e president is considering a proposals prepared by members of his staff. For next year, the sales manager would to increase the unit selling price by 20%, increase the sales commission by 9%, and increase advertising by $100,00. Basaed on marketing studies, he is confident this would increase unit sales by one third. What profits would be under th

e president is considering a proposals prepared by members of his staff. For next year, the sales manager would to increase the unit selling price by 20%, increase the sales commission by 9%, and increase advertising by $100,00. Basaed on marketing studies, he is confident this would increase unit sales by one third. What profits would be under th

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter2: Basic Cost Management Concepts

Section: Chapter Questions

Problem 24E: Last year, Orsen Company produced 25,000 juicers and sold 26,500 juicers for 60 each. The actual...

Related questions

Question

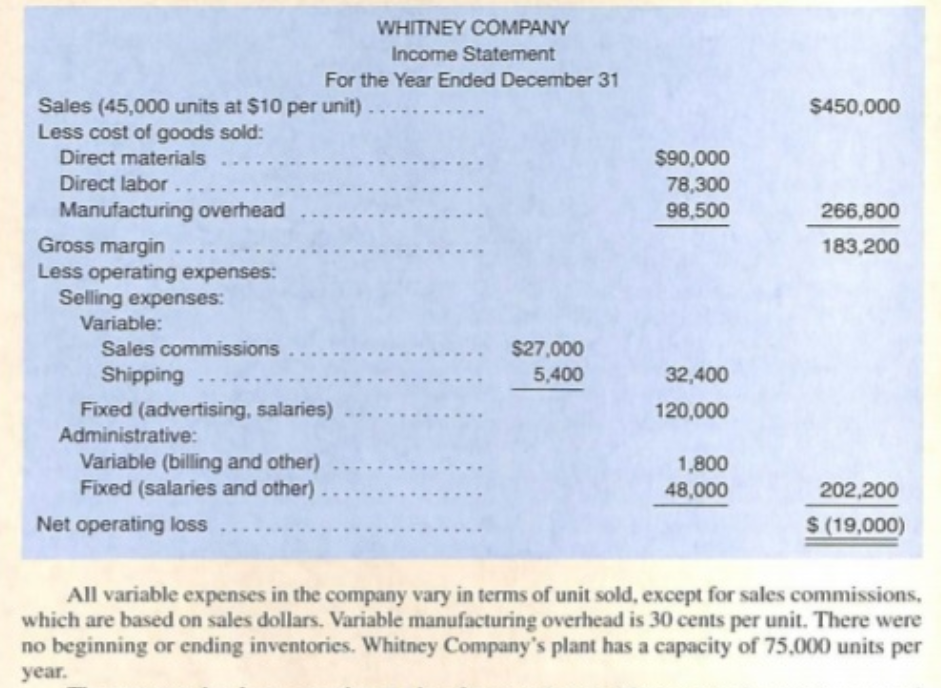

The president is considering a proposals prepared by members of his staff. For next year, the sales manager would to increase the unit selling price by 20%, increase the sales commission by 9%, and increase advertising by $100,00. Basaed on marketing studies, he is confident this would increase unit sales by one third. What profits would be under the sales manager's proposal? include both Total and Per Unit columns.

Transcribed Image Text:WHITNEY COMPANY

Income Statement

For the Year Ended December 31

Sales (45,000 units at $10 per unit)

Less cost of goods sold:

$450,000

Direct materials

$90,000

..

Direct labor....

Manufacturing overhead

Gross margin ......

Less operating expenses:

Selling expenses:

Variable:

78,300

98,500

266,800

183,200

Sales commissions

$27,000

Shipping

5,400

32,400

...

Fixed (advertising, salaries)

Administrative:

Variable (billing and other)

Fixed (salaries and other).

120,000

1,800

48,000

202,200

Net operating loss

$ (19,000)

All variable expenses in the company vary in terms of unit sold, except for sales commissions,

which are based on sales dollars. Variable manufacturing overhead is 30 cents per unit. There were

no beginning or ending inventories. Whitney Company's plant has a capacity of 75,000 units per

year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College