Data Example E Cost of equipment needed Working capital needed Overhaul of equipment in four years Salvage value of the equipment in five years Annual revenues and costs: $120,000 $80,000 $40,000 $20,000

Data Example E Cost of equipment needed Working capital needed Overhaul of equipment in four years Salvage value of the equipment in five years Annual revenues and costs: $120,000 $80,000 $40,000 $20,000

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter9: Long-term Assets: Fixed And Intangible

Section: Chapter Questions

Problem 9.4BE: Revision of depreciation Equipment with a cost of 180,000 has an estimated residual value of 14,400,...

Related questions

Question

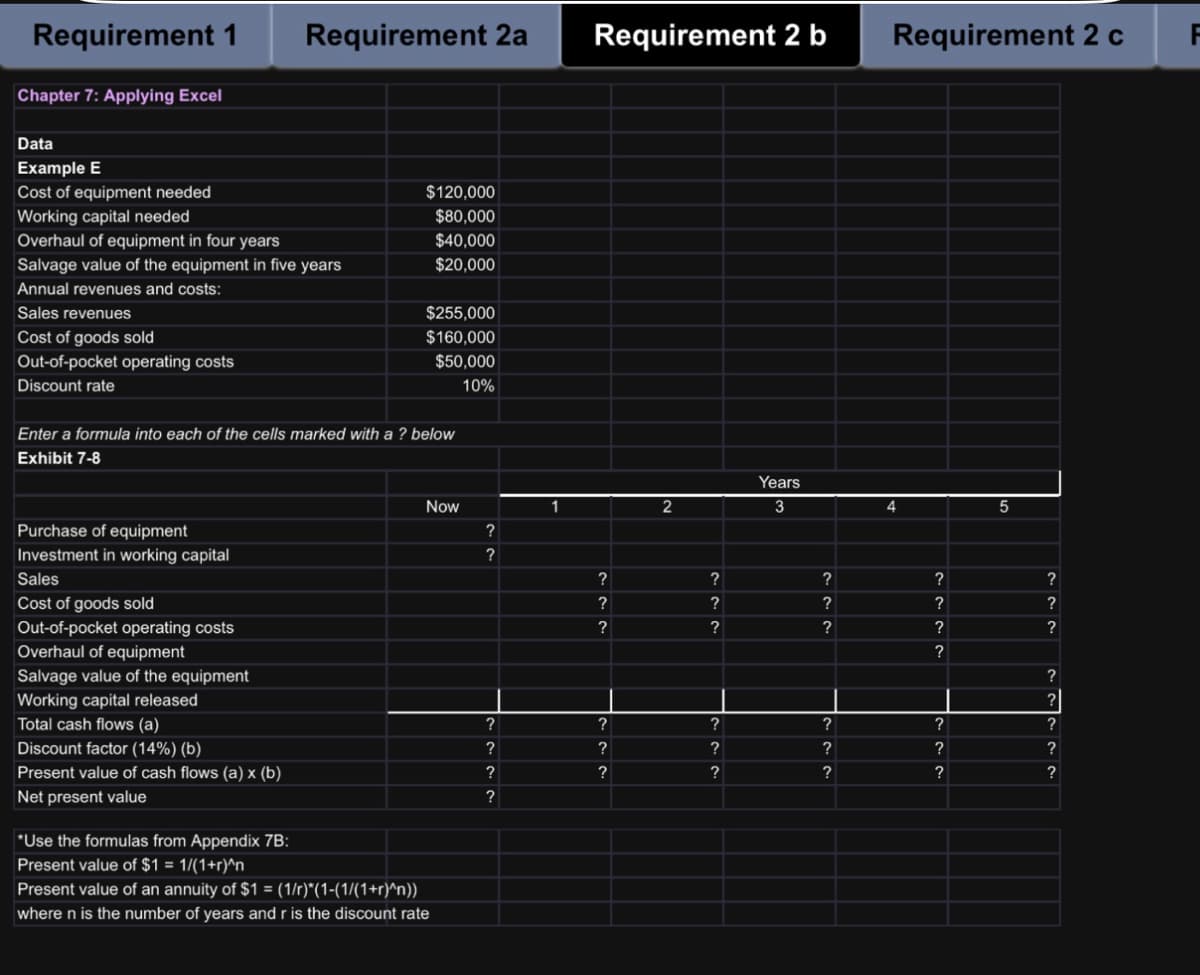

Filling in where “?” Are present

Transcribed Image Text:Requirement 1

Chapter 7: Applying Excel

Data

Example E

Cost of equipment needed

Working capital needed

Overhaul of equipment in four years

Salvage value of the equipment in five years

Annual revenues and costs:

Sales revenues

Cost of goods sold

Out-of-pocket operating costs

Discount rate

Requirement 2a

Purchase of equipment

Investment in working capital

Sales

Cost of goods sold

Out-of-pocket operating costs

Overhaul of equipment

Salvage value of the equipment

Working capital released

Total cash flows (a)

Discount factor (14%) (b)

Present value of cash flows (a) x (b)

Net present value

$120,000

$80,000

$40,000

$20,000

Enter a formula into each of the cells marked with a ? below

Exhibit 7-8

$255,000

$160,000

$50,000

10%

Now

*Use the formulas from Appendix 7B:

Present value of $1 = 1/(1+r)^n

Present value of an annuity of $1 = (1/r)*(1-(1/(1+r)^n))

where n is the number of years and r is the discount rate

?

?

?

?

?

?

1

Requirement 2 b

?

?

?

?

?

?

2

?

?

?

?

?

?

Years

3

?

?

?

?

?

?

Requirement 2 c

4

?

?

?

?

?

?

?

5

?

?

?

?

?

?

?

?

F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning