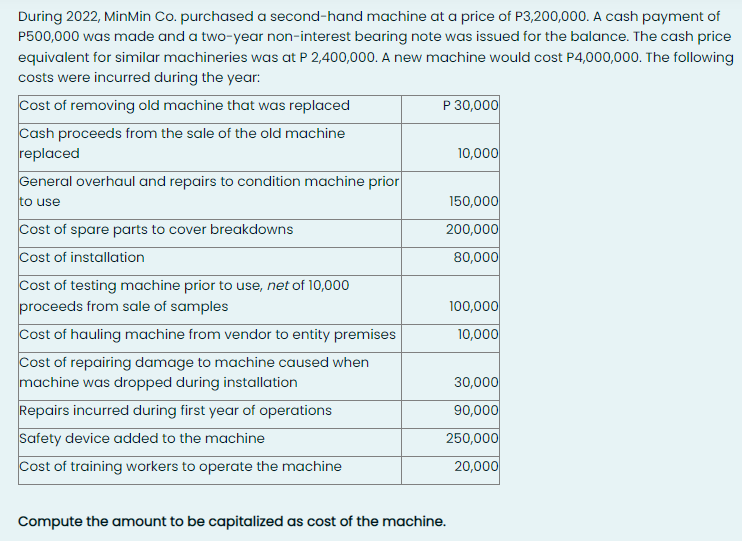

During 2022, MinMin Co. purchased a second-hand machine at a price of P3,200,000. A cash payment of P500,000 was made and a two-year non-interest bearing note was issued for the balance. The cash price equivalent for similar machineries was at P 2,400,000. A new machine would cost P4,000,000. The following costs were incurred during the year: Cost of removing old machine that was replaced Cash proceeds from the sale of the old machine replaced General overhaul and repairs to condition machine prior to use Cost of spare parts to cover breakdowns Cost of installation Cost of testing machine prior to use, net of 10,000 proceeds from sale of samples Cost of hauling machine from vendor to entity premises Cost of repairing damage to machine caused when machine was dropped during installation Repairs incurred during first year of operations Safety device added to the machine Cost of training workers to operate the machine P 30,000 10,000 150,000 200,000 80,000 100,000 10,000 30,000 90,000 250,000 20,000 Compute the amount to be capitalized as cost of the machine.

During 2022, MinMin Co. purchased a second-hand machine at a price of P3,200,000. A cash payment of P500,000 was made and a two-year non-interest bearing note was issued for the balance. The cash price equivalent for similar machineries was at P 2,400,000. A new machine would cost P4,000,000. The following costs were incurred during the year: Cost of removing old machine that was replaced Cash proceeds from the sale of the old machine replaced General overhaul and repairs to condition machine prior to use Cost of spare parts to cover breakdowns Cost of installation Cost of testing machine prior to use, net of 10,000 proceeds from sale of samples Cost of hauling machine from vendor to entity premises Cost of repairing damage to machine caused when machine was dropped during installation Repairs incurred during first year of operations Safety device added to the machine Cost of training workers to operate the machine P 30,000 10,000 150,000 200,000 80,000 100,000 10,000 30,000 90,000 250,000 20,000 Compute the amount to be capitalized as cost of the machine.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 19P

Related questions

Question

100%

Transcribed Image Text:During 2022, MinMin Co. purchased a second-hand machine at a price of P3,200,000. A cash payment of

P500,000 was made and a two-year non-interest bearing note was issued for the balance. The cash price

equivalent for similar machineries was at P 2,400,000. A new machine would cost P4,000,000. The following

costs were incurred during the year:

Cost of removing old machine that was replaced

Cash proceeds from the sale of the old machine

replaced

General overhaul and repairs to condition machine prior

to use

Cost of spare parts to cover breakdowns

Cost of installation

Cost of testing machine prior to use, net of 10,000

proceeds from sale of samples

Cost of hauling machine from vendor to entity premises

Cost of repairing damage to machine caused when

machine was dropped during installation

Repairs incurred during first year of operations

Safety device added to the machine

Cost of training workers to operate the machine

P 30,000

10,000

150,000

200,000

80,000

Compute the amount to be capitalized as cost of the machine.

100,000

10,000

30,000

90,000

250,000

20,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning