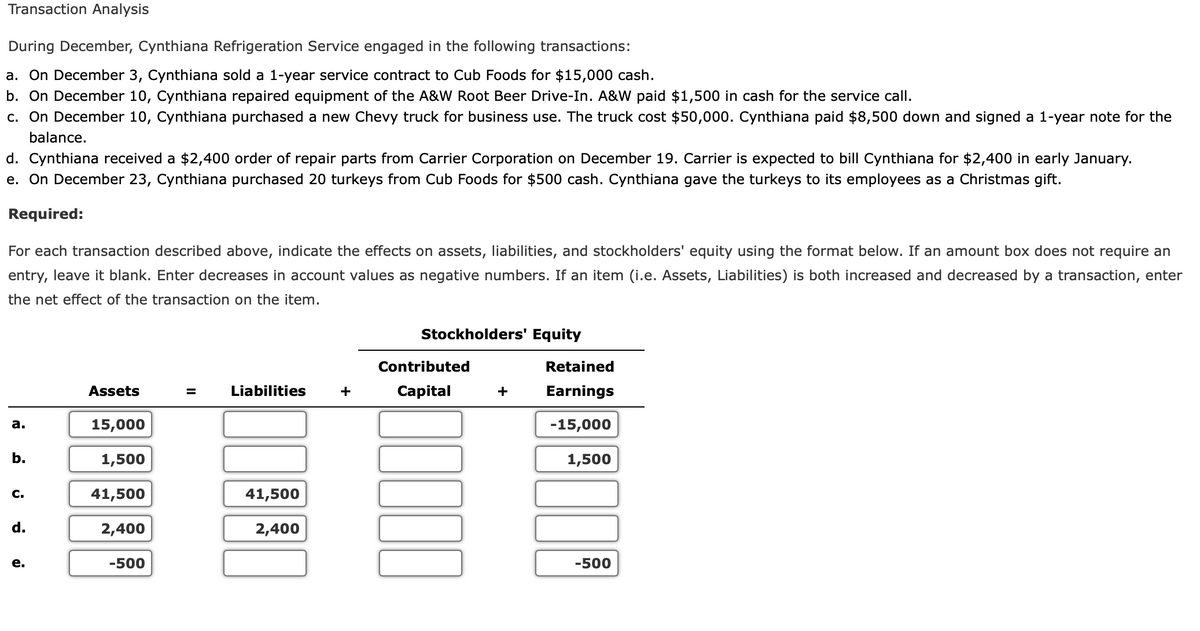

During December, Cynthiana Refrigeration Service engaged in the following transactions: a. On December 3, Cynthiana sold a 1-year service contract to Cub Foods for $15,000 cash. b. On December 10, Cynthiana repaired equipment of the A&W Root Beer Drive-In. A&W paid $1,500 in cash for the service call. c. On December 10, Cynthiana purchased a new Chevy truck for business use. The truck cost $50,000. Cynthiana paid $8,500 down and signed a 1-year note for the balance. d. Cynthiana received a $2,400 order of repair parts from Carrier Corporation on December 19. Carrier is expected to bill Cynthiana for $2,400 in early January. e. On December 23, Cynthiana purchased 20 turkeys from Cub Foods for $500 cash. Cynthiana gave the turkeys to its employees as a Christmas gift. Required: For each transaction described above, indicate the effects on assets, liabilities, and stockholders' equity using the format below. If an amount box does not require an entry, leave it blank. Enter decreases in account values as negative numbers. If an item (i.e. Assets, Liabilities) is both increased and decreased by a transaction, enter the net effect of the transaction on the item. Stockholders' Equity Contributed Retained Assets Liabilities Capital + Earnings а. 15,000 -15,000 b. 1,500 1,500 C. 41,500 41,500 d. 2,400 2,400 е. -500 -500

During December, Cynthiana Refrigeration Service engaged in the following transactions: a. On December 3, Cynthiana sold a 1-year service contract to Cub Foods for $15,000 cash. b. On December 10, Cynthiana repaired equipment of the A&W Root Beer Drive-In. A&W paid $1,500 in cash for the service call. c. On December 10, Cynthiana purchased a new Chevy truck for business use. The truck cost $50,000. Cynthiana paid $8,500 down and signed a 1-year note for the balance. d. Cynthiana received a $2,400 order of repair parts from Carrier Corporation on December 19. Carrier is expected to bill Cynthiana for $2,400 in early January. e. On December 23, Cynthiana purchased 20 turkeys from Cub Foods for $500 cash. Cynthiana gave the turkeys to its employees as a Christmas gift. Required: For each transaction described above, indicate the effects on assets, liabilities, and stockholders' equity using the format below. If an amount box does not require an entry, leave it blank. Enter decreases in account values as negative numbers. If an item (i.e. Assets, Liabilities) is both increased and decreased by a transaction, enter the net effect of the transaction on the item. Stockholders' Equity Contributed Retained Assets Liabilities Capital + Earnings а. 15,000 -15,000 b. 1,500 1,500 C. 41,500 41,500 d. 2,400 2,400 е. -500 -500

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter3: Processing Accounting Information

Section: Chapter Questions

Problem 3.7AMCP

Related questions

Question

i need help with the

Transcribed Image Text:Transaction Analysis

During December, Cynthiana Refrigeration Service engaged in the following transactions:

a. On December 3, Cynthiana sold a 1-year service contract to Cub Foods for $15,000 cash.

b. On December 10, Cynthiana repaired equipment of the A&W Root Beer Drive-In. A&W paid $1,500 in cash for the service call.

c. On December 10, Cynthiana purchased a new Chevy truck for business use. The truck cost $50,000. Cynthiana paid $8,500 down and signed a 1-year note for the

balance.

d. Cynthiana received a $2,400 order of repair parts from Carrier Corporation on December 19. Carrier is expected to bill Cynthiana for $2,400 in early January.

e. On December 23, Cynthiana purchased 20 turkeys from Cub Foods for $500 cash. Cynthiana gave the turkeys to its employees as a Christmas gift.

Required:

For each transaction described above, indicate the effects on assets, liabilities, and stockholders' equity using the format below. If an amount box does not require an

entry, leave it blank. Enter decreases in account values as negative numbers. If an item (i.e. Assets, Liabilities) is both increased and decreased by a transaction, enter

the net effect of the transaction on the item.

Stockholders' Equity

Contributed

Retained

Assets

Liabilities

+

Capital

+

Earnings

%3D

а.

15,000

-15,000

b.

1,500

1,500

C.

41,500

41,500

d.

2,400

2,400

е.

-500

-500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,