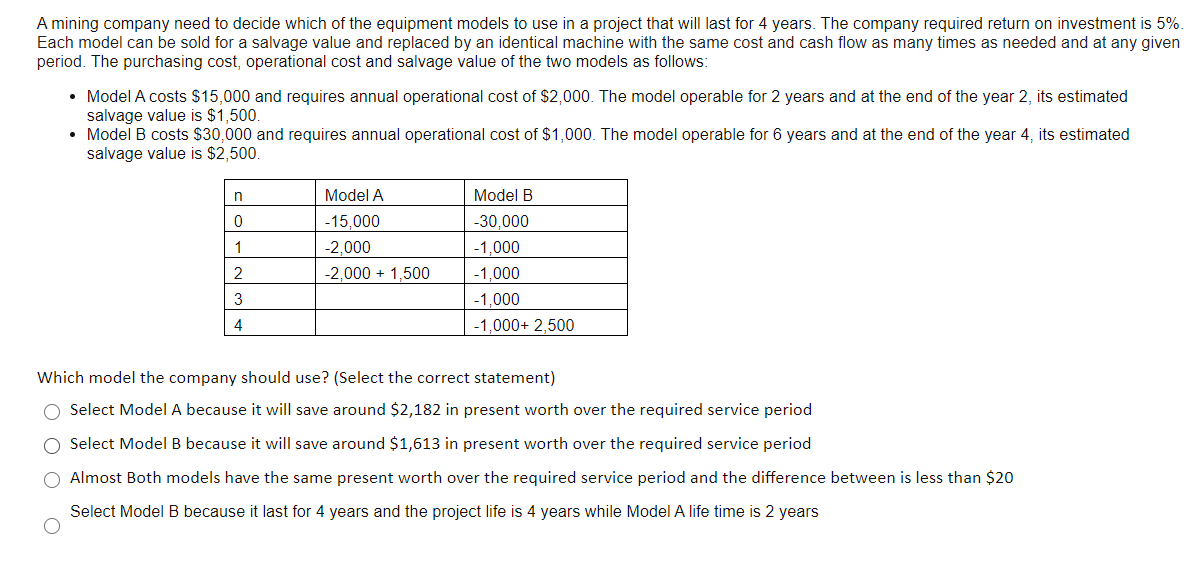

A mining company need to decide which of the equipment models to use in a project that will last for 4 years. The company required return on investment is 5%. Each model can be sold for a salvage value and replaced by an identical machine with the same cost and cash flow as many times as needed and at any given period. The purchasing cost, operational cost and salvage value of the two models as follows: • Model A costs $15,000 and requires annual operational cost of $2,000. The model operable for 2 years and at the end of the year 2, its estimated salvage value is $1,500 • Model B costs $30,000 and requires annual operational cost of $1,000. The model operable for 6 years and at the end of the year 4, its estimated salvage value is $2,500 Model A Model B -15,000 -30,000 1 -2,000 -1,000 2 -2,000 + 1,500 -1,000 -1,000 4 -1,000+ 2,500 Which model the company should use? (Select the correct statement) O Select Model A because it will save around $2,182 in present worth over the required service period O Select Model B because it will save around $1,613 in present worth over the required service period O Almost Both models have the same present worth over the required service period and the difference between is less than $20 Select Model B because it last for 4 years and the project life is 4 years while Model A life time is 2 years

A mining company need to decide which of the equipment models to use in a project that will last for 4 years. The company required return on investment is 5%. Each model can be sold for a salvage value and replaced by an identical machine with the same cost and cash flow as many times as needed and at any given period. The purchasing cost, operational cost and salvage value of the two models as follows: • Model A costs $15,000 and requires annual operational cost of $2,000. The model operable for 2 years and at the end of the year 2, its estimated salvage value is $1,500 • Model B costs $30,000 and requires annual operational cost of $1,000. The model operable for 6 years and at the end of the year 4, its estimated salvage value is $2,500 Model A Model B -15,000 -30,000 1 -2,000 -1,000 2 -2,000 + 1,500 -1,000 -1,000 4 -1,000+ 2,500 Which model the company should use? (Select the correct statement) O Select Model A because it will save around $2,182 in present worth over the required service period O Select Model B because it will save around $1,613 in present worth over the required service period O Almost Both models have the same present worth over the required service period and the difference between is less than $20 Select Model B because it last for 4 years and the project life is 4 years while Model A life time is 2 years

Chapter10: Capital Budgeting: Decision Criteria And Real Option

Section: Chapter Questions

Problem 14P

Related questions

Question

100%

Transcribed Image Text:A mining company need to decide which of the equipment models to use in a project that will last for 4 years. The company required return on investment is 5%.

Each model can be sold for a salvage value and replaced

period. The purchasing cost, operational cost and salvage value of the two models as follows:

an identical machine with the same cost and cash flow as many times as needed and at any given

• Model A costs $15,000 and requires annual operational cost of $2,000. The model operable for 2 years and at the end of the year 2, its estimated

salvage value is $1,500.

• Model B costs $30,000 and requires annual operational cost of $1,000. The model operable for 6 years and at the end of the year 4, its estimated

salvage value is $2,500.

Model A

Model B

-15,000

-30,000

1

-2,000

-1,000

2

-2,000 + 1,500

-1,000

3

-1.000

4

-1,000+ 2,500

Which model the company should use? (Select the correct statement)

O Select Model A because it will save around $2,182 in present worth over the required service period

O Select Model B because it will save around $1,613 in present worth over the required service period

O Almost Both models have the same present worth over the required service period and the difference between is less than $20

Select Model B because it last for 4 years and the project life is 4 years while Model A life time is 2 years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning