During year 1, Finch Manufacturing Company incurred $15,000,000 of research and development (R&D) costs to create a long-life battery to use in computers. In accordance with FASB standards, the entire R&D cost was recognized as an expense in year 1. Manufacturing costs (direct materials, direct labor, and overhead) are expected to be $50 per unit. Packaging, shipping, and sales commissions are expected to be $18 per unit. Finch expects to sell 2,500,000 batteries before new research renders the battery design technologically obsolete. During year 1, Finch made 438,000 batteries and sold 392,000 of them. Required a. Identify the upstream and downstream costs. b. Determine the year 1 amount of cost of goods sold and the ending inventory balance that would appear on the financial statements that are prepared in accordance with GAAP. c Determine the sales price assuming that Finch desires to earn a profit margin that is equal to 30 percent of the total cost of developing, making, and distributing the batteries. d. Prepare a GAAP-based income statement for year 1. Use the sales price developed in Requirement c.

During year 1, Finch Manufacturing Company incurred $15,000,000 of research and development (R&D) costs to create a long-life battery to use in computers. In accordance with FASB standards, the entire R&D cost was recognized as an expense in year 1. Manufacturing costs (direct materials, direct labor, and overhead) are expected to be $50 per unit. Packaging, shipping, and sales commissions are expected to be $18 per unit. Finch expects to sell 2,500,000 batteries before new research renders the battery design technologically obsolete. During year 1, Finch made 438,000 batteries and sold 392,000 of them. Required a. Identify the upstream and downstream costs. b. Determine the year 1 amount of cost of goods sold and the ending inventory balance that would appear on the financial statements that are prepared in accordance with GAAP. c Determine the sales price assuming that Finch desires to earn a profit margin that is equal to 30 percent of the total cost of developing, making, and distributing the batteries. d. Prepare a GAAP-based income statement for year 1. Use the sales price developed in Requirement c.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter14: Quality And Environmental Cost Management

Section: Chapter Questions

Problem 43P: The following environmental cost reports for 20x3, 20x4, and 20x5 (year end December 31) are for the...

Related questions

Question

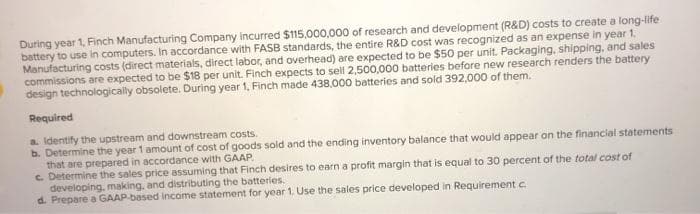

Transcribed Image Text:During year 1, Finch Manufacturing Company incurred $115,000,000 of research and development (R&D) costs to create a long-life

battery to use in computers. In accordance with FASB standards, the entire R&D cost was recognized as an expense in year 1.

Manufacturing costs (direct materials, direct labor, and overhead) are expected to be $50 per unit. Packaging, shipping, and sales

commissions are expected to be $18 per unit. Finch expects to sell 2,500,000 batteries before new research renders the battery

design technologically obsolete. During year 1, Finch made 438,000 batteries and sold 392,000 of them.

Required

a. Identify the upstream and downstream costs.

b. Determine the year 1 amount of cost of goods sold and the ending inventory balance that would appear on the financial statements

that are prepared in accordance with GAAP.

c. Determine the sales price assuming that Finch desires to earn a profit margin that is equal to 30 percent of the total cost of

developing, making, and distributing the batteries.

d. Prepare a GAAP based Income statement for year 1. Use the sales price developed in Requirement c.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning