During 2024, its first year of operations, Baginski Steel Corporation reported a net operating loss of $360,000 for financial reporting and tax purposes. During 2025, Baginski reported income of $200,000 for financial reporting and tax purposes. The enacted tax rate is 25% Required: 1. Prepare the journal entry to recognize Baginski's 2025 tax expense or tax benefit. 2. Show the lower portion of the 2025 Income statement that reports income tax expense or benefit. Complete this question by entering your answers in the tabs below. Required 1 Required 2

During 2024, its first year of operations, Baginski Steel Corporation reported a net operating loss of $360,000 for financial reporting and tax purposes. During 2025, Baginski reported income of $200,000 for financial reporting and tax purposes. The enacted tax rate is 25% Required: 1. Prepare the journal entry to recognize Baginski's 2025 tax expense or tax benefit. 2. Show the lower portion of the 2025 Income statement that reports income tax expense or benefit. Complete this question by entering your answers in the tabs below. Required 1 Required 2

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 13P

Related questions

Question

Ef 535.

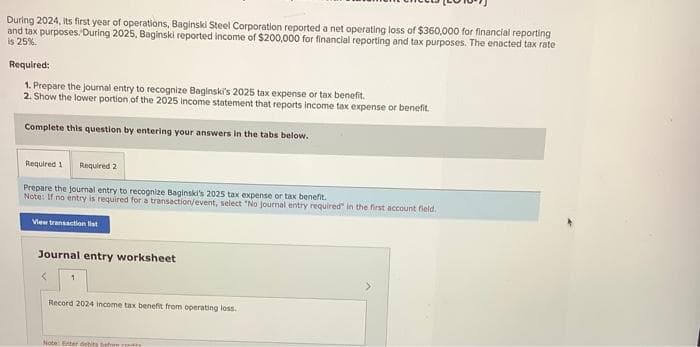

Transcribed Image Text:During 2024, its first year of operations, Baginski Steel Corporation reported a net operating loss of $360,000 for financial reporting

and tax purposes. During 2025, Baginski reported income of $200,000 for financial reporting and tax purposes. The enacted tax rate

is 25%.

Required:

1. Prepare the journal entry to recognize Baginski's 2025 tax expense or tax benefit.

2. Show the lower portion of the 2025 income statement that reports income tax expense or benefit.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Prepare the journal entry to recognize Baginski's 2025 tax expense or tax benefit.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list

Journal entry worksheet

<

1

Record 2024 income tax benefit from operating loss.

Note: Enter debits before re

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning