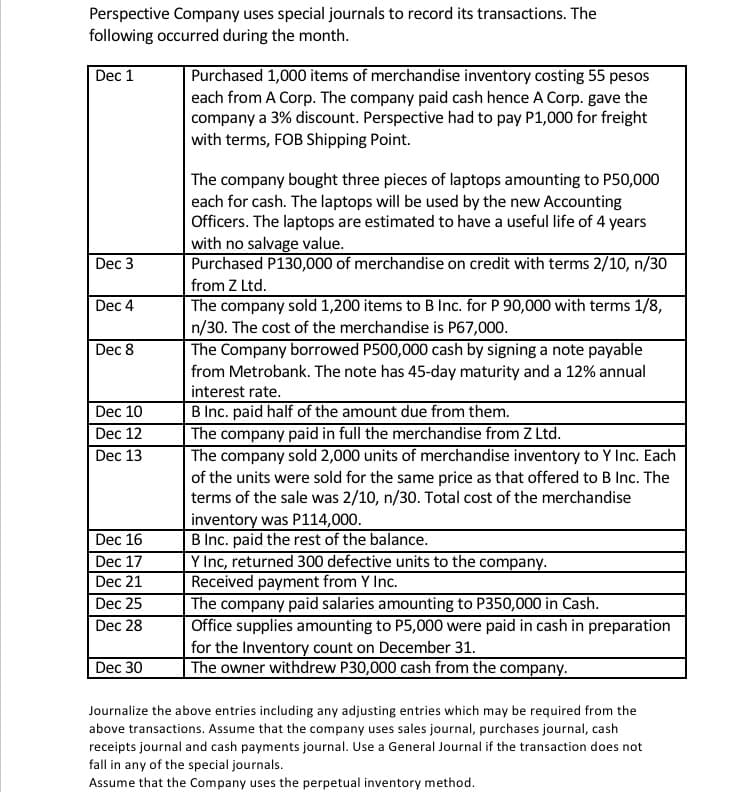

Perspective Company uses special journals to record its transactions. The following occurred during the month. Dec 1 Purchased 1,000 items of merchandise inventory costing 55 pesos each from A Corp. The company paid cash hence A Corp. gave the company a 3% discount. Perspective had to pay P1,000 for freight with terms, FOB Shipping Point. The company bought three pieces of laptops amounting to P50,000 each for cash. The laptops will be used by the new Accounting Officers. The laptops are estimated to have a useful life of 4 years with no salvage value. Purchased P130,000 of merchandise on credit with terms 2/10, n/30 from Z Ltd. The company sold 1,200 items to B Inc. for P 90,000 with terms 1/8, n/30. The cost of the merchandise is P67,000. The Company borrowed P500,000 cash by signing a note payable from Metrobank. The note has 45-day maturity and a 12% annual Dec 3 Dec 4 Dec 8 interest rate. B Inc. paid half of the amount due from them. The company paid in full the merchandise from Z Ltd. The company sold 2,000 units of merchandise inventory to Y Inc. Each of the units were sold for the same price as that offered to B Inc. The terms of the sale was 2/10, n/30. Total cost of the merchandise inventory was P114,000. B Inc. paid the rest of the balance. Y Inc, returned 300 defective units to the company. Received payment from Y Inc. The company paid salaries amounting to P350,000 in Cash. Office supplies amounting to P5,000 were paid in cash in preparation for the Inventory count on December 31. The owner withdrew P30,000 cash from the company. Dec 10 Dec 12 Dec 13 Dec 16 Dec 17 Dec 21 Dec 25 Dec 28 Dec 30

Perspective Company uses special journals to record its transactions. The following occurred during the month. Dec 1 Purchased 1,000 items of merchandise inventory costing 55 pesos each from A Corp. The company paid cash hence A Corp. gave the company a 3% discount. Perspective had to pay P1,000 for freight with terms, FOB Shipping Point. The company bought three pieces of laptops amounting to P50,000 each for cash. The laptops will be used by the new Accounting Officers. The laptops are estimated to have a useful life of 4 years with no salvage value. Purchased P130,000 of merchandise on credit with terms 2/10, n/30 from Z Ltd. The company sold 1,200 items to B Inc. for P 90,000 with terms 1/8, n/30. The cost of the merchandise is P67,000. The Company borrowed P500,000 cash by signing a note payable from Metrobank. The note has 45-day maturity and a 12% annual Dec 3 Dec 4 Dec 8 interest rate. B Inc. paid half of the amount due from them. The company paid in full the merchandise from Z Ltd. The company sold 2,000 units of merchandise inventory to Y Inc. Each of the units were sold for the same price as that offered to B Inc. The terms of the sale was 2/10, n/30. Total cost of the merchandise inventory was P114,000. B Inc. paid the rest of the balance. Y Inc, returned 300 defective units to the company. Received payment from Y Inc. The company paid salaries amounting to P350,000 in Cash. Office supplies amounting to P5,000 were paid in cash in preparation for the Inventory count on December 31. The owner withdrew P30,000 cash from the company. Dec 10 Dec 12 Dec 13 Dec 16 Dec 17 Dec 21 Dec 25 Dec 28 Dec 30

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 1PB: Record journal entries for the following transactions of Furniture Warehouse. A. July 5: Purchased...

Related questions

Question

Transcribed Image Text:Perspective Company uses special journals to record its transactions. The

following occurred during the month.

Dec 1

Purchased 1,000 items of merchandise inventory costing 55 pesos

each from A Corp. The company paid cash hence A Corp. gave the

company a 3% discount. Perspective had to pay P1,000 for freight

with terms, FOB Shipping Point.

The company bought three pieces of laptops amounting to P50,000

each for cash. The laptops will be used by the new Accounting

Officers. The laptops are estimated to have a useful life of 4 years

with no salvage value.

Purchased P130,000 of merchandise on credit with terms 2/10, n/30

Dec 3

from Z Ltd.

The company sold 1,200 items to B Inc. for P 90,000 with terms 1/8,

n/30. The cost of the merchandise is P67,000.

The Company borrowed P500,000 cash by signing a note payable

from Metrobank. The note has 45-day maturity and a 12% annual

Dec 4

Dec 8

interest rate.

B Inc. paid half of the amount due from them.

The company paid in full the merchandise from Z Ltd.

The company sold 2,000 units of merchandise inventory to Y Inc. Each

of the units were sold for the same price as that offered to B Inc. The

terms of the sale was 2/10, n/30. Total cost of the merchandise

inventory was P114,000.

B Inc. paid the rest of the balance.

Y Inc, returned 300 defective units to the company.

Received payment from Y Inc.

The company paid salaries amounting to P350,000 in Cash.

Dec 10

Dec 12

Dec 13

Dec 16

Dec 17

Dec 21

Dec 25

Dec 28

Office supplies amounting to P5,000 were paid in cash in preparation

for the Inventory count on December 31.

The owner withdrew P30,000 cash from the company.

Dec 30

Journalize the above entries including any adjusting entries which may be required from the

above transactions. Assume that the company uses sales journal, purchases journal, cash

receipts journal and cash payments journal. Use a General Journal if the transaction does not

fall in any of the special journals.

Assume that the Company uses the perpetual inventory method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage