CengageNOWv2 | Online teachirn X ow.com/ilrn/takeAssignment/takeAssignmentMan.uo?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). The income statement for Marley's Manufacturing is shown below: Marley's Manufacturing Income Statement Month Ending August 31, 2018 Dept. A Dept. B 000a 27,560 Sales Cost of goods sold 11,040 096'$ $24,440 3,640 Gross profit Utility expenses 1,380 Wages expense 5,980 10,920 Costs allocated from corporate 2,530 15,080 Total expenses 068$ $29,640 $2,070 -$5,200 Operating income/(loss) in dollars Operating income/(loss) in percentage Assume the market price for the items your department purchase is 15% below what you are being charged by department A of Marley's Manufacturing. Determine the operating income for department B, assuming department A "sold" department B 1,000 units during the month and department A reduces the selling price to the market price. Round your percentage answer to one decimal place. New operating income/(loss) for department B in dollars 24 New operating income/(loss) for department B in percentage

CengageNOWv2 | Online teachirn X ow.com/ilrn/takeAssignment/takeAssignmentMan.uo?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). The income statement for Marley's Manufacturing is shown below: Marley's Manufacturing Income Statement Month Ending August 31, 2018 Dept. A Dept. B 000a 27,560 Sales Cost of goods sold 11,040 096'$ $24,440 3,640 Gross profit Utility expenses 1,380 Wages expense 5,980 10,920 Costs allocated from corporate 2,530 15,080 Total expenses 068$ $29,640 $2,070 -$5,200 Operating income/(loss) in dollars Operating income/(loss) in percentage Assume the market price for the items your department purchase is 15% below what you are being charged by department A of Marley's Manufacturing. Determine the operating income for department B, assuming department A "sold" department B 1,000 units during the month and department A reduces the selling price to the market price. Round your percentage answer to one decimal place. New operating income/(loss) for department B in dollars 24 New operating income/(loss) for department B in percentage

Chapter9: Responsibility Accounting And Decentralization

Section: Chapter Questions

Problem 5EA: Assume you are the department B manager for Marleys Manufacturing. Marleys operates under a...

Related questions

Question

Transcribed Image Text:CengageNOWv2 | Online teachirn X

ow.com/ilrn/takeAssignment/takeAssignmentMan.uo?invoker=&takeAssignmentSessionLocator=&inprogress=false

eBook

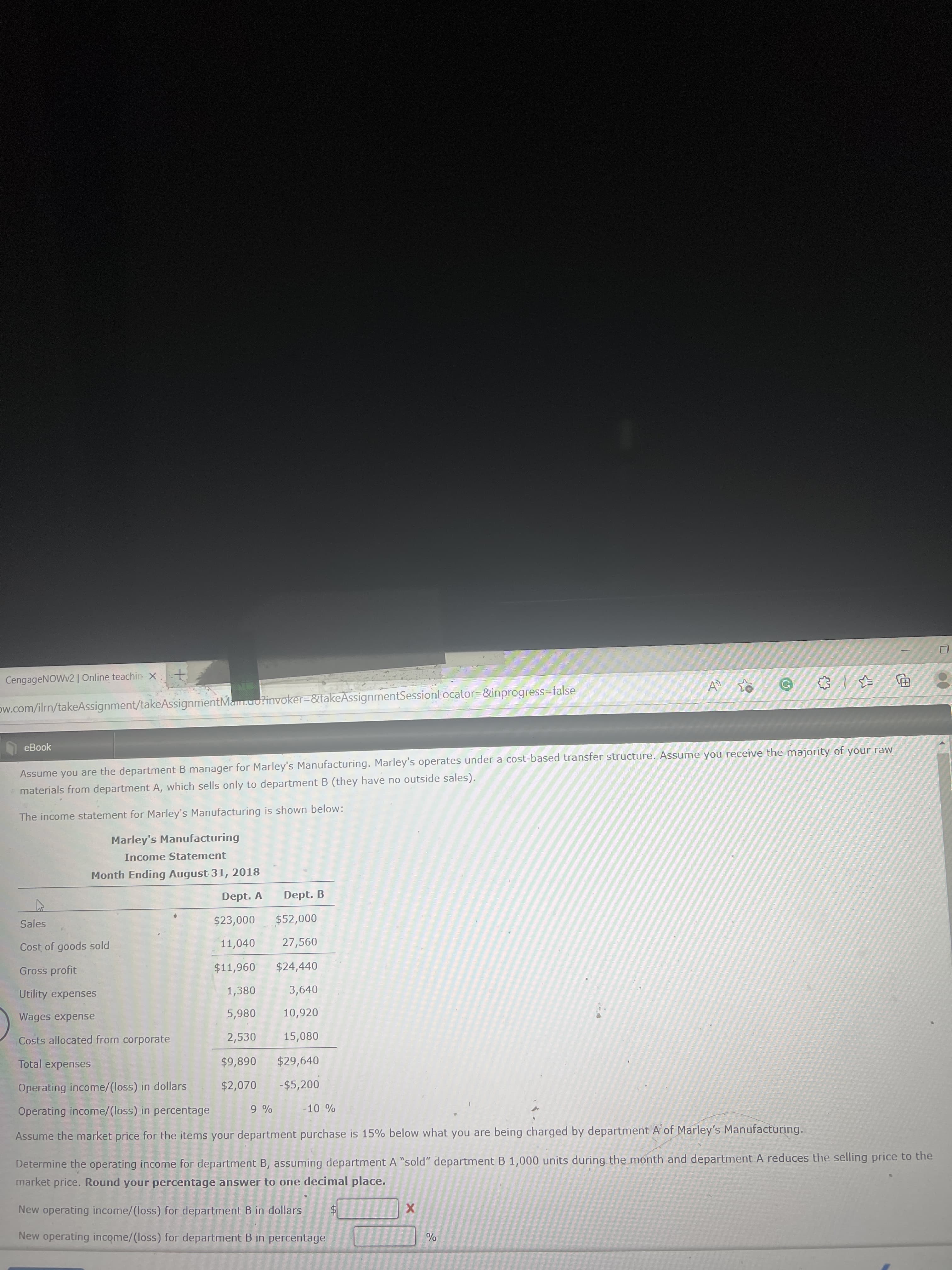

Assume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw

materials from department A, which sells only to department B (they have no outside sales).

The income statement for Marley's Manufacturing is shown below:

Marley's Manufacturing

Income Statement

Month Ending August 31, 2018

Dept. A

Dept. B

000a

27,560

Sales

Cost of goods sold

11,040

096'$

$24,440

3,640

Gross profit

Utility expenses

1,380

Wages expense

5,980 10,920

Costs allocated from corporate

2,530

15,080

Total expenses

068$

$29,640

$2,070 -$5,200

Operating income/(loss) in dollars

Operating income/(loss) in percentage

Assume the market price for the items your department purchase is 15% below what you are being charged by department A of Marley's Manufacturing.

Determine the operating income for department B, assuming department A "sold" department B 1,000 units during the month and department A reduces the selling price to the

market price. Round your percentage answer to one decimal place.

New operating income/(loss) for department B in dollars

24

New operating income/(loss) for department B in percentage

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning