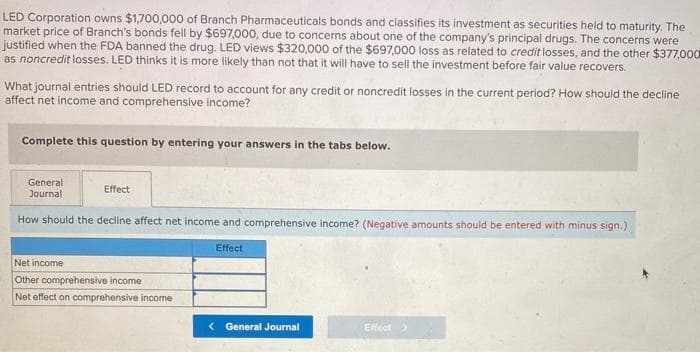

General Journal Effect How should the decline affect net income and comprehensive income? (Negative amounts should be entered with minus sign.) Net income Other comprehensive income Net effect on comprehensive income Effect < General Journal Effect >

General Journal Effect How should the decline affect net income and comprehensive income? (Negative amounts should be entered with minus sign.) Net income Other comprehensive income Net effect on comprehensive income Effect < General Journal Effect >

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 10RE: On September 30, Franz Corporation notices a decline in value of its investment in held-to-maturity...

Related questions

Question

D1.

Account

Transcribed Image Text:LED Corporation owns $1,700,000 of Branch Pharmaceuticals bonds and classifies its investment as securities held to maturity. The

market price of Branch's bonds fell by $697,000, due to concerns about one of the company's principal drugs. The concerns were

justified when the FDA banned the drug. LED views $320,000 of the $697,000 loss as related to credit losses, and the other $377,000

as noncredit losses. LED thinks it is more likely than not that it will have to sell the investment before fair value recovers.

What journal entries should LED record to account for any credit or noncredit losses in the current period? How should the decline

affect net income and comprehensive income?

Complete this question by entering your answers in the tabs below.

General

Journal

Effect

How should the decline affect net income and comprehensive income? (Negative amounts should be entered with minus sign.)

Effect

Net income

Other comprehensive income

Net effect on comprehensive income

General Journal

Effect >

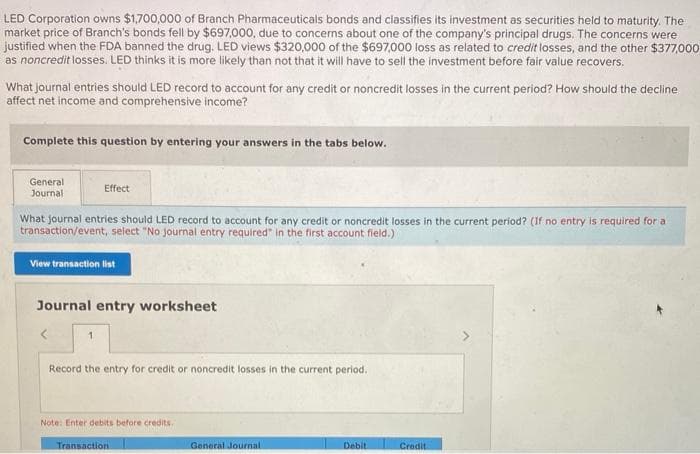

Transcribed Image Text:LED Corporation owns $1,700,000 of Branch Pharmaceuticals bonds and classifies its investment as securities held to maturity. The

market price of Branch's bonds fell by $697,000, due to concerns about one of the company's principal drugs. The concerns were

justified when the FDA banned the drug. LED views $320,000 of the $697,000 loss as related to credit losses, and the other $377,000

as noncredit losses. LED thinks it is more likely than not that it will have to sell the investment before fair value recovers.

What journal entries should LED record to account for any credit or noncredit losses in the current period? How should the decline

affect net income and comprehensive income?

Complete this question by entering your answers in the tabs below.

General

Journal

Effect

What journal entries should LED record to account for any credit or noncredit losses in the current period? (If no entry is required for a

transaction/event, select "No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

1

Record the entry for credit or noncredit losses in the current period.

Note: Enter debits before credits.

Transaction.

General Journal

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning