e answer all parts withi

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 57E: Outstanding Stock Lars Corporation shows the following information in the stockholders equity...

Related questions

Question

please answer all parts within 30 minutes.

remember all parts need to be answered.

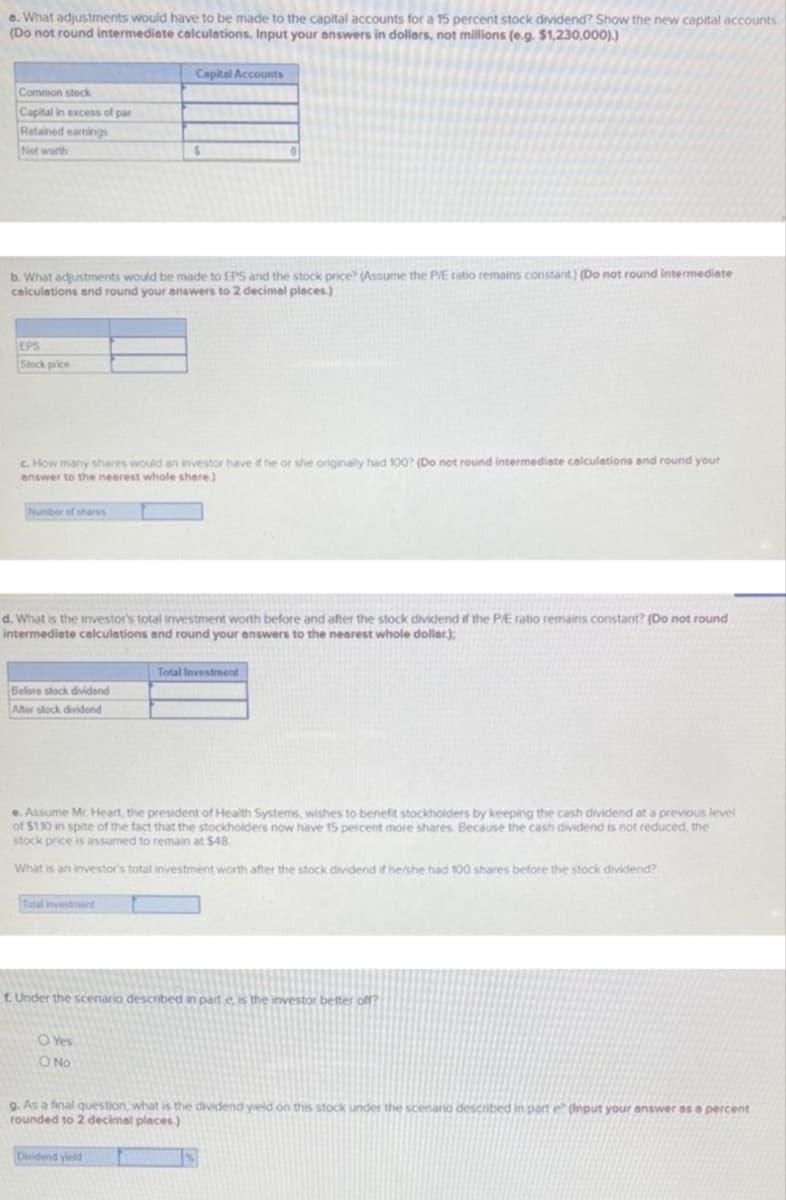

Transcribed Image Text:a. What adjustments would have to be made to the capital accounts for a 15 percent stock dividend? Show the new capital accounts

(Do not round intermediate calculations. Input your answers in dollars, not millions (e.g. $1,230,000).)

Capital Accounts

Common stock

Capital in excess of par

Retained earnings

Net worth

b. What adjustments would be made to EPS and the stock price? (Assume the P/E ratio remains constant) (Do not round intermediete

calculations and round your answers to 2 decimel pleces)

EPS

Slock price

c. How many shares would an investor have if he or she originaly had 100? (Do not round intermediate calculations and round your

enswer to the nearest whole shere.)

Number of shares

d. What is the investor's total investment worth before and after the stock dividend if the PE ratio remains constant? (Do not round

intermediate calculations and round your answers to the nearest whole dollar.):

Total Investment

Before stock dividend

Alter stock dividend

e. Assume Mr. Heart, the president of Health Systems, wishes to benefit stockholders by keeping the cash dividend at a previous level

of $110 in spite of the fact that the stockholders now have 15 percent more shares Because the cash dividend is not reduced, the

stock price is assumed to remain at $48

What is an investor's total investment worth after the stock dividend if he/she had 100 shares before the stock dividend?

Total investrent

f. Under the scenario descnbed in part e, is the investor better off?

O Yes

O No

g. As a final question, what is the dividend yeld on this stock under the scenario described in part e (Input your answer as a percent

rounded to 2 decimal places.)

Dividend yield

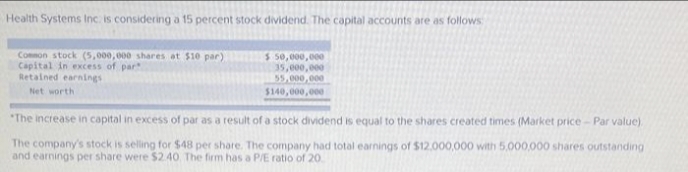

Transcribed Image Text:Health Systems Inc. is considering a 15 percent stock dividend. The capital accounts are as follows

Conmon stock (5,000, 000 shares at $10 par)

Capital in excess of par

Retalned earnings

$ 50,000,000

35,e00,000

55,000,000

Net worth

$140,000,000

*The increase in capital in excess of par as a result of a stock dividend is equal to the shares created times (Market price- Par value).

The company's stock is selling for $48 per share. The company had total earnings of $12.000,000 with 5,000,000 shares outstanding

and earnings per share were $2.40 The firm has a P/E ratio of 20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College