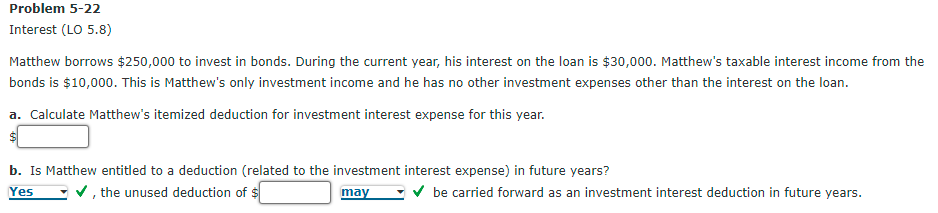

ds. During the current year, his interest on the loan is $30,0 vestment income and he has no other investment expenses for investment interest expense for this year.

Q: As of December 31, 2019, Armani Company's financial records show the following items and amounts. Ca...

A: Theory Concept: Income Statement: In Income statement only items of Revenues and expenses are to be ...

Q: Which of the following is not a provision of the Sarbanes-Oxley Act as to the responsibility of a co...

A: Solution: The Sarbanes–Oxley Act of 2002 is a United States law that mandates certain practices in f...

Q: objective of Managerial Accounting?

A: Managerial accounting is the system in which the method of accounting provides such statements or re...

Q: Jaguar Plastics Company has been operating for three years. At December 31 of last year, the account...

A: 1. Balance Sheet - This Statement shows the balance of assets liabilities and Equity as at the balan...

Q: Subject- Audit SUMMARIZE THE CORE ISSUES for the following topic:- • ISA 805, Special Considerations...

A: An auditor is a person with the authority to examine and verify financial documents for authenticity...

Q: Grace Corporation's pretax financial income is $600,000 and taxable income is $550,000 for year 2020...

A: The temporary differences arises when the tax is charged on the transaction at different point of ti...

Q: Required: a) Prepare an Income Statement for the period ended 31st October 2021 The closing invento...

A: An income statement is one of the financial statements which shows the financial position of the bus...

Q: Guests Monday Tuesday Wednesday Thursday Friday Saturday Sunday Week's Total P 1 Daily Average P 2 R...

A: In order to determine the daily average, the total sum of observations (Revenue / Served ) are requi...

Q: Understand the intentions of accounting students on career as professional accountant .

A: Accounting has a wide range of applications. Accounting students can work as professional accountant...

Q: Required to prepare : A) Trading and profit and loss appropriation account for the year ended 31 De...

A: Statement of income shows all the income(s) earned by the organization. There are certain ways for c...

Q: 1. The following are the attributes of a corporation, except * A. It is an artificial being. B. It i...

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any ...

Q: s for the year ended December 31, 20X1. Account Title Debits Cash $37,500

A: The income statement explains the financial performance of the company for a particular period of ti...

Q: Determine if sole proprietorship, partnership, or corporation. Select all that is applicable between...

A: A partnership is the type of business where two or more partners agree to operate a business and sha...

Q: Stephanie's Bridal Shoppe sells wedding dresses. The average selling price of each dress is $1,000, ...

A: Contribution = Sales - Variable costs Sales = Number of units * Selling price per unit Variable cost...

Q: Massy Company issued $4,000,000 of 10-year, 11% bonds on January 4, 2021. The bonds pay interest sem...

A: Introduction:- A journal entry is the act of recording or keeping track of any financial or non-fina...

Q: Guests Revenue Served P 480.00 Monday Tuesday Wednesday Thursday Friday Saturday Sunday Week's Total...

A: Formula Used: Daily Average = All the seven days revenue from Monday to Sunday / 7 days

Q: les On the other hand, Company B sells Buko Juice in Brgy. Cabacungan area for 5 years. Company B i...

A: The income statement shows the profit for the year and the cash flow statement shows the closing cas...

Q: Megan Company (not a corporation) was careless about its financial records during its first year of ...

A: The effect of each individual business transaction is analyzed on three elements as assets, liabilit...

Q: The Harriott manufacturing company uses job order costing system. The company uses machine hours to ...

A: The overhead variance is the difference between actual overhead and applied overhead cost.

Q: Which of the following types of interest is not deductible? a.Qualified mortgage interest on residen...

A: Deductible interest is the amount of interest on qualified mortgage or loans which are deductible in...

Q: ross method. Purchased $4,600 of merchandise from Lyon Company with credit terms of 2/15, n/60, invo...

A: The practice of recording financial activity for the first time in the books of accounts is known as...

Q: xplain the difference between a Shar

A: Efforts of various people in order to run a successful business and many people associated with the ...

Q: A company that sells smartphones prepays $20,000 to cover the next 12 months’ worth of utilities. Wh...

A: Every transaction is recorded in books of account and has got different relevance. Assets , liabilit...

Q: Eliza Vega started an accountinin on June, investing 523,000. Her net loss for the month was \$3,000...

A: Formula: Ending capital Balance = Beginning Capital balance - Net loss - Withdrawals

Q: Stephanie's Bridal Shoppe sells wedding dresses. The average selling price of each dress is $1,000, ...

A: Operating income can be calculated by deducting the total variable cost and fixed cost from the tota...

Q: Black Widow Corporation engaged you for the first time to audit their financial statements as of and...

A: Intangibles as of 31.12.2020 Life Balance as of 31.12.2020 Patent A 10 years 1,317,500 Patent B...

Q: basic earnings per share on the face of the income statement under each of the following assumptions...

A: Basic earnings per share States how much the company earns . This earning per share is important mea...

Q: Prepare an income statement for China Tea Company for the year ended December 31, 2018 Debit 10,900 ...

A: Income statement means the statement which show the cost of goods sold and selling price and give ou...

Q: tion of costs to the activity cost pools. Removing asbestos Estimating and Job Setup Working on Nonr...

A: Under the first stage allocation , the cost are distributed among the different activities as per th...

Q: *check the attached photo for the problem REQUIRED: What is the total cost per unit?

A: Gigi decided to make chicken and rice to sell, it is necessary to decide the cost per unit.

Q: Which of the following statements are true about systematic risk? Select one or more: a. Beta is a m...

A: Beta: Beta is an idea that describes the normal move in a stock in comparison with developments in t...

Q: ACCOUNTS FURNITURES ACCOUNTS UTILIITES OWNER'S TRANSACTION CASH RECEIVABLES & FIXTURES PAYABLE PAYAB...

A: Transaction Cash Account receivable Furniture & Fixtures Accounts payable Utilities pa...

Q: Following are the merchandising transactions of Dollar Store. Nov. 1 Dollar Store purchases merchand...

A: The journal entries are prepared to record day to day transactions of the business. Under perpetual ...

Q: Which of the following taxes is not deductible as an itemized deduction? a.Sales tax in a state with...

A: Non Deductible Taxes under itemized deduction: 1. federal income tax 2. Federal, state or local esta...

Q: Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2020. As of that date, Ja...

A: Particulars. Amount Life Annual Amortization Purchase Price of Jackson Co. $588,000 Book value. (...

Q: Choose ONE of the MAS studied in this unit from the list below, and answer the questions that follow...

A: given • Budgeting System

Q: Determine the balance in PASTEL Company's finished goods inventory account at the end of August — us...

A: Cost of goods available for sale - Ending finished goods inventory = Cost of goods sold Ending finis...

Q: gross method. Purchased $4,600 of merchandise from Lyon Company with credit terms of 2/15, n/60, inv...

A: Journal Entries - Journal Entries are the recording of transactions of the organization. It is recor...

Q: A manufacturer has been shipping his product (moderately heavy machines), mounted only on skids with...

A: Every manufacturing or trading organization has to maintain some stock for ease of operations and to...

Q: Determine what is longer between the normal operating cycle and 1 year to determine the short term. ...

A: Operating cycle:- refers to average period of time a business require to complete one cycle of ini...

Q: Copperfield Manufacturing employs a weighted average process costing system for its products. One pr...

A:

Q: ou are a newly hired fraud examiner. You have been asked to write a preliminary report on the scenar...

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three sub...

Q: Pharoah’s flour supplier has announced a shortage of gluten-free flour. As a result, Pharoah will on...

A: Contribution means the difference between the selling price and variable cost. When some input is in...

Q: 2 On June 1, 20X1, the firm bought supplies for $7,750. The $7750 was debited to the Supplies accoun...

A: Adjusting entries are prepared by management to ensure the accrual basis accounting system. It is pr...

Q: Fields Finance Ltd. (FFL), a leasing company that reports under ASPE, is in the process of preparing...

A: (A) To be classified as capital lease any one of below conditions should be met : transfer of owner...

Q: Problem 7-5B Determine depreciation under three methods (LO7-4) [The following information applies t...

A: 2. Depreciation using double-declining method = (Original cost – Salvage value) /4 years x 2

Q: Use the following information for the Exercises below. Textra produces parts for a machine manufact...

A: The overhead rate is calculated as estimated overhead cost divided by estimated base activity.

Q: O60 260 300 Land 300 120 130 Buildings (net) 1,200 220 280 Equipment 360 100 75 Accounts payable 480...

A: Consolidation means combination of assets and liabilities and other financial items of two or more c...

Q: In cash basis accounting, for tax purposes: a.Income is generally recognized when it is actually or ...

A: There are two types or forms of accounting, that are used. These are cash basis accounting and accru...

Q: The Harriott manufacturing company uses job order costing system. The company uses machine hours to ...

A: The journal entries keep the record for day to day transactions of the business. The overhead is app...

Assessees are eligible for a deduction for definite interest incurred or paid throughout the fiscal year (tax). The amount and kind of deduction are determined by the purpose for which the money is lent. For adjusted gross income, interest on loans for rent, royalties, and commercial operations is deducted.

Step by step

Solved in 3 steps

- LO.4 Elizabeth made the following interest-free loans during the year. Assume that tax avoidance is not a principal purpose of any of the loans. Assume that the relevant Federal rate is 5% and that the loans were outstanding for the last six months of the year. What are the effects of the imputed interest rules on these transactions? Compute Elizabeths gross income from each loan: a. Richard b. Woody c. IreneProblem 5-56 (LO. 4) Vic, who was experiencing financial difficulties, was able to adjust his debts as follows: a. Vic is an attorney. Vic owed his uncle $25,000. The uncle told Vic that if he serves as the executor of the uncle's estate, Vic's debt will be canceled in the uncle's will. The $25,000 debt cancellation is Vic's gross income when the uncle dies. b. Vic borrowed $80,000 from First Bank. The debt was secured by land that Vic purchased for $100,000. Vic was unable to pay, and the bank foreclosed when the liability was $80,000, which was also the fair market value of the property. Vic has a $fill in the blank 564552fca057f99_1 as a result of the foreclosure. c. The Land Company, which had sold land to Vic for $80,000, reduced the mortgage on the land by $12,000. The $12,000 reduction in the debt is Vic's gross income and Vic must his basis in the property.Problem 5-25Interest (LO 5.8) Helen paid the following amounts of interest during the 2019 tax year: Mortgage interest on Dallas residence (loan balance $50,000) $1,600 Automobile loan interest (personal use only) 440 Mortgage interest on Vail residence (loan balance $50,000) 3,100 Visa and Mastercard interest 165 Calculate the amount of Helen's itemized deduction for interest (after limitations) for 2019

- Problem 7-46 (LO. 1, 2, 3, 4, 7) Jed is married with no children. Both he and his wife are age 55. During 2020, Jed had the following income and expense items: a. Three years ago, Jed loaned a friend $10,000 to help him purchase a new car. In June of the current year, Jed learned that his friend had been declared bankrupt and had left the country. There is no possibility that Jed will ever collect any of the $10,000. b. In April of last year, Jed purchased some stock for $5,000. In March of the current year, the company was declared bankrupt, and Jed was notified that his shares of stock were worthless. c. Several years ago, Jed purchased some § 1244 stock for $120,000. This year, he sold the stock for $30,000. d. In July of this year, Jed sold some land that he had held for two years for $60,000. He had originally paid $42,000 for the land. e. Jed received $40,000 of interest income from State of Minnesota bonds. f. In September, Jed's home was damaged by an earthquake; Jed's county…MN.38. Levi brings in four Forms 1098 with mortgage interest for the following properties: First mortgage on his home: $157,350 balance with interest paid of $6,294. Equity debt on his home: highest balance for year of $47,000 (all used for home improvements) with interest paid of $1,880. Mortgage on his vacation home: $99,000 balance with interest of paid of $4,455. Mortgage on his rental property: $142,300 balance with interest paid of $6,403. How much is he able to deduct on Schedule A (Form 1040), Itemized Deductions, for interest reported on these forms? $8,174 $10,749 $12,629 $19,032 please don't choose 8,174 wrongProblem 8-73 (LO 8-4) (Algo) In 2021, Laureen is currently single. She paid $2,740 of qualified tuition and related expenses for each of her twin daughters Sheri and Meri to attend State University as freshmen ($2,740 each for a total of $5,480). Sheri and Meri qualify as Laureen’s dependents. Laureen also paid $1,920 for her son Ryan’s (also Laureen’s dependent) tuition and related expenses to attend his junior year at State University. Finally, Laureen paid $1,420 for herself to attend seminars at a community college to help her improve her job skills.What is the maximum amount of education credits Laureen can claim for these expenditures in each of the following alternative scenarios? (Leave no answer blank. Enter zero if applicable.) a. Laureen's AGI is $45,000. Answer is complete but not entirely correct. Description Credits American opportunity tax credit $ Lifetime learning credit $284

- incorrect, 1.3.51 A mother wants to invest $6 comma 000.00 for her son's future education. She invests a portion of the money in a bank certificate of deposit (CD account) which earns 4% and the remainder in a savings bond that earns 7%. If the total interest earned after one year is $ 360.00 comma how much money was invested in the CD account? The total interest earned after one year is $360.00 . How much money was invested in the CD account? $Problem 10-38 (LO. 2, 3, 4, 5, 6, 7) Evan is single and has AGI of $277,300 in 2020. His potential itemized deductions before any limitations for the year total $52,300 and consist of the following: Medical expenses (before the AGI limitation) $29,000 Interest on home mortgage 8,700 State income taxes 9,500 Real estate taxes 3,600 Charitable contributions 2,500 After all necessary adjustments are made, what is the amount of itemized deductions Evan may claim? Do not round intermediate calculations. Round medical deduction and final answer to the nearest dollar. Evan's total itemized deduction is $fill in the blank 1.Problem 7-19Education Tax Credits (LO 7.5) Janie graduates from high school in 2021 and enrolls in college in the fall. Her parents (who file a joint return) pay $4,000 for her tuition and fees. Question Content Area a. Assuming Janie's parents have AGI of $172,000, what is the American Opportunity tax credit they can claim for Janie?$fill in the blank a7afe900d02b00c_1 Question Content Area b. Assuming Janie's parents have AGI of $75,000, what is the American Opportunity tax credit they can claim for Janie?$fill in the blank 827b93f69fa7ff5_1

- 2. A couple borrowed P 4,000 from a lending company for 6 years at 12%. At the end of 6 years, it renews the loan for the amount due plus P 4,000 more for 3 years at 12%. What is the lump sum due? ANSWER: 16,382.60OLA#9.2: Hannah purchased a house for $475,000. She made a downpayment of 25% of the value of the house and received a mortgage for the rest of the amount at 5.50% compounded semi-annually for 25 years. The interest rate was fixed for a 5-year term. a. Calculate the size of the monthly payments. b. Calculate the principal balance at the end of the 5-year term. c. Calculate the size of the monthly payments if after the first 5-year term the mortgage was renewed for another 5-year term at 5.25% compounded semi-annually?Problem 6-50 (LO. 1, 3) Chee, single, age 40, had the following income and expenses during 2021: Income Salary $43,000 Rental of vacation home (rented 60 days, used personally 60 days, vacant 245 days) 4,000 Municipal bond interest 2,000 Dividend from General Electric 400 Expenses Interest on home mortgage 8,400 Interest on vacation home 4,758 Interest on loan used to buy municipal bonds 3,100 Property tax on home 2,200 Property tax on vacation home 1,098 State income tax 3,300 State sales tax 900 Charitable contributions 1,100 Tax return preparation fee 300 Utilities and maintenance on vacation home 2,600 Depreciation on rental portion of vacation home 3,500 Calculate Chee's net income from the vacation home, itemized deductions and taxable income for the year. If Chee has any options, choose the method that maximizes his deductions. In your computations, round any fractions to four decimal places. Then, round any amounts to the…