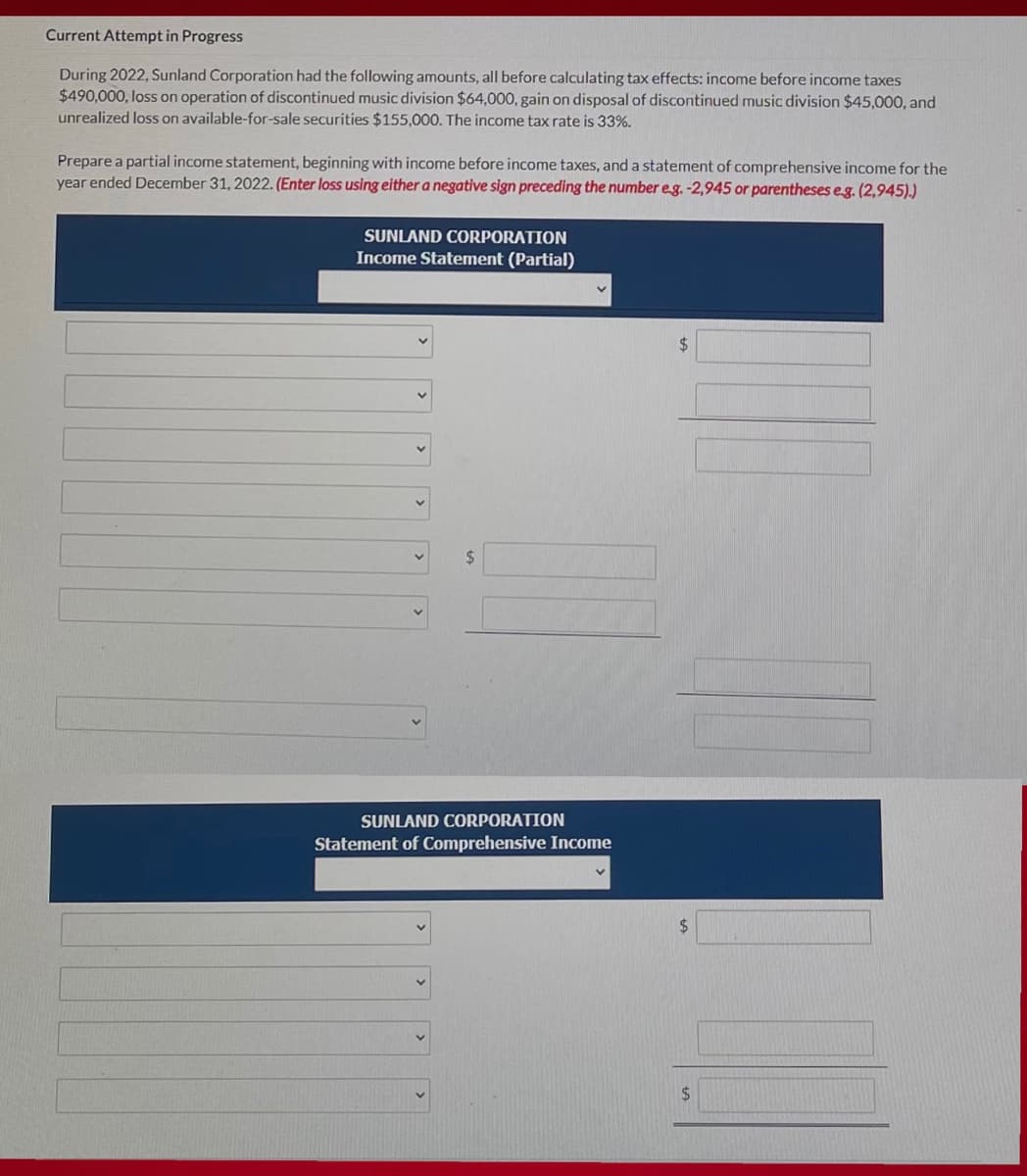

During 2022, Sunland Corporation had the following amounts, all before calculating tax effects: income before income taxes $490,000, loss on operation of discontinued music division $64,000, gain on disposal of discontinued music division $45,000, and unrealized loss on available-for-sale securities $155,000. The income tax rate is 33%. Prepare a partial income statement, beginning with income before income taxes, and a statement of comprehensive income for the year ended December 31, 2022. (Enter loss using either a negative sign preceding the number eg.-2,945 or parentheses eg. (2,945).) SUNLAND CORPORATION Income Statement (Partial) %24 %24 SUNLAND CORPORATION Statement of Comprehensive Income

During 2022, Sunland Corporation had the following amounts, all before calculating tax effects: income before income taxes $490,000, loss on operation of discontinued music division $64,000, gain on disposal of discontinued music division $45,000, and unrealized loss on available-for-sale securities $155,000. The income tax rate is 33%. Prepare a partial income statement, beginning with income before income taxes, and a statement of comprehensive income for the year ended December 31, 2022. (Enter loss using either a negative sign preceding the number eg.-2,945 or parentheses eg. (2,945).) SUNLAND CORPORATION Income Statement (Partial) %24 %24 SUNLAND CORPORATION Statement of Comprehensive Income

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 12P: Comprehensive Colt Company reports pretax financial income of 143,000 in 2019. In addition to pretax...

Related questions

Topic Video

Question

Please answer accounting problem correctly. Fill out every single box

Transcribed Image Text:Current Attempt in Progress

During 2022, Sunland Corporation had the following amounts, all before calculating tax effects: income before income taxes

$490,000, loss on operation of discontinued music division $64,000, gain on disposal of discontinued music division $45,000, and

unrealized loss on available-for-sale securities $155,000. The income tax rate is 33%.

Prepare a partial income statement, beginning with income before income taxes, and a statement of comprehensive income for the

year ended December 31, 2022. (Enter loss using either a negative sign preceding the number eg. -2,945 or parentheses eg. (2,945).)

SUNLAND CORPORATION

Income Statement (Partial)

24

2$

SUNLAND CORPORATION

Statement of Comprehensive Income

24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning