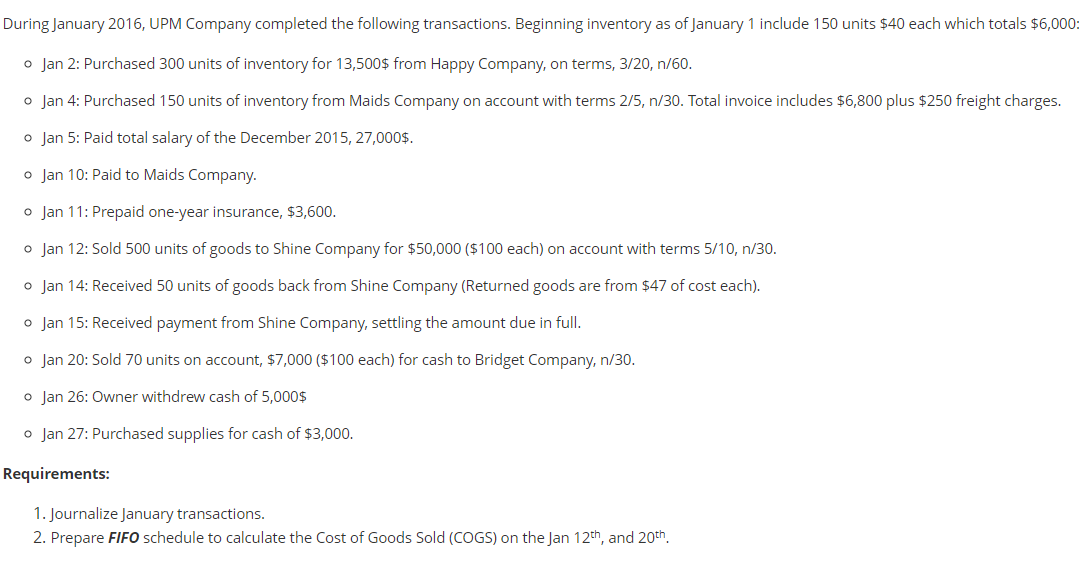

During January 2016, UPM Company completed the following transactions. Beginning inventory as of January 1 include 150 units $40 each which totals $6,000: o Jan 2: Purchased 300 units of inventory for 13,500$ from Happy Company, on terms, 3/20, n/60. o Jan 4: Purchased 150 units of inventory from Maids Company on account with terms 2/5, n/30. Total invoice includes $6,800 plus $250 freight charges. o Jan 5: Paid total salary of the December 2015, 27,000$. o Jan 10: Paid to Maids Company. o Jan 11: Prepaid one-year insurance, $3,600. o Jan 12: Sold 500 units of goods to Shine Company for $50,000 ($100 each) on account with terms 5/10, n/30. o Jan 14: Received 50 units of goods back from Shine Company (Returned goods are from $47 of cost each). o Jan 15: Received payment from Shine Company, settling the amount due in full. o Jan 20: Sold 70 units on account, $7,000 ($100 each) for cash to Bridget Company, n/30. o Jan 26: Owner withdrew cash of 5,000$ o Jan 27: Purchased supplies for cash of $3,000. Requirements: 1. Journalize January transactions. 2. Prepare FIFO schedule to calculate the Cost of Goods Sold (COGS) on the Jan 12th, and 20th.

During January 2016, UPM Company completed the following transactions. Beginning inventory as of January 1 include 150 units $40 each which totals $6,000: o Jan 2: Purchased 300 units of inventory for 13,500$ from Happy Company, on terms, 3/20, n/60. o Jan 4: Purchased 150 units of inventory from Maids Company on account with terms 2/5, n/30. Total invoice includes $6,800 plus $250 freight charges. o Jan 5: Paid total salary of the December 2015, 27,000$. o Jan 10: Paid to Maids Company. o Jan 11: Prepaid one-year insurance, $3,600. o Jan 12: Sold 500 units of goods to Shine Company for $50,000 ($100 each) on account with terms 5/10, n/30. o Jan 14: Received 50 units of goods back from Shine Company (Returned goods are from $47 of cost each). o Jan 15: Received payment from Shine Company, settling the amount due in full. o Jan 20: Sold 70 units on account, $7,000 ($100 each) for cash to Bridget Company, n/30. o Jan 26: Owner withdrew cash of 5,000$ o Jan 27: Purchased supplies for cash of $3,000. Requirements: 1. Journalize January transactions. 2. Prepare FIFO schedule to calculate the Cost of Goods Sold (COGS) on the Jan 12th, and 20th.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter7: Inventories

Section: Chapter Questions

Problem 4CP: Golden Eagle Company began operations on April 1 by selling a single product. Data on purchases and...

Related questions

Question

Transcribed Image Text:During January 2016, UPM Company completed the following transactions. Beginning inventory as of January 1 include 150 units $40 each which totals $6,000:

o Jan 2: Purchased 300 units of inventory for 13,500$ from Happy Company, on terms, 3/20, n/60.

o Jan 4: Purchased 150 units of inventory from Maids Company on account with terms 2/5, n/30. Total invoice includes $6,800 plus $250 freight charges.

o Jan 5: Paid total salary of the December 2015, 27,000$.

o Jan 10: Paid to Maids Company.

o Jan 11: Prepaid one-year insurance, $3,600.

o Jan 12: Sold 500 units of goods to Shine Company for $50,000 ($100 each) on account with terms 5/10, n/30.

o Jan 14: Received 50 units of goods back from Shine Company (Returned goods are from $47 of cost each).

o Jan 15: Received payment from Shine Company, settling the amount due in full.

o Jan 20: Sold 70 units on account, $7,000 ($100 each) for cash to Bridget Company, n/30.

o Jan 26: Owner withdrew cash of 5,000$

o Jan 27: Purchased supplies for cash of $3,000.

Requirements:

1. Journalize January transactions.

2. Prepare FIFO schedule to calculate the Cost of Goods Sold (COGS) on the Jan 12th, and 20th.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT