e answer it experts thank

College Algebra

7th Edition

ISBN:9781305115545

Author:James Stewart, Lothar Redlin, Saleem Watson

Publisher:James Stewart, Lothar Redlin, Saleem Watson

Chapter9: Counting And Probability

Section9.4: Expected Value

Problem 1E: If a game gives payoffs of $10 and $100 with probabilities 0.9 and 0.1, respectively, then the...

Related questions

Question

please answer it experts thanku in advance

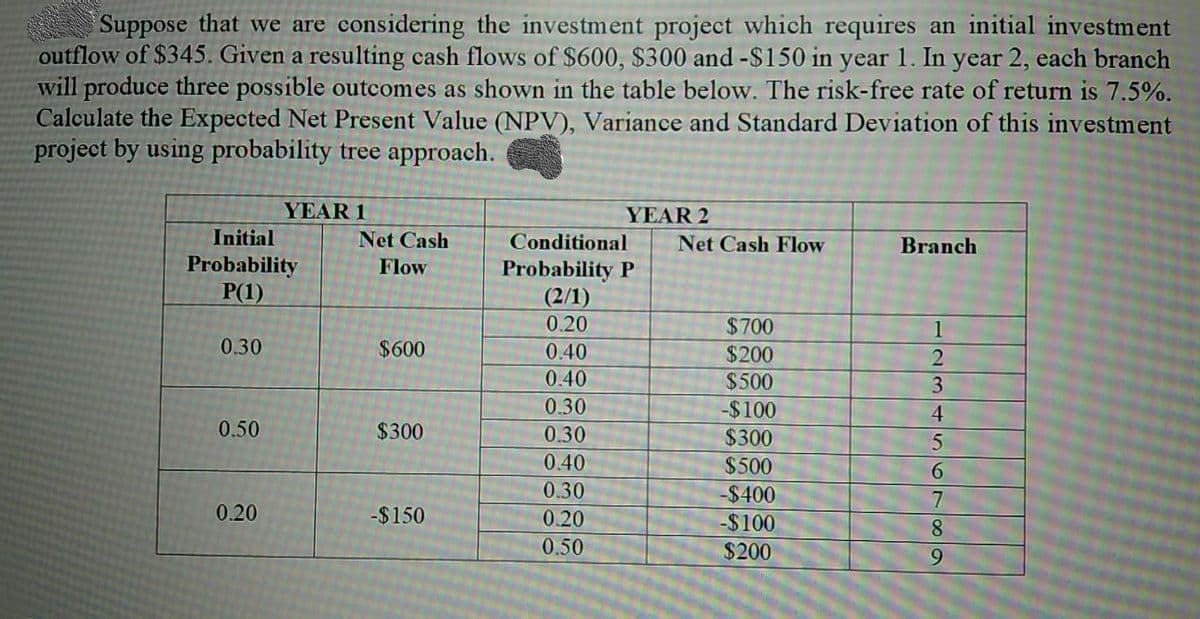

Transcribed Image Text:Suppose that we are considering the investment project which requires an initial investment

outflow of $345. Given a resulting cash flows of $600, $300 and -$150 in year 1. In year 2, each branch

will produce three possible outcomes as shown in the table below. The risk-free rate of return is 7.5%.

Calculate the Expected Net Present Value (NPV), Variance and Standard Deviation of this investment

project by using probability tree approach.

YEAR 1

YEAR 2

Initial

Net Cash

Conditional

Net Cash Flow

Branch

Probability

P(1)

Flow

Probability P

(2/1)

0.20

$700

1

0.30

$600

0.40

$200

$500

0.40

0.30

-$100

4

0.50

$300

0.30

$300

0.40

$500

0.30

-$400

0.20

-$150

0.20

-$100

0.50

$200

6.

23

647989

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning

College Algebra

Algebra

ISBN:

9781305115545

Author:

James Stewart, Lothar Redlin, Saleem Watson

Publisher:

Cengage Learning