Q: Suppose Lion Cage Multinational floated 5000 bonds on January 1, 2020 with a par value of 1500 at…

A: Bond valuation involves five components – coupon rate, yield, present value, future value and time…

Q: Given the following three mutually exclusive alternatives, Alternative A •.. B C Initial Cost $50…

A: Let initial cost = C Annual benefits = A n = 5 years i = 10%

Q: the Financial Manager of C&C Corporation and are evaluating to launch a new product that requires an…

A: Net present value is the difference between the present value of cash flow and initial investment of…

Q: Economists worry about the "Too Big to Fail" problem because those banks:

A: “Too big to fail” firms are the ones that have become so deeply ingrained in the economic system…

Q: Modified True or False T means Correct and F means Wrong Scenario: CHUGS are considering two equally…

A: Periodic Payment $ 5,000.00 Time Period 10 Years

Q: Big Sky Mining Company must install $1.5 million of new machinery in its Nevada mine. It can obtain…

A: Answer - Part 1 - NPV LEASE ANALYSIS 0 1 2 3 4 Cost of Owning After-tax loan…

Q: At the end of March 2019, a Zambian corporate bond had a coupon rate of 6%, a par (face) value of…

A: Given, The face value of the bond is K1,000 Yield is 4.5% Coupon rate is 6%

Q: Mr Dela Cruz deposited ₱18,980.00 from the project you’ve earned in a time deposit account with your…

A: Future Value is the product of present value with interest rate and its time period Future Value =…

Q: 23. n a single period common sized statement, the base amount is net sales in the Statement of…

A: Solution:- Common sized statement is a statement where each item is shown as percentage of a common…

Q: Option Trading Strategies - Two Assets $40 First Asset Profit Second Asset Profit Total Profit 1st…

A: In case of a Long put, Payoff is (exercise price - Stock price,0), I,e option is exercised only if…

Q: The credit card with the transactions described in the popup below uses the average daily balance…

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: f the economy is getting better, what's the most likley result in the Default Risk Premium Spreads

A: Default risk premium spread is the spread or the difference between the interest rate of a debt…

Q: A. What is the monthly payment? Alejandra has a payment of $ a month. B. How much interest will be…

A: Mortgage amortization refers to a schedule which is prepared to shows the periodic loan payments,…

Q: Arnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements…

A: Initial Investment $ 1,50,00,000.00 Sales revenue $ 50,00,000.00 Manufacturing costs…

Q: The coupon rate is calculated on the bond's face value for par value). not on the issue price or…

A: Coupon rate is the interest rate for periodic interest payments on the bond. Value of the bond =…

Q: 21. You purchased a property for $4,000,000 using 50% LTV. If net cash flow is $200,000, what is the…

A: “Since you have asked multiple questions, we will solve the one question for you. If you want any…

Q: 1. To save for their new child's college education, a couple places $28,400 in an account. What…

A: Present value of a future amount With periodic compounded interest rate (i), period (n) and future…

Q: Assume you buy a March RM1625 FBM-KLCI call option for RM25 and hold until expiry. What will be your…

A: In the given case, Call option is purchased at a premium of $25 Long call is exercised only if Stock…

Q: Using the formula for YTM (yield to maturity) in the lecture, what is the rate return for a bond…

A: YTM that means yield to maturity is rate of realized when bond is held till the maturity of the bond…

Q: A. If the market price of the common stock is $40 and dividends are expected to grow at a rate of 6%…

A: Company’s cost of retained earnings financing = (D1 or dividend next year/P0)+growth rate Company’s…

Q: When the economy is weak, money is spent freely on needs and wants. True False

A: An economy is a large set of interrelated production, consumption, and exchange activities that help…

Q: 19. You borrow $1,500,000 to purchase a small apartment building. The lender charges you a 2%…

A: Present value of annuity Annuity is a series of equal payment at equal interval. With annuity (PMT),…

Q: Mike Energy has been paying dividends steadily for 20 years. During that time, dividends have grown…

A: Solution:- Cost of common equity means the required rate of return of equity shareholders. It is…

Q: Allan Corporation would like to purchase 60% of Mark Corporation in an acquisition. If Allan pushes…

A: Investment decisions are one of the major decisions of financial management. This investment…

Q: PROBLEM: 1. What is the current value of the Php 200 payment to be made at the end of each of the…

A:

Q: An introduction about the Euromarket and background about the euro market and objective about it?

A: The foreign exchange market is an institution for exchanging the currency of one country for the…

Q: XTY Company has total assets turnover ratio of 1.90 and a return on total assets of 7.20%. What is…

A: Asset turnover ratio = 1.90 Return on assets = 7.20%

Q: K&K Manufacturing just issued a bond with a $1,000 face value and a coupon rate of 8.5%. If the bond…

A: Face value (FV) = $1000 Coupon rate = 8.5% Coupon amount (C) = 1000*0.085 = $85 Years to maturity…

Q: (b) Assume you can borrow $100,000.00, using covered interest arbitrage for a 30- day investment,…

A: Given, (b) Here, we have to find out the arbitrage value after 30 days. The working is done…

Q: Which of the following statements is correct? O The fundamental value of the shares in a firm is…

A: Fundamental value of a firm is its intrinsic value. It is the value which is determined after…

Q: The following financial information was provided by Anya Company: Net Income 8,255,000.00…

A: Net profit margin depends on sales and net income and all these are quite interrelated to each…

Q: Discuss the payback period, NPV (net present value), and IRR (internal rate of return) methods for…

A: Capital budgeting is the process of comparing the project's return to the needed return. It aids in…

Q: 15. Net profits after taxes are defined as * gross profits minus operating expenses. sales revenue…

A: Earnings before interest and taxes: Earnings before interest, depreciation and taxes are the…

Q: QUESTION 53 As Fis consolidate and expand their range of financial services, customer relationships…

A: True. It is important for a firm to maintain customer relationships with commercial entities when it…

Q: You deposit $300 each month into an account earning 3% interest compounded monthly. a) How much will…

A: Monthly deposit (P) = $300 Interest rate = 3% Monthly interest rate (r) = 3%/12 = 0.25% Period = 15…

Q: The following information related to the Postretirement Benefits (health) for the Union Company on…

A: Here, To Find: Part a. Calculate the EPBO at end of 2021 =? Part b. Calculate accumulated…

Q: What is the rate-of-return on assets if the growth rate is 9.5%?

A: retained earnings = 90500*(1-15%) = 76925 net income = 76925*(1+9.5%)= 84232.875

Q: A service enterprise's working capital at the beginning of January was P70,000. The following…

A: Inventory: Inventory can be described as a good or material that a company holds for the purpose of…

Q: Using the formula for YTM (yield to maturity) in the lecture, what is the rate of return for a bond…

A: A Bond refers to an instrument that represents the loan being made by the investor to the company…

Q: Using the formula for YTM (yield to maturity) in the lecture, what is the rate of return for a bond…

A: Bonds: Bonds are the liabilities of the company which is issued to raise the funds required to…

Q: $ 143 is placed in an account that earns a nominal 8 percent interest, compounded quarterly.…

A: Initial Deposit (IV) = $143 Interest rate = 0.08 Quarterly interest rate (r) = 0.02 (i.e. 0.08 / 4)…

Q: You have invested P100,000 in a mutual fund that promises to pay 8% each year. You will keep this…

A: Mutual funds are the investment vehicles where a manager collects capital from multiple investors…

Q: The amount by which the balance sheet does not balance at first is called ______ Total Liability…

A: The balance sheet can be defined as one of the financial statements of the business organization…

Q: Although most financial statements forecasting models are structurally similar, they have to be…

A: Financial statements forecasting models are made in spreadsheets in which all relevant cells are…

Q: A firm buys on terms of 3/15, net 45. It does not take the discount, and it generally pays after 60…

A: Discount rate = 0.03 (i.e. 3%) Payment days = 60 Discount days = 15 Nominal annual percentage cost…

Q: 59. Modified True or False T means Correct and F means Wrong Scenario: If you have a series of…

A: Cash flow is the inflow and outflow of cash in the business. It is real or virtual movement of money…

Q: end paid dividend by average number of shares outstanding is equivalent to retained earnings. True…

A: Companies pay the dividend out of net income to the shareholders but some income is also retained…

Q: 12. A property has an NOI of $800,000. If you have a loan with annual debt service of $600,000, what…

A: DCR (Debt coverage ratio) It helps to determine the available net operating income to cover per unit…

Q: Housing prices in a particula county have incheased by 255% over the prce of houses five yrs ago (a)…

A: Solution: Average cost of house today will be the cost in today's terms after adjusting percentage…

Q: can the stock price decline (%) from your purchase price before triggering a margin call? When…

A: Brokers provide loans to clients to do trading on margin and this gives the clients extra earnings…

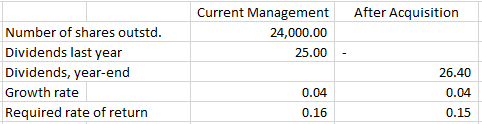

Acquirer Corporation would like to purchase the equity of Target Corporation. Target Corporation has the following financial information and

*How much is the value of control over Target Corporation from the point of view of Acquirer Corporation?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- You have been provided with the following information for the year ended 30 June 2022 for ABCLtd:RNet profit for the year -R1 800 000Weighted average number of shares (WANOS) outstanding during the year-R 120 000Average fair value per share -R30.00Weighted average number of shares (WANOS) under option during the year -R25 000Exercise price for shares under option during the year -R28.00REQUIRED:Q.2.1 Explain the purpose and objective of disclosing diluted earnings per share.Bulgasal Company provided the following data: 2020 2021 Share capital (P100 par value) 5,000,000 5,850,000 Share premium 1,000,000 1,600,000 Retained Earnings 3,400,000 4,500,000 During the current year, the entity declared and paid cash dividends or P1,000,000 and also declared and issued a share dividend. There were no other changes in shares issued and outstanding during the year. What is the net income for the current year? Present solutions in good accounting form. No parenthetical solutions. Thanks and God bless!NEED ASAP. Solve correctly and show your computations. The H2 Corp has the following classes of share capital outstanding as of Dec 31, 2021. Ordinary share capital, P20 par value, 20,000 shares outstanding Preference share capital, 5% P100 par value, cumulative and partially participating 4%, 2,000 shares outstanding No dividends were paid on Preference shares for two years. On Dec 31, 2021 a total Cash dividend of P180,000 was declared. How much dividends will be received by the preference shares holders?

- Sabo Company reported the following shareholders’ equity at year end:6% noncumulative preference share share capital, P100 par,Liquidation value of P105 per share 1,000,000Ordinary share capital, P100 par 3,000,000Retained earnings 950,000Preference dividends have been paid up to December 31, 2020. What is the book value per ordinary share?Calculate the transaction value (in $ thousands) of a theoretical company based on the information provided below. Current Share Price $18.00 Shares Outstanding (Thousands) 5,000 Total Debt ($ Thousands) $3,700 Cash ($ Thousands) $2,100 Acquisition Premium 10%31 - The stock movements of entity A are as follows. Calculate STMMAVAILABLE OF GOODS PER PERIOD: 50000 TLPERIOD PURCHASES: 90000 TLFINANCIAL AVAILABILITY AT THE END OF THE TERM: 20000TLA) 120.000 TLB) 70.000 TLC) 60.000 TLD) 100.000 TLE) 130.000 TL

- Consider the followingSuppose a stock had an initial price of $74 per share, paid a dividend of $1.65 per share during the year, and had an ending share price of $83. Compute the percentage total return. Input area: Initial price Dividend paid Ending share price (Use cells A6 to B8 from the given information to complete this question.) Output area: $74 $1.65 $83 Total returnAnswer with computation and explanation If the total authorized share capital is P1,000,000 at P10 par, the unissued share capital is 25,000 shares, and all the issued shares were sold at P15, then the total shareholders' equity before any operation activities is a 2 750,000. b P1,125,000 c. P375,000. d. P250,000.1. Mack Company reported the following outstanding share capital on December 31, 2020: - 30,000 preference shares, 5% cumulative, par value P10, fully participating as to dividends. No dividends were in arrears. - 200,000 ordinary shares, par value P1. On December 31, 2019, the entity declared dividends of P100,000. What was the amount of dividends payable to ordinary share holders? a. P34,000 b. P47,500 c. P40,000 d. P10,0002. Knicks Corporation was organized on January 1, 2018 with authorized capital of P 2,000,000, P 20 par value. Subsequently, incorporators subscribed for 25,000 shares at P 24. How much must be paid up upon subscription to comply with the requirement of the Securities and Exchange Commission?Required to answer. Single choice. a. P125,000 b. P500,000 c. P600,000 d. P150,0003. On June 1, 2015, Golden Warriors Corporation declared a share capital dividend entitling its shareholders to one additional share for each share held. At…

- BE4.8 In 2020, Jollis corporation reported net income of $1000000. it declared and paid perferred stock dividends of $250000. During 2020, Hollis had weighted average of 190000 common shares outstanding. Compute Hollis's 2020 earnings per share.An entity provided the following shareholders' equity at year-end:Ordinary share capital, P100 par, 72,000 shares 7,200,000Subscribed ordinary share capital, 12,000 shares 1,200,000Subscription receivable 400,000Treasury shares, 4,000 at cost 600,000Retained earnings 2,000,000What is the book value per ordinary share?Cabuslay Company showed the following shareholders’ equity on December 31, 2021: Ordinary share capital, P100 par 2,000,000 Preference share capital, 8% P50 par, cumulative and participating 2,500,000 Preference share capital, 10% P50 par, noncumulative and participating 1,500,000 Retained earnings 270,000 Dividends are in arrears for two years, and preference share has preference as to assets.Compute the Book value per ordinary share