spend $95,000 on a capital project to upgrade a package delivery system. The…

A: Present worth is calculated by present value of annual savings from the project less of initial cost…

Q: years. One person will operate the machine at a rate of Php24 per hour. The expected output is 8…

A: Given data initial cost 23000 8000 useful life 10year 5year AMC 3500 1500 salvage value 4400 0…

Q: Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filamen with…

A: Solution: - Calculation of present worth for DDM method as follows under: -

Q: Tim Smunt has been asked to evaluate two machines. After some investigation, he determines that…

A: NPV is an approach used in capital budgeting for evaluation of long term investments. NPV is given…

Q: Costs associated with the manufacture of miniature high-sensitivity piezoresistive pressure…

A: It is given that the original cost of manufacture is $85000 and by spending $19000 the cost will…

Q: Your company is planning to add a piece of equipment with 7 years of expected life for its…

A: MARR = 11% Time period = 7 years Salvage value = zero The NPV of each project is to compute to…

Q: How long will it take to recover an investment of $245,000 in enhanced CNC controls that include…

A: Break-Even is point where entity is neither earning profit nor incurring losses. It is point where…

Q: Consider a project to supply Detrolt with 27,000 tons of machine screws annually for automobile…

A: Total volume of sales is 27,000 tones. The price of per ton is $332, variable cost per ton is $225,…

Q: A piece of new equipment has been proposed by engineers to increase the productivity of a certain…

A: The present value of the cash flows means the discounted values of cash flows as if they happen to…

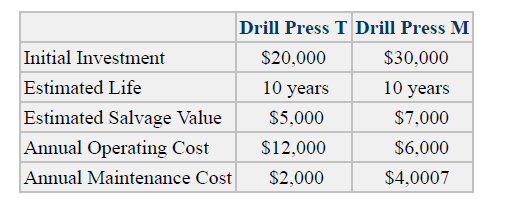

Two numerically controlled drill presses are being considered by the production department of Zunni’s Manufacturing; one must be selected. Comparison data is shown in the table below. MARR is 10%/year. Solve, a. What is the future worth of each drill press? b. Which drill press should be recommended?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- 1 An equipment costs P45,000 with an economic life of 18 years. Its salvage value is P12,000. Maintenance cost is done every 5 years for P6000. Operating cost is 4000 annually. Money is worth 12%. Compute for its capitalized cost.3. An Industrial plant bought a generator set for P90,000. Other expenses including installation amounted to P10,000. The generator is to have 17 years with a salvage value at the end of life of P5,000. Determine the book value at the end of 12 years by the following method;Declining balance method:P12,068P14,393P10.118P8,483Sinking fund method at 12% P59.860P53,100P45,529P65.896 SHOW YOUR SOLUTIONS PLEASECost of new equipment: $200,000 Installation: $20,000 Change in Net Operating Working Capital: $50,000 New sales per year: $115,000 New operating costs per year: $50,000 Economic life: 4 years Depreciable life: MACRS 3-year class (33%, 45%, 15%, 7%) Salvage value: $20,000 Tax Rate: 25% WACC: 9% What is the total initial investment outlay (FCF0)? What is the operating cash flow for year 2, or FCF2? (SHOW ALL WORK/STEPS) What are the planned non-operating cash flows in year 4 (i.e. terminal cash flows)? (SHOW ALL WORK/STEPS) What is the book value of the equipment after three years?

- H7. Query Company is considering an investment in machinery with the following information. Initial investment $ 200,000 Materials, labor, and overhead (except depreciation) $ 45,000 Useful life 9 years Depreciation—Machinery 20,000 Salvage value $ 20,000 Selling, general, and administrative expenses 5,000 Expected sales per year 10,000 units Selling price per unit $ 10 (a) Compute the investment’s annual income and annual net cash flow. (b) Compute the investment’s payback period. Please show all step by step calculationConstruct a Cash-flow diagram. An industrial plant bought a generator set for P90,000. Other expenses including installation amounted to P10,000. The generator set is to have a life of 17 years with a salvage value at the end of life of P5,000. Determine the depreciation charge during the 13th year and the book value at the end of 13 years by the (a) declining balance method (b) double declining balance method (c) sinking fund method and (d) SYD method.A firm bought an equipment for P56,000. Other expenses including installation amounted to P4,000. The equipment is expected to have a life of 16 years with a salvage of 10 percent of the original cost. Determine the book value at the end of 12 years by (a) the straight line method and (b) sinking fund method at 12% interest.

- Capitalized Cost 1.Find the capitalized cost of an asset whose cost is P100,000, salvage value is P10,000, life is 15 years at 5%. 2.A bridge that was constructed at a cost of P75,000 is expected to last 30 years, at the end of which time its renewal cost will be P40,000. Annual repairs and maintenance are P3,000. What is the capitalized cost of the bridge at an interest of 6%?Create a units of production depreciation Cargo Van Price $26,000 Machine Price $48,000Salvage value $2,000 Salvage value $3,000Useful life 10 years Useful life 8 yearsTotal miles 90,000 Total hours 13,000Yr 1 miles 12,100 Yr 1 hours 1,250Yr 2 miles 9,400 Yr 2 hours 1,46An industrial plant bought a generator set for P90,000. Other expenses including installation amounted to P10,000. The generator set is to have a life of 17 years with a salvage value at the end of life of P5,000. Determine the depreciation charge during the 13th year and the book value at the end of 13 years by the (a) declining balance method (b) SLM (c) sinking fund method if i=4% and (d) SYD method.

- Lotus contractors construction. Building cost= $13650000. Weighted average accumulated expenditures = $5600000 Actual interest was $562000, and avoidable interest was $272000. If the salvage value is $1150000, and the useful life is 40 years, depreciation expense for the first full year using the straight-line method is A.$319300 B.$348050 C.$326100 D.$459300Q7.Alyoum Newspaper purchased LG printing machine for 100,000. Installation of the machine costs 8,000. The machine is expected to be used for 10 years at end of which the salvage value is expected to be 10,000. DDB method is used. What is the book value at end of year 3? 55,296 51,200 64,000 None of the other answers Q8.Given an asset that has a cost basis of $300,000 and was sold for $350,000. The book value for the asset at the time of sale was $150,000. Assume that the capital gain tax rate is 40% while the ordinary gain tax rate is 20%. What are the net proceeds from this sale? $300,000 $310,000 $270,000 None of the other answers Q9.Consider a 5-year MACRS asset, which was purchased at $140,000. The asset was disposed of at end of year 5 with a salvage value of $50,000. What is amount of gain(or loss) when asset is disposed of ? $33,872 $11,280 $17,744 $16,128An equipment costing P1.8M has a salvage value of P300,000 after 5 years. Calculate the depreciation value (book value) at the end of 3 years using the straight-line method. A. P860,000 B. P750,000 C. P900,000 D. P700,000