During January, Luxury Cruise Lines incurs employee salaries of $2.4 million. Withholdings in January are $183,600 for the employee portion of FICA, and $510,000 for employee federal and state. The company incurs an additional $148,800 for federal and state unemployment tax and $72,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shield). Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).)

During January, Luxury Cruise Lines incurs employee salaries of $2.4 million. Withholdings in January are $183,600 for the employee portion of FICA, and $510,000 for employee federal and state. The company incurs an additional $148,800 for federal and state unemployment tax and $72,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shield). Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).)

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 1PB

Related questions

Question

Please read and create

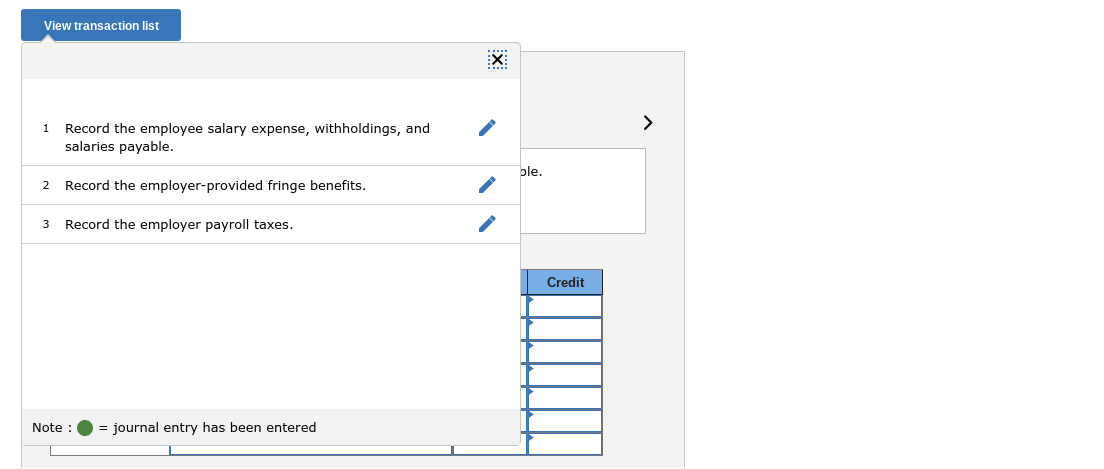

Transcribed Image Text:View transaction list

X:

>

Record the employee salary expense, withholdings, and

salaries payable.

1

ple.

2

Record the employer-provided fringe benefits.

3

Record the employer payroll taxes.

Credit

Note :

= journal entry has been entered

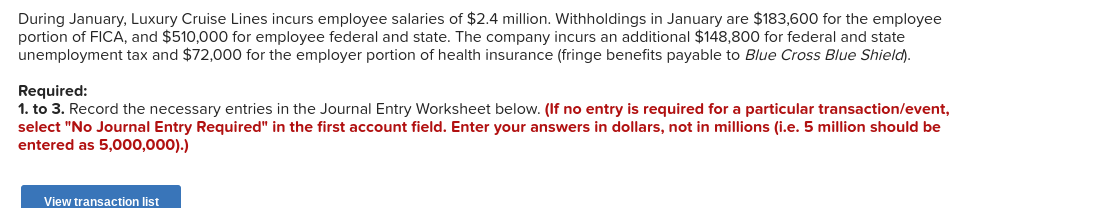

Transcribed Image Text:During January, Luxury Cruise Lines incurs employee salaries of $2.4 million. Withholdings in January are $183,600 for the employee

portion of FICA, and $510,000 for employee federal and state. The company incurs an additional $148,800 for federal and state

unemployment tax and $72,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shield).

Required:

1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event,

select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be

entered as 5,000,000).)

View transaction list

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,