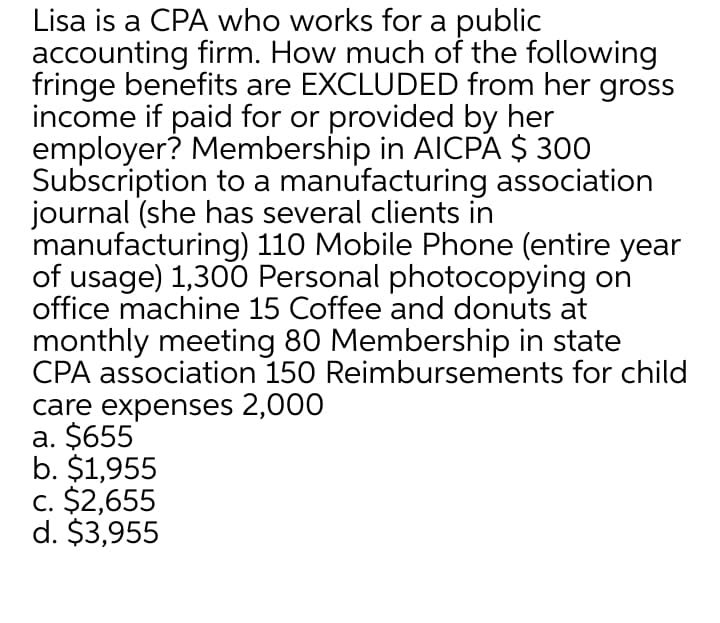

Lisa is a CPA who works for a public accounting firm. How much of the following fringe benefits are EXCLUDED from her gross income if paid for or provided by her employer? Membership in AICPA $ 300 Subscription to a manufacturing association journal (she has several clients in manufacturing) 110 Mobile Phone (entire year of usage) 1,30O Personal photocopying on office machine 15 Coffee and donuts at monthly meeting 80 Membership in state CPA association 150 Reimbursements for child care expenses 2,000 a. $655 b. $1,955 c. $2,655 d. $3,955

Lisa is a CPA who works for a public accounting firm. How much of the following fringe benefits are EXCLUDED from her gross income if paid for or provided by her employer? Membership in AICPA $ 300 Subscription to a manufacturing association journal (she has several clients in manufacturing) 110 Mobile Phone (entire year of usage) 1,30O Personal photocopying on office machine 15 Coffee and donuts at monthly meeting 80 Membership in state CPA association 150 Reimbursements for child care expenses 2,000 a. $655 b. $1,955 c. $2,655 d. $3,955

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 72IIP

Related questions

Question

Transcribed Image Text:Lisa is a CPA who works for a public

accounting firm. How much of the following

fringe benefits are EXCLUDED from her gross

income if paid for or provided by her

employer? Membership in AICPA $ 300

Subscription to a manufacturing association

journal (she has several clients in

manufacturing) 110 Mobile Phone (entire year

of usage) 1,300 Personal photocopying on

office machine 15 Coffee and donuts at

monthly meeting 80 Membership in state

CPA association 150 Reimbursements for child

care expenses 2,000

a. $655

b. $1,955

c. $2,655

d. $3,955

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage