beginning April 24, 2020. Assume basic payroll deductions for Ontario. They work five days a week (Mon-Fri). oril 17 Record cash sales for the week in the amount of $8,000 + 13% HST. Cost of Goods Sold amounted to $3,450. oril 17 Purchased store furniture and equipment from CCE Inc. for $4,000. Paid $1,500 down and the balance was placed on account. Payments will be $210.00 per month for 12 months. The first payment is due May 1. Note: Use accounts payable for the balance due. Ignore HST and interest here. oril 17 Record sales on account for the week in the amount of $12,000 + HST. Cost of goods sold was $4,450. oril 24 Paid both Jali and Holly their bi-weekly pay. Calculate deductions for CPP, El and Ontario tax for 2020. Record employee portion only. oril 24 Record cash sales for the week in the amount of $14,000 + 13% HST. Cost of Goods Sold amounted to $7,960. oril 24 Declared and paid dividend paid to owner in the amount of $4,000. oril 24 Record sales on account for the week in the amount of $15,000 + HST. Cost of goods sold was $5,975.

beginning April 24, 2020. Assume basic payroll deductions for Ontario. They work five days a week (Mon-Fri). oril 17 Record cash sales for the week in the amount of $8,000 + 13% HST. Cost of Goods Sold amounted to $3,450. oril 17 Purchased store furniture and equipment from CCE Inc. for $4,000. Paid $1,500 down and the balance was placed on account. Payments will be $210.00 per month for 12 months. The first payment is due May 1. Note: Use accounts payable for the balance due. Ignore HST and interest here. oril 17 Record sales on account for the week in the amount of $12,000 + HST. Cost of goods sold was $4,450. oril 24 Paid both Jali and Holly their bi-weekly pay. Calculate deductions for CPP, El and Ontario tax for 2020. Record employee portion only. oril 24 Record cash sales for the week in the amount of $14,000 + 13% HST. Cost of Goods Sold amounted to $7,960. oril 24 Declared and paid dividend paid to owner in the amount of $4,000. oril 24 Record sales on account for the week in the amount of $15,000 + HST. Cost of goods sold was $5,975.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 16EA: Discuss how each of the following transactions for Watson, International, will affect assets,...

Related questions

Question

I need the answer as soon as possible

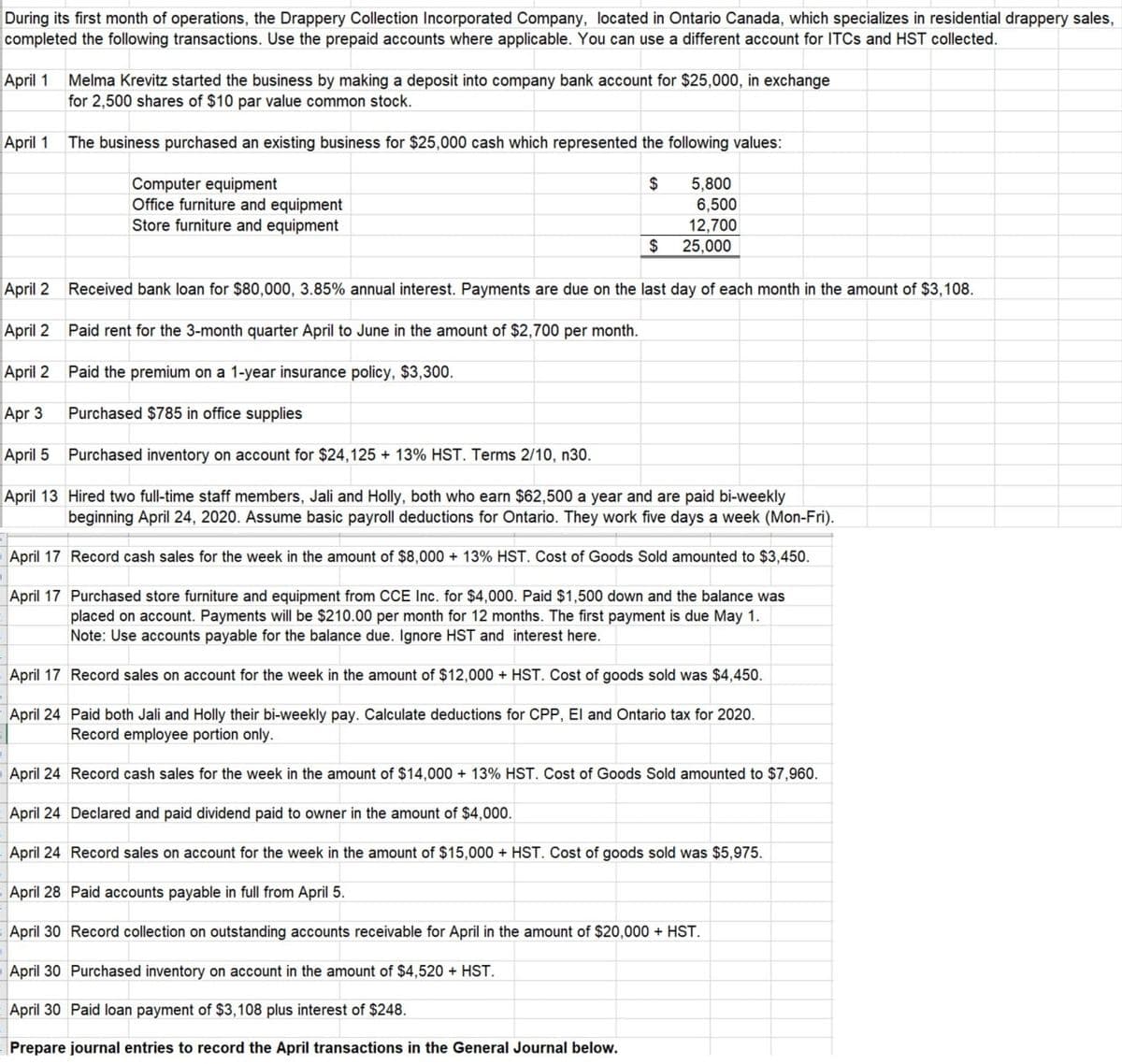

Transcribed Image Text:During its first month of operations, the Drappery Collection Incorporated Company, located in Ontario Canada, which specializes in residential drappery sales,

completed the following transactions. Use the prepaid accounts where applicable. You can use a different account for ITCS and HST collected.

April 1

Melma Krevitz started the business by making a deposit into company bank account for $25,000, in exchange

for 2,500 shares of $10 par value common stock.

April 1

The business purchased an existing business for $25,000 cash which represented the following values:

Computer equipment

Office furniture and equipment

Store furniture and equipment

2$

5,800

6,500

12,700

2$

25,000

April 2 Received bank loan for $80,000, 3.85% annual interest. Payments are due on the last day of each month in the amount of $3,108.

April 2

Paid rent for the 3-month quarter April to June in the amount of $2,700 per month.

April 2 Paid the premium on a 1-year insurance policy, $3,300.

Apr 3

Purchased $785 in office supplies

April 5 Purchased inventory on account for $24,125 + 13% HST. Terms 2/10, n30.

April 13 Hired two full-time staff members, Jali and Holly, both who earn $62,500 a year and are paid bi-weekly

beginning April 24, 2020. Assume basic payroll deductions for Ontario. They work five days a week (Mon-Fri).

April 17 Record cash sales for the week in the amount of $8,000 + 13% HST. Cost of Goods Sold amounted to $3,450.

April 17 Purchased store furniture and equipment from CCE Inc. for $4,000. Paid $1,500 down and the balance was

placed on account. Payments will be $210.00 per month for 12 months. The first payment is due May 1.

Note: Use accounts payable for the balance due. Ignore HST and interest here.

April 17 Record sales on account for the week in the amount of $12,000 + HST. Cost of goods sold was $4,450.

April 24 Paid both Jali and Holly their bi-weekly pay. Calculate deductions for CPP, El and Ontario tax for 2020.

Record employee portion only.

April 24 Record cash sales for the week in the amount of $14,000 + 13% HST. Cost of Goods Sold amounted to $7,960.

April 24 Declared and paid dividend paid to owner in the amount of $4,000.

April 24 Record sales on account for the week in the amount of $15,000 + HST. Cost of goods sold was $5,975.

April 28 Paid accounts payable in full from April 5.

April 30 Record collection on outstanding accounts receivable for April in the amount of $20,000 + HST.

April 30 Purchased inventory on account in the amount of $4,520 + HST.

April 30 Paid loan payment of $3,108 plus interest of $248.

Prepare journal entries to record the April transactions in the General Journal below.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning