During the current year, TLI Corporation sells a tract of land for $90,000. The sale is made to Sophie, TLI Corporation's sole shareholder. TLI Corporation originally purchased years earlier for $121,000.

During the current year, TLI Corporation sells a tract of land for $90,000. The sale is made to Sophie, TLI Corporation's sole shareholder. TLI Corporation originally purchased years earlier for $121,000.

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 28P

Related questions

Question

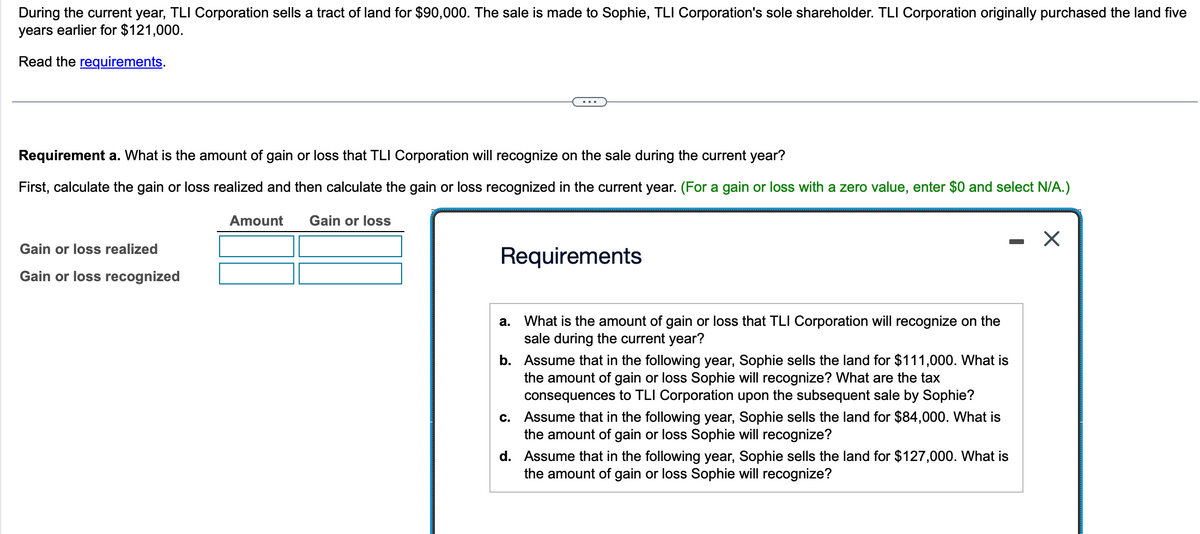

Transcribed Image Text:During the current year, TLI Corporation sells a tract of land for $90,000. The sale is made to Sophie, TLI Corporation's sole shareholder. TLI Corporation originally purchased the land five

years earlier for $121,000.

Read the requirements.

Requirement a. What is the amount of gain or loss that TLI Corporation will recognize on the sale during the current year?

First, calculate the gain or loss realized and then calculate the gain or loss recognized in the current year. (For a gain or loss with a zero value, enter $0 and select N/A.)

Amount Gain or loss

Gain or loss realized

Gain or loss recognized

Requirements

a.

What is the amount of gain or loss that TLI Corporation will recognize on the

sale during the current year?

b.

Assume that in the following year, Sophie sells the land for $111,000. What is

the amount of gain or loss Sophie will recognize? What are the tax

consequences to TLI Corporation upon the subsequent sale by Sophie?

c.

Assume that in the following year, Sophie sells the land for $84,000. What is

the amount of gain or loss Sophie will recognize?

d.

Assume that in the following year, Sophie sells the land for $127,000. What is

the amount of gain or loss Sophie will recognize?

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you