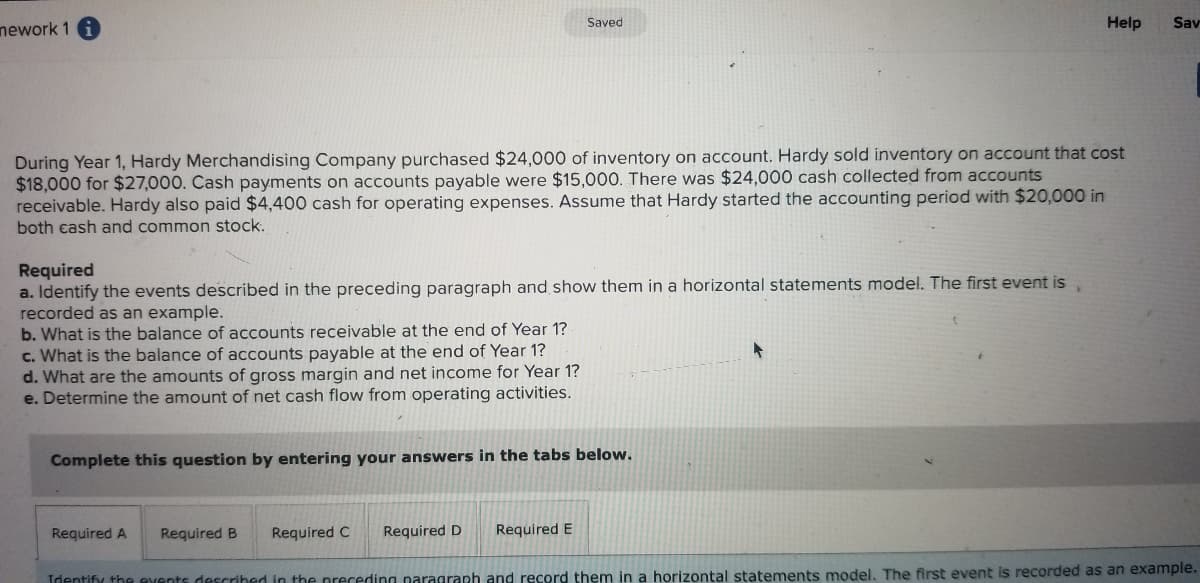

During Year 1, Hardy Merchandising Company purchased $24,000 of inventory on account. Hardy sold inventory on account that cost $18,000 for $27,000. Cash payments on accounts payable were $15,000. There was $24,000 cash collected from accounts receivable. Hardy also paid $4,400 cash for operating expenses. Assume that Hardy started the accounting period with $20,000 in both cash and common stock. Required a. Identify the events described in the preceding paragraph and show them in a horizontal statements model. The first event is recorded as an example. b. What is the balance of accounts receivable at the end of Year 1? c. What is the balance of accounts payable at the end of Year 1? d. What are the amounts of gross margin and net income for Year 1? e. Determine the amount of net cash flow from operating activities.

During Year 1, Hardy Merchandising Company purchased $24,000 of inventory on account. Hardy sold inventory on account that cost $18,000 for $27,000. Cash payments on accounts payable were $15,000. There was $24,000 cash collected from accounts receivable. Hardy also paid $4,400 cash for operating expenses. Assume that Hardy started the accounting period with $20,000 in both cash and common stock. Required a. Identify the events described in the preceding paragraph and show them in a horizontal statements model. The first event is recorded as an example. b. What is the balance of accounts receivable at the end of Year 1? c. What is the balance of accounts payable at the end of Year 1? d. What are the amounts of gross margin and net income for Year 1? e. Determine the amount of net cash flow from operating activities.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5.5BPR: Multiple-step income statement and balance sheet The following selected accounts and their current...

Related questions

Question

Please answer full question. Answer only please.

Transcribed Image Text:nework 1 i

Saved

Help

Sav

During Year 1, Hardy Merchandising Company purchased $24,000 of inventory on account. Hardy sold inventory on account that cost

$18,000 for $27,000. Cash payments on accounts payable were $15,000. There was $24,000 cash collected from accounts

receivable. Hardy also paid $4,400 cash for operating expenses. Assume that Hardy started the accounting period with $20,000 in

both cash and common stock.

Required

a. Identify the events described in the preceding paragraph and show them in a horizontal statements model. The first event is

recorded as an example.

b. What is the balance of accounts receivable at the end of Year 1?

c. What is the balance of accounts payable at the end of Year 1?

d. What are the amounts of gross margin and net income for Year 1?

e. Determine the amount of net cash flow from operating activities.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Required D

Required E

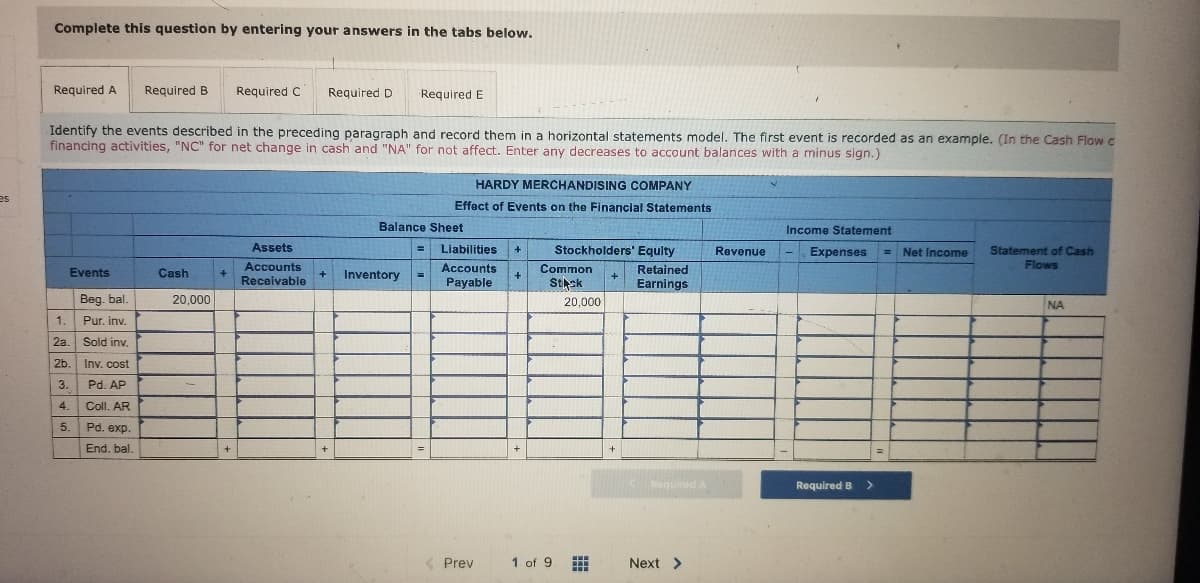

Identify the events described in the preceding paragraph and record them in a horizontal statements model. The first event is recorded as an example.

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Required D

Required E

Identify the events described in the preceding paragraph and record them in a horizontal statements model. The first event is recorded as an example. (In the Cash Flow c

financing activities, "NC" for net change in cash and "NA" for not affect. Enter any decreases to account balances with a minus sign.)

HARDY MERCHANDISING COMPANY

es

Effect of Events on the Financial Statements

Balance Sheet

Income Statement

Assets

Liabilities

Stockholders' Equity

Statement of Cash

Flows

%3D

Revenue

Expenses

Net Income

%3D

Events

Cash

Accounts

Accounts

Common

Retained

Inventory

%3D

+

Receivable

Payable

Stask

Earnings

Beg. bal.

20,000

20,000

NA

1.

Pur. inv.

2a. Sold inv.

2b. Inv. cost

3.

Pd. AP

4.

Coll. AR

5.

Pd. exp.

End, bal.

+

panbe

Required A

Required B

Prev

1 of 9

Next >

...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning