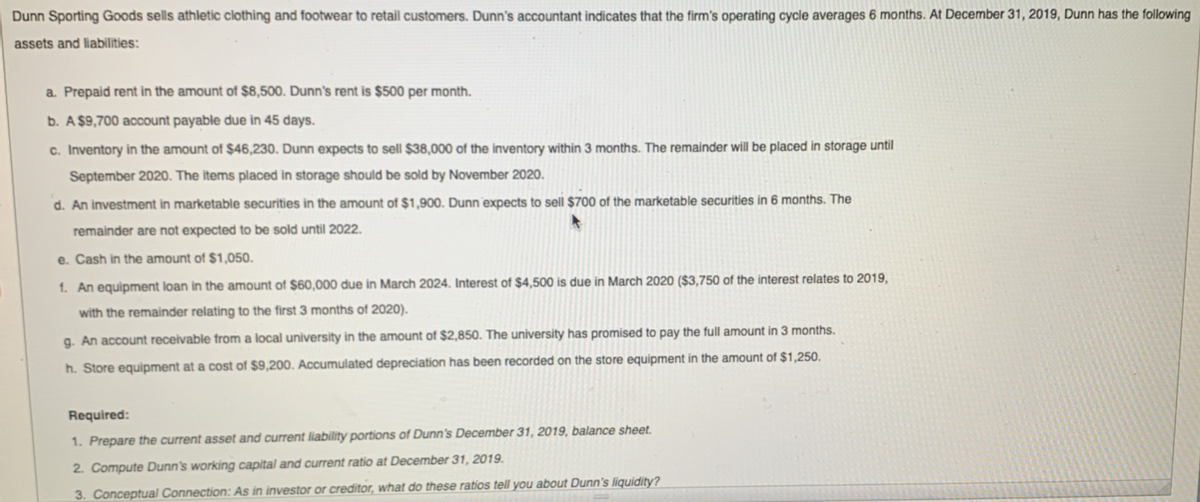

Dunn Sporting Goods sells athletic clothing and footwear to retail customers. Dunn's accountant indicates that the firm's operating cycle averages 6 months. At December 31, 2019, Dunn has the following assets and liabilities: a. Prepaid rent in the amount of $8,500. Dunn's rent is $500 per month. b. A $9,700 account payable due in 45 days. c. Inventory in the amount of $46,230. Dunn expects to sell $38,000 of the inventory within 3 months. The remainder will be placed in storage until September 2020. The items placed in storage should be sold by November 2020. d. An investment in marketable securities in the amount of $1,900. Dunn expects to sell $700 of the marketable securities in 6 months. The remainder are not expected to be sold until 2022. e. Cash in the amount of $1,050. 1. An equipment loan in the amount of $60,000 due in March 2024. Interest of $4,500 is due in March 2020 ($3,750 of the interest relates to 2019, with the remainder relating to the first 3 months of 2020). g. An account receivable from a local university in the amount of $2,850. The university has promised to pay the full amount in 3 months. h. Store equipment at a cost of $9,200. Accumulated depreciation has been recorded on the store equipment in the amount of $1,250. Required: 1. Prepare the current asset and current liability portions of Dunn's December 31, 2019, balance sheet. 2. Compute Dunn's working capital and current ratio at December 31, 2019. 3. Conceptual Connection: As in investor or creditor, what do these ratios tell you about Dunn's liquidity?

Dunn Sporting Goods sells athletic clothing and footwear to retail customers. Dunn's accountant indicates that the firm's operating cycle averages 6 months. At December 31, 2019, Dunn has the following assets and liabilities: a. Prepaid rent in the amount of $8,500. Dunn's rent is $500 per month. b. A $9,700 account payable due in 45 days. c. Inventory in the amount of $46,230. Dunn expects to sell $38,000 of the inventory within 3 months. The remainder will be placed in storage until September 2020. The items placed in storage should be sold by November 2020. d. An investment in marketable securities in the amount of $1,900. Dunn expects to sell $700 of the marketable securities in 6 months. The remainder are not expected to be sold until 2022. e. Cash in the amount of $1,050. 1. An equipment loan in the amount of $60,000 due in March 2024. Interest of $4,500 is due in March 2020 ($3,750 of the interest relates to 2019, with the remainder relating to the first 3 months of 2020). g. An account receivable from a local university in the amount of $2,850. The university has promised to pay the full amount in 3 months. h. Store equipment at a cost of $9,200. Accumulated depreciation has been recorded on the store equipment in the amount of $1,250. Required: 1. Prepare the current asset and current liability portions of Dunn's December 31, 2019, balance sheet. 2. Compute Dunn's working capital and current ratio at December 31, 2019. 3. Conceptual Connection: As in investor or creditor, what do these ratios tell you about Dunn's liquidity?

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 12PB: Prepare journal entries to record the following transactions that occurred in March: A. on first day...

Related questions

Question

Transcribed Image Text:Dunn Sporting Goods sells athletic clothing and footwear to retail customers. Dunn's accountant indicates that the firm's operating cycle averages 6 months. At December 31, 2019, Dunn has the following

assets and liabilities:

a. Prepaid rent in the amount of $8,500. Dunn's rent is $500 per month.

b. A $9,700 account payable due in 45 days.

c. Inventory in the amount of $46,230. Dunn expects to sell $38,000 of the inventory within 3 months. The remainder will be placed in storage until

September 2020. The items placed in storage should be sold by November 2020.

d. An investment in marketable securities in the amount of $1,900. Dunn expects to sell $700 of the marketable securities in 6 months. The

remainder are not expected to be sold until 2022.

e. Cash in the amount of $1,050.

1. An equipment loan in the amount of $60,000 due in March 2024. Interest of $4,500 is due in March 2020 ($3,750 of the interest relates to 2019,

with the remainder relating to the first 3 months of 2020).

g. An account receivable from a local university in the amount of $2,850. The university has promised to pay the full amount in 3 months.

h. Store equipment at a cost of $9,200. Accumulated depreciation has been recorded on the store equipment in the amount of $1,250.

Required:

1. Prepare the current asset and current liability portions of Dunn's December 31, 2019, balance sheet.

2. Compute Dunn's working capital and current ratio at December 31, 2019.

3. Conceptual Connection: As in investor or creditor, what do these ratios tell you about Dunn's liquidity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT