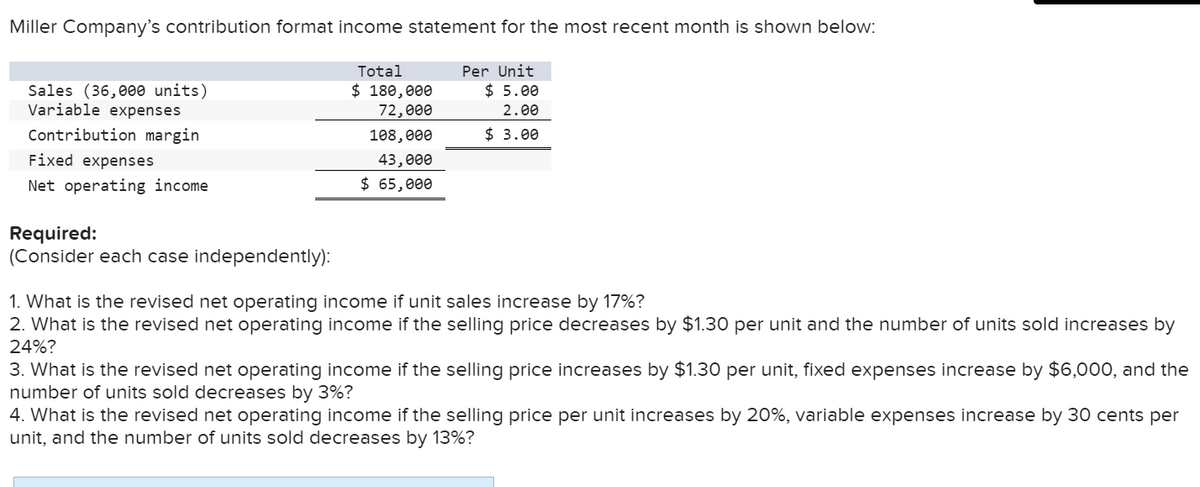

Miller Company’s contribution format income statement for the most recent month is shown below: Total Per Unit Sales (36,000 units) $ 180,000 $ 5.00 Variable expenses 72,000 2.00 Contribution margin 108,000 $ 3.00 Fixed expenses 43,000 Net operating income $ 65,000 Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 17%? 2. What is the revised net operating income if the selling price decreases by $1.30 per unit and the number of units sold increases by 24%? 3. What is the revised net operating income if the selling price increases by $1.30 per unit, fixed expenses increase by $6,000, and the number of units sold decreases by 3%? 4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 30 cents per unit, and the number of units sold decreases by 13%?

Miller Company’s contribution format income statement for the most recent month is shown below:

| Total | Per Unit | |

|---|---|---|

| Sales (36,000 units) | $ 180,000 | $ 5.00 |

| Variable expenses | 72,000 | 2.00 |

| Contribution margin | 108,000 | $ 3.00 |

| Fixed expenses | 43,000 | |

| Net operating income | $ 65,000 |

Required:

(Consider each case independently):

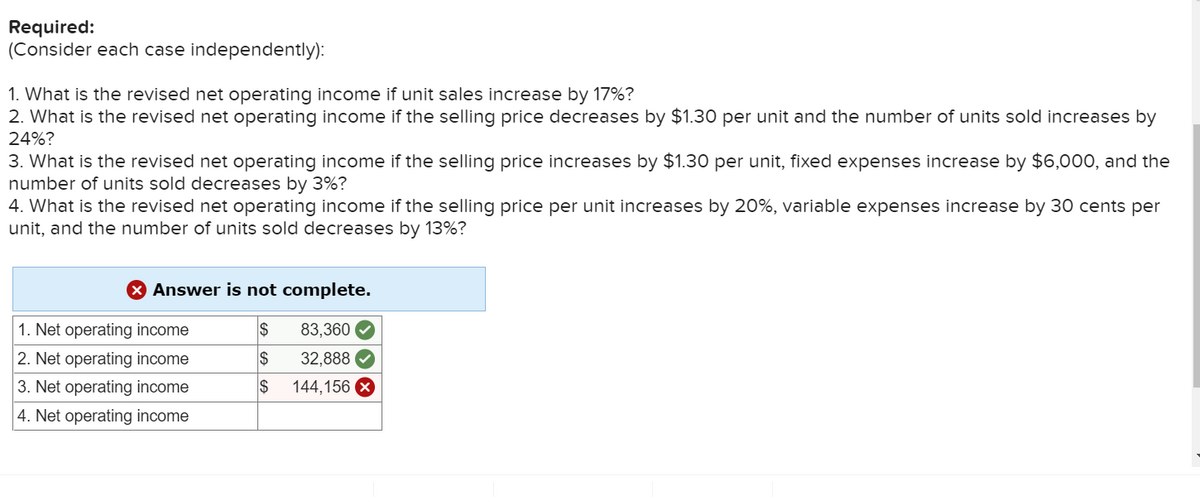

1. What is the revised net operating income if unit sales increase by 17%?

2. What is the revised net operating income if the selling price decreases by $1.30 per unit and the number of units sold increases by 24%?

3. What is the revised net operating income if the selling price increases by $1.30 per unit, fixed expenses increase by $6,000, and the number of units sold decreases by 3%?

4. What is the revised net operating income if the selling price per unit increases by 20%, variable expenses increase by 30 cents per unit, and the number of units sold decreases by 13%?

(ONLY QUESTION 3 & 4 NEEDS AN ANSWER.)

Trending now

This is a popular solution!

Step by step

Solved in 3 steps